Download Pintu App

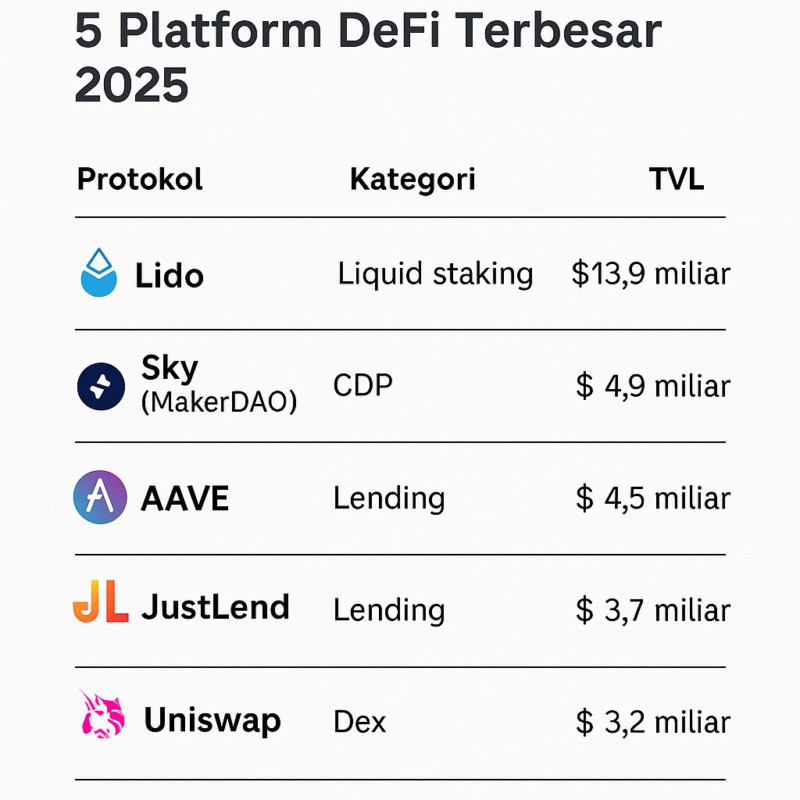

5 Biggest DeFi Platforms 2025

Jakarta, Pintu News – The year 2025 is an important moment for the crypto world, especially in the DeFi (Decentralized Finance) sector.

Although the market is still facing high volatility, some protocols have managed to survive and even strengthen their position through total value locked or TVL (Total Value Locked).

The latest data lists five DeFi platforms with the largest TVL in 2025 that dominate the landscape, ranging from staking, lending, to decentralized exchange (DEX).

Here’s a list of the five biggest DeFi protocols that crypto investors should keep an eye on this year!

Lido: King of Liquid Staking with a TVL of Rp225.8 Trillion

Lido remains the liquid staking king in 2025 with a TVL of $13.9 billion or around Rp225.8 trillion.

Initially supporting only Ethereum (ETH), Lido now also offers staking services for Polygon (MATIC) and Solana (SOL). Through Lido, users can stake their assets and receive derivative tokens such as stETH, stMATIC, or stSOL that can be used on various other DeFi platforms.

Lido’s main advantage is flexibility, where users can still utilize liquidity even when their assets are being staked.

However, like any crypto product, risks remain, including the possibility of derivative tokens losing pegs or technical risks of smart contracts. Even so, Lido has so far managed to maintain the trust of the global community.

Sky (MakerDAO): Stablecoin Pioneer Now with a New Name

Sky, previously known as MakerDAO, recorded a TVL of $4.9 billion. The protocol is best known as the creator of the DAI stablecoin, now renamed USDS.

This stablecoin is softly pegged to the US dollar, making it one of the most popular crypto assets to hedge against volatility.

Sky operates as a DAO (Decentralized Autonomous Organization) on the Ethereum network. Users can open a vault with crypto assets as collateral to print USDS.

This multi-collateralized system allows for greater stability and makes USDS one of the most widely used stablecoins in the DeFi ecosystem and other blockchain-based applications.

Also read: 5 Types of DeFi Wallets for Token Swaps

Aave: Multi-Chain Lending Protocol Leader

Aave, built since 2017, maintains its position as one of the largest lending protocols with a TVL of $4.5 billion.

Aave is present on nine blockchain networks, including Ethereum, Polygon, Avalanche, Arbitrum, and Optimism. It has the advantage of loan interest flexibility, where users can choose a fixed or variable interest rate.

In addition, Aave also introduced unique features such as flash loans, which allow for instant unsecured loans.

Its native token, AAVE, serves as a governance tool while also being staked for rewards. With continuous innovation, Aave remains the top choice of crypto investors looking to earn interest on their digital assets.

JustLend: Lending Solution on TRON Blockchain

JustLend emerged as the top DeFi platform on the TRON network with a TVL of $3.7 billion.

The platform allows users to lend and borrow TRON-based assets (TRC-20) and stablecoins such as USDT. JustLend provides both fixed and variable interest options, as well as a staking feature to generate additional rewards.

The platform’s native token, JST, is used as a governance tool and votes on community proposals. With the TRON ecosystem growing, JustLend plays an important role in expanding the use of TRC-20-based cryptocurrencies.

Also read: 5 Native Tokens with the Best Performance According to Birdeye Data

Uniswap: The Still Dominating King of DEX

Uniswap, the largest DEX on Ethereum, managed to maintain a TVL of around $3.2 billion. As a pioneer automated market maker (AMM), Uniswap allows anyone to create liquidity pools with ease. With nearly zero token listing fees, the platform is home to thousands of ERC-20 tokens.

Users who provide liquidity are rewarded with transaction fees in the pool. However, Ethereum’s gas fees sometimes make small transactions uneconomical. However, thanks to integrations across chains such as Arbitrum, Polygon, and Optimism, Uniswap remains relevant and continues to dominate the global DEX market.

Conclusion

The five platforms above prove that the DeFi sector continues to grow and mature. From liquid staking through Lido, stablecoin Sky, lending protocols Aave and JustLend, to popular DEX Uniswap, they all play an important role in the crypto ecosystem.

With a TVL value that reaches hundreds of trillions of rupiah, these platforms not only emphasize their dominance, but also show the level of investor confidence in the cryptocurrency world.

In addition to these five big names, Pintu Web3 Wallet is also present, which is one of the best Web3 wallets for users. Through Pintu Web3 Wallet, users can easily access various DeFi opportunities to obtain yield or passive profit.

Features offered include token staking with competitive yields, to yield farming strategies in various leading DeFi ecosystems.

This wallet has been directly integrated with various DeFi protocols, so that users can manage assets while looking for profit opportunities without the need to switch applications. In this way, Pintu Web3 Wallet provides more convenience and efficiency for those who want to maximize the potential of the world of decentralized finance.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Koinly. 10 Biggest and Best DeFi Crypto Projects 2025. Accessed August 24, 2025.

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.