Download Pintu App

Discover the Secret of Crypto Investment Stability Through Crypto Vesting!

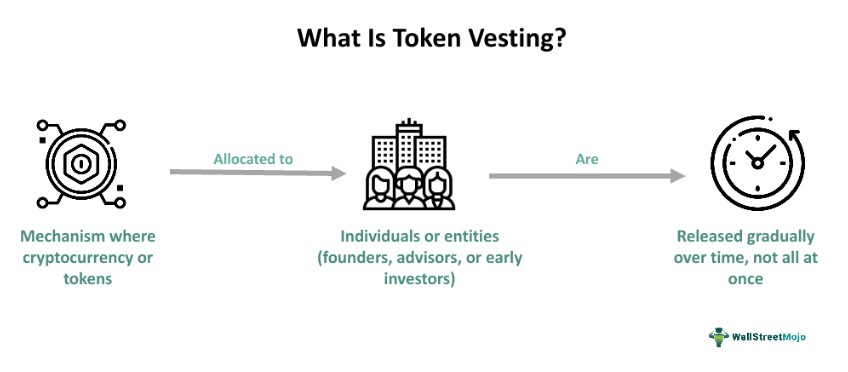

Jakarta, Pintu News – An in-depth understanding of vesting in the crypto world is key to ensuring stability and trust in the cryptocurrency ecosystem. Vesting is the process by which tokens or coins are gradually released to developers, investors, and team members over a predetermined period of time.

This mechanism is designed to prevent market manipulation and ensure that all parties remain committed to the long-term success of the project. This article will explain in detail about vesting, the importance of vesting schedules, and the different types of vesting schedules that are often used.

Understanding Vesting in the Crypto World

In the context of cryptocurrency, crypto vesting is the process by which tokens or coins are awarded to team members, developers, and early investors over a predetermined period of time. Instead of receiving the entire allocation at once, recipients get their tokens gradually.

This practice is especially important for projects carrying out initial coin offerings (ICOs) or token sales, as it helps align the interests of all parties involved. By distributing tokens gradually, projects can reduce the risk of sudden, massive sales that could destabilize the market. Overall, vesting plays an important role in promoting a sustainable and healthy crypto ecosystem.

Also Read: Ondo Finance could be a crypto dark horse in Q4 2025? Here are 4 ONDO facts to know!

Vesting Schedule Preference

Vesting schedules are critical for several reasons, most notably to increase stability and trust in the project. When the tokens of project founders and team members are locked for a certain period, it shows their commitment to the long-term vision of the project. This commitment can increase investor confidence, encouraging more people to participate in the project.

Additionally, vesting helps prevent early investors or team members from rapidly selling their tokens, which can cause significant price volatility. The overall credibility of a project often depends on how they manage their token distribution.

Types of Vesting Schedules

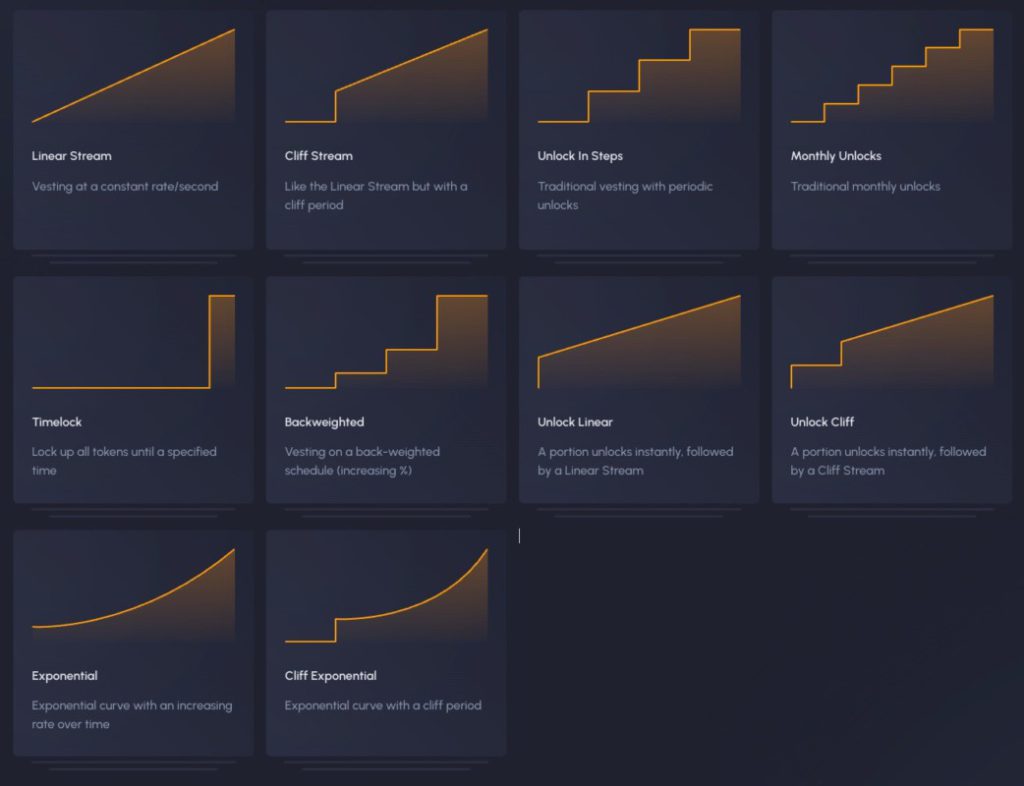

There are several types of vesting schedules that projects can implement, each with its own rules and timeline. The choice of vesting schedule can affect investor sentiment and the long-term sustainability of the project.

Understanding these different types is essential for anyone looking to invest in cryptocurrency. Some common types of vesting schedules include:

- Time-based vesting

- Achievement-based vesting

- Vesting with cliff

- Gradual vesting

- Token buyback vesting

Impact of Vesting on Investors

For investors, understanding the vesting schedule is crucial as it directly affects their investment strategy. When tokens are locked, it can lead to a more stable pricing environment, especially in the early stages of project launch.

However, after the vesting period ends, there may be significant selling pressure if a large number of tokens are released simultaneously. This potential volatility may affect investor sentiment and market prices.

Conclusion

In the dynamic and evolving world of cryptocurrency, understanding vesting and its timelines is vital for project teams and investors. Vesting serves as a mechanism to promote stability, ensure commitment, and align incentives among stakeholders.

Different types of vesting schedules offer flexibility for projects to customize their token distribution strategy to their specific needs. By understanding the implications of vesting, investors can make more informed decisions, leading to better outcomes for their investment portfolios. As the crypto landscape evolves, the importance of vesting and its impact on project success will continue to be a key area of focus.

Also Read: XRP or Bitcoin? 3 Facts from the Chart that Reveal the Truth

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- OSL. What is Vesting in Crypto: Understanding Crypto Vesting Schedules. Accessed on August 26, 2025

- Featured Image: CoinMarketCap

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.