Download Pintu App

Bitwise Submits S-1 Filing to the US SEC for a Spot Chainlink (LINK) ETF!

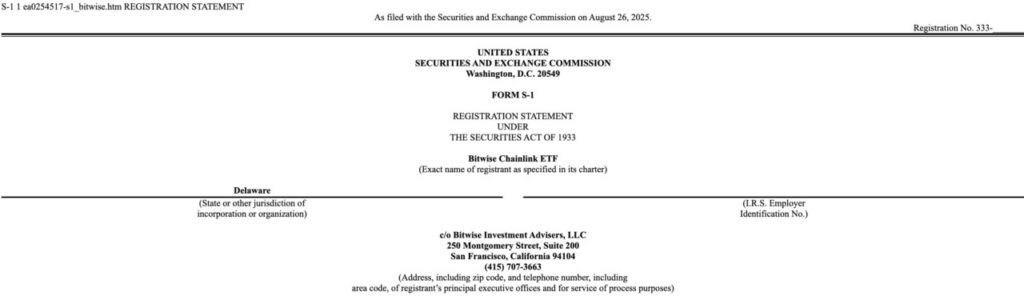

Jakarta, Pintu News – American fund manager Bitwise Asset Management has filed S-1 documents with the US Securities and Exchange Commission (SEC) to launch an exchange-traded product (ETF) that will track the price of Chainlink (LINK), a move that could bring the crypto asset into the mainstream of investors.

Bitwise Files Chainlink ETF with SEC

Bitwise Asset Management, known for its innovation and crypto investment products, has now set its sights on Chainlink (LINK).

Read also: Bio Protocol Launches Aubrai, the First Decentralized AI for Longevity!

By filing S-1 documents, Bitwise hopes to gain approval from the SEC for an ETF that will directly hold the LINK token. The ETF is designed to track the CME CF Chainlink-Dollar Reference Rate (New York Variant), a standard regulated by CF Benchmarks.

This ETF, if approved, will be one of the first ETFs in the US to focus on native tokens from decentralized oracle networks. This marks an important step considering the SEC recently approved ETFs for Bitcoin (BTC) and Ethereum (ETH).

Furthermore, Bitwise is also awaiting the SEC’s decision on several other crypto ETF offerings, including those related to Ripple (XRP), Solana (SOL), Dogecoin (DOGE), and Aptos.

Chainlink ETF Structure and Mechanism

The Chainlink ETF will be structured as a Delaware statutory trust. The Net Asset Value (NAV) of the ETF will be linked to the CME CF Chainlink-Dollar Reference Rate. Shares will be created and redeemed in blocks of 10,000, allowing authorized participants to transact in both LINK and US dollars.

As with other crypto ETFs, secondary market trading may cause shares to trade at a premium or discount relative to NAV. Coinbase Custody Trust Company, LLC has been appointed as trustee, responsible for the custody of LINK’s reserves.

Although the assets are not insured by the FDIC, Coinbase Custody maintains a private insurance policy to protect the deposited assets.

Read also: MANTRA Launches First RWA Product Organized with Pyse Earth Electric Bike Fleet!

Outlook and Market Reaction to Chainlink ETFs

The launch of the Chainlink ETF by Bitwise has generated optimism among investors and industry watchers. Although LINK saw a decline of about 5% in as of August 26, 2025, its long-term outlook remains bullish. Whale activity has increased and trading volumes have surged since the ETF filing, indicating strong interest from large investors.

Chainlink (LINK) itself is a very well-performing digital asset, now the 11th largest digital asset by market capitalization.

If this ETF is approved, there could be a surge in demand that creates supply pressure on LINK, given Chainlink’s tokenomics that continue to lock tokens in smart contracts.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitwise Files for Chainlink Crypto ETF with SEC. Accessed on August 27, 2025

- CoinSpeaker. Bitwise Files S-1 Filing with SEC to Spot Chainlink ETF. Accessed on August 27, 2025

- Crypto Briefing. Chainlink ETF: Bitwise Files for LINK Fund with SEC. Accessed on August 27, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.