Download Pintu App

Antam Gold Price Chart Today – August 27, 2025

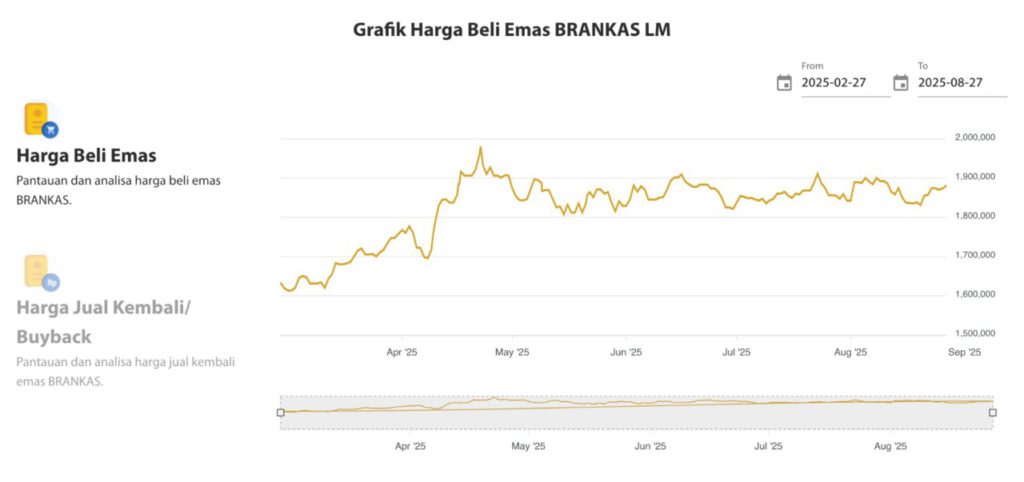

Jakarta, Pintu News – In the latest chart from the Berencana Aman Kelola Emas (BRANKAS) service, the buying price of gold stands at IDR 1,880,600 per gram and the physical price stands at around IDR 1,940,000 per gram-both up IDR 8,000 from the previous price according to official data released on Wednesday, August 27, 2025 at 08:13 WIB, as reported by BRANKAS LM.

Here are five important facts you need to know as a careful investor, including how they relate to the world of crypto and cryptocurrencies.

1. Recent Surges that Raise Attention (But Not FOMO)

On the BRANKAS chart, it can be seen that the buying price of gold reached its highest point in recent months, breaking into the region of IDR 1.9 million per gram-reflecting the momentum in the market neutrally, without the need for hype.

These upward movements are not only indicative of short-term trends, but also an indication of global and domestic market conditions-as an official data source from BRANKAS. As such, this information can be used as an educative reference for traditional asset owners as well as those interested in cryptocurrencies for diversification.

Also Read: Dogecoin (DOGE) Price Prediction: 3 Key Levels to Watch This Week

2. Consistent Chart, No Longer Volatile

The BRANKAS chart shows that after peaking in May and early June 2025, gold prices tend to stabilize and stay within the range of IDR 1.8 million to IDR 1.9 million per gram.

This illustrates the consistency of the gold market, in contrast to the high volatility often found in the crypto market (think Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Pepe Coin (PEPE), and others), where price movements can be very sharp in a short period of time. This data is important for investors seeking stability between conventional assets and cryptocurrency instruments.

3. Gold Movement Compared to Crypto Assets

Despite the stable gold chart, external sources noted that the world spot price per gram reached around IDR 1,775,896 per gram, up by around IDR 11,284 compared to the previous day.

When compared to cryptocurrencies like Bitcoin (BTC) and Ether (ETH), which can change in value by tens of percent in a single day, gold still offers a conservative approach-long term and minimal drama.

This is important as non-persuasive educational information for those who want to maintain a balance between digital and physical assets.

4. Dollar vs Rupiah – Impact on Gold Price

The world spot gold price of around $108.8 per gram, when calculated at an exchange rate of IDR 16,348 (assumed exchange rate), results in an equivalent price of around IDR 1,774,182 per gram. This difference reflects local market premiums and physical distribution costs.

This data is useful as a dollar to rupiah conversion lesson to evaluate the value of local inflation and distribution premium costs, especially for investors who also follow the global cryptocurrency market in US dollars.

5. Gold vs Crypto Investing – Portfolio Balance

Looking at BRANKAS’ relatively stable chart and modest gains in late August, investors can learn the importance of combining physical gold with crypto assets such as Bitcoin (BTC), Ethereum (ETH), and others-for risk diversification and return opportunities.

BRANKAS’ transparent pricing and charting information helps build a well-thought-out investment strategy that is not driven by fear of missing out (FOMO), but rather based on facts and long-term data.

Conclusion

The five facts above provide a comprehensive overview of today’s gold market conditions – based on charts and data from BRANKAS LM and other reliable sources. For the investor community, both conservative and those who also monitor crypto and cryptocurrencies, a neutral and data-driven approach like this is crucial in making wise investment decisions.

Also Read: XRP or Bitcoin? 3 Facts from the Chart that Reveal the Truth

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BRANKAS LM. BRANKAS Gold Purchase Price & Physical Gold Today. Accessed on August 27, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.