Download Pintu App

Whales Return to Accumulate as PEPE Turns Green – What’s Next?

Jakarta, Pintu News – Memecoin seems to be making a comeback after the previous day’s performance, when the altcoin continued to outperform Bitcoin (BTC).

Pepe (PEPE), one of the leading memecoins on the Ethereum (ETH) network, surged 10% on August 23 and extended a rally that had already occurred the day before.

Strong community support means the token is seen as a beta version of ETH, which means its price movements often follow Ethereum trends. To give you an idea, ETH is leading the surge in the overall crypto market. However, the price of PEPE itself is still moving in an accumulation pattern.

PEPE Still in Accumulation Phase

On the daily chart (23/8), PEPE is seen moving inside a symmetrical triangle pattern formed since early May and is now nearing its peak.

Read also: Powell’s Comments Boost Crypto Market to $4 Trillion – Analysts Expect Shiba Inu to Rally?

The Strength of Accumulation Index shows a flat line, indicating that PEPE is in a consolidation phase. This trend has been going on since the low point in March, indicating that buyers have started to enter long positions since then.

As of August 23, PEPE is trading at $0.00001157. If the price is able to break $0.00001366, the market structure could turn bullish. However, if there is a decline instead, the potential uptrend formed after the double bottom pattern could be canceled.

The RSI indicator shows a slight uptrend after forming equal lows, after dropping to the fair value gap area. This zone previously triggered a 20% rise after a sharp correction in July-August.

Whale Returns after a Long Absence

As the price bounced back, thewhales started to get back into memecoin.

A legendary trader with a 100% successful track record in PEPE is back in action after a five-month hiatus. He bought $2 million worth of tokens and withdrew them from the Binance exchange.

Based on EyeOnChain data, the wallet still holds 1.31 trillion PEPE at an average purchase price of $0.00001683 – meaning it is carrying a loss on paper of around $7.25 million.

Despite experiencing a 69% drop in value since June 2024, this whale did not give up and instead continued to add to its holdings.

In addition, the 100 largest addresses holding PEPE increased their accumulation by 1.50% this month. Total transactions recorded 6.819 million, with buyers accounting for 1.206 million transactions, while sellers only 851 thousand.

In short, both large and retail investors alike are adding PEPE supply to their cold wallets.

Read also: BitMine Expands the World’s Largest ETH Reserve, Turning a $45M Buy Into $1.9B Gains

Spot Traders Drive PEPE Price Increase

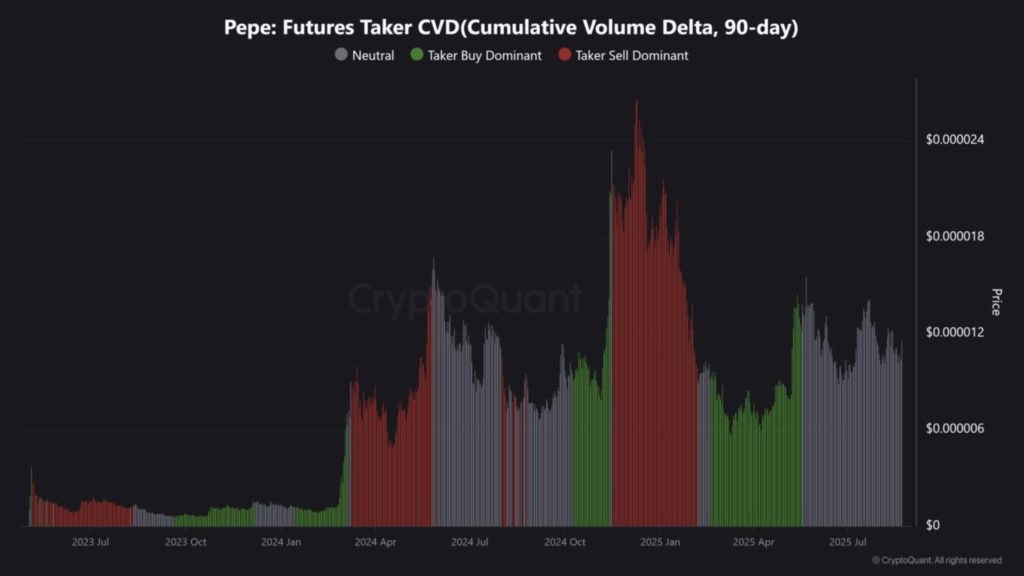

On closer inspection, the surge in PEPE prices turned out to be mainly driven by activity in the spot market. Data from CryptoQuant shows that Futures Taker CVD has been neutral over the past three months.

Although known as ETH beta, the movement of PEPE this time is different from ETH, whose rally is mostly supported by leverage.

The lack of leveraged traders on PEPE indicates that the market still has no clear direction. Therefore, a breakout is needed to attract them.

To conclude, PEPE did close the day in the green, but the volume was not strong enough to trigger a sustained breakout. For a more solid rally, participation from the derivatives market should increase.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Pepe in the green as whales load, the market watches for next moves. Accessed on August 25, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.