Download Pintu App

Dogecoin Price Drops 8% Today (26/8/25): Is DOGE at a Critical Juncture?

Jakarta, Pintu News – Dogecoin (DOGE) continues to lag behind the overall altcoin market. On August 25, DOGE was trading at $0.22, down 32.50% since the beginning of the year (YTD) despite several other cryptocurrencies rising.

Looking ahead, a possible rate cut in September could be a catalyst for a broader crypto market recovery. While many altcoins could potentially reach new highs before then, Dogecoin’s technical indicators and on-chain data point to a more limited performance.

Here are the reasons why DOGE’s price surge may be lagging compared to other altcoins, citing a CCN report (Aug 25).

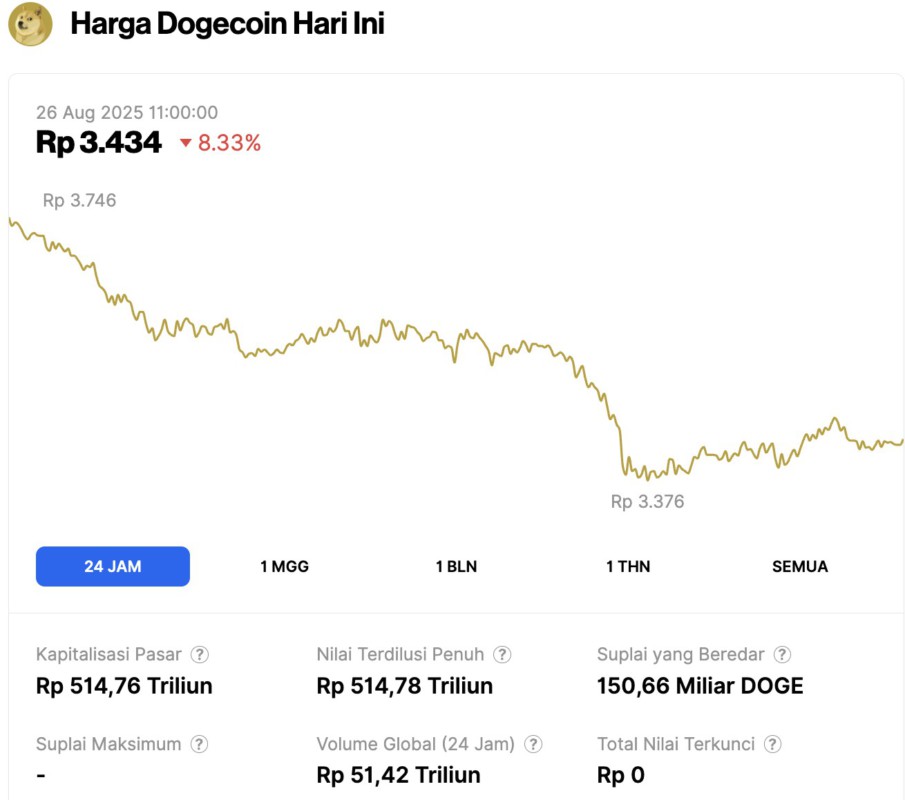

Dogecoin Price Drops 8.33% in 24 Hours

On August 26, 2025, Dogecoin’s price dropped by 8.33% in the last 24 hours, trading at $0.2098, or approximately IDR 3,434. Over the past 24 hours, DOGE’s price fluctuated between IDR 3,376 and IDR 3,746.

At the time of writing, Dogecoin’s market capitalization is around IDR 514.76 trillion, with a 24-hour trading volume of approximately IDR 51.42 trillion.

Read also: Dogecoin Under the Spotlight, Whale Buys 200 Million DOGE Tokens!

Dogecoin Bears Rule the Market

On the 4-hour chart (25/8), Dogecoin price failed to break the upper trend line of its symmetrical triangle, with strong resistance sitting at $0.24. Instead, DOGE is at risk of falling below the lower trend line of the triangle, where the support level is at $0.22.

This weakness is reinforced by the decline in the Bull Bear Power (BBP). As of August 25, the BBP has dropped to -0.016, confirming that sellers are currently in control, reducing the probability of a bullish breakout in the short term.

Amidst this, the Bollinger Bands (BB) have widened, signaling increased volatility in the DOGE market. When the bands widen, it usually means that the price is ready to move quickly.

In this case, volatility can push the DOGE in both directions – if the price drops below support, a decline is likely, while a surprise breakout above resistance can trigger a rapid rally.

No Strong Support

With bears dominating the market, the Dogecoin price could drop below the $0.20 level. Analysts at X have pointed out that DOGE is now at a tipping point, where its next move could determine its short-term direction.

For example, Pakistani crypto analyst Muhammad Imran highlighted $0.20 as a crucial support level that could either hold and trigger a recovery, or collapse and trigger further declines.

According to him, this zone will “determine” DOGE’s next big move.

“DOGE is trading at 0.2177. Immediate support is around 0.2074-0.2077, which will be crucial to maintaining the trend. In the event of a bounce from here, prices could test 0.2395, with stronger resistance near 0.2466. Failure to maintain support could extend the decline towards 0.2004,” Imran wrote.

Read also: Ethereum Price Drops 6% on August 26, 2025 as Market Dominance Hits 14%

DOGE Price at Critical Point

The DOGE/USD daily chart shows that the cryptocurrency has fallen below its 20-period Exponential Moving Average (EMA).

With the 20 EMA acting as resistance and sellers dominating the market, DOGE prices may continue to consolidate or move down, unless buying volumes increase.

Given the current conditions, bears might pull Dogecoin down to $0.19. If buyers fail to defend this level, the price could slide to $0.15. Conversely, if BBP turns positive and trading volume increases, this prediction could be invalidated. In that situation, the Dogecoin price could bounce to $0.31.

If the Federal Reserve cuts interest rates in September, DOGE’s price target could be higher, and DOGE could potentially reach $0.35.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Dogecoin (DOGE) Bounce Delayed – $0.35 Unlikely Until Potential September Rate Cut. Accessed on August 26, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.