Download Pintu App

More than 9% of Ethereum Supply is Held by Institutions and ETFs, Start of a Bull Run?

Jakarta, Pintu News – The control of Ethereum (ETH) supply by financial institutions and exchange-traded funds (ETFs) has reached significant numbers, signaling increased interest from the traditional financial sector.

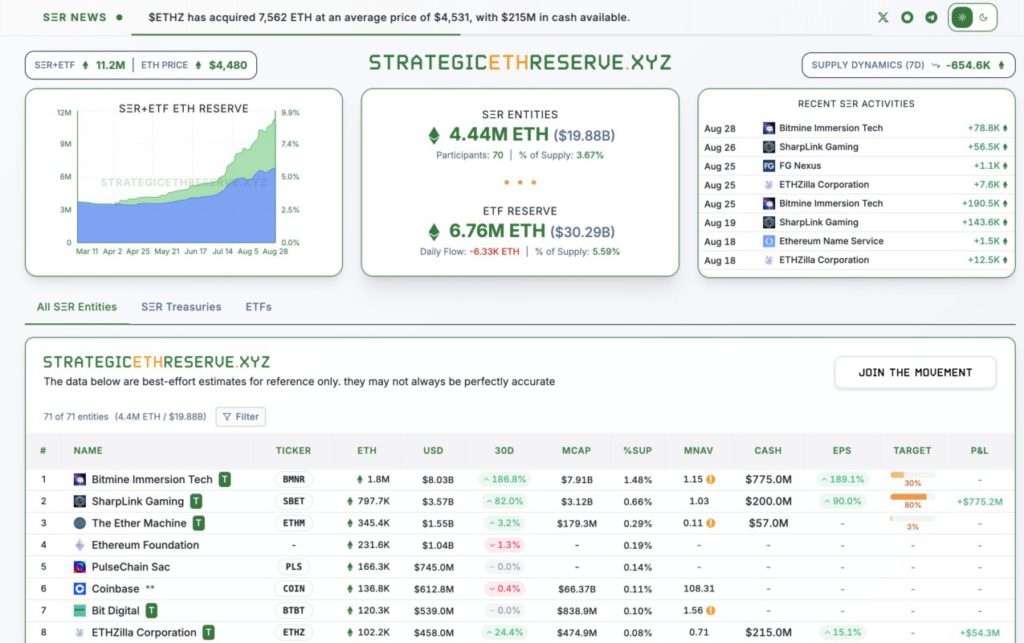

Recent data shows that more than 9% of the total Ethereum (ETH) supply is now in the hands of reserve entities and spot ETFs. This increase reflects the positive trend in the adoption and integration of Ethereum (ETH) in mainstream investment portfolios.

Check out the full information below!

Strengthening Market Dominance by US Ethereum ETF

The Ethereum (ETH) ETF market in the United States is a key player in this trend. Since their launch one year ago, these ETFs have accumulated 5.6% of the total Ethereum (ETH) supply, valued at around $31.2 billion.

Their presence in the market has had a significant impact on the liquidity and price stability of Ethereum (ETH). As many as 70 institutions in the US now own Ethereum (ETH), with many of them starting to add to their reserves since early April this year.

In total, they control 3.6% of the circulating supply, which equates to approximately 4.36 million Ethereum (ETH) or $20.1 billion. This increase in the number of institutions investing in Ethereum (ETH) shows the growing confidence in this crypto asset as a long-term investment instrument.

Also read: XRP September Price Prediction: Can it Reach $4? Here’s What Crypto Analysts Say!

The Role of Public Companies in the Ethereum Price Rally

Analysis shows that publicly traded companies holding Ethereum (ETH) are a major factor behind the price increases that have occurred this year. Their periods of aggressive buying often coincided with the most significant spikes in Ethereum (ETH) price.

This suggests a direct correlation between institutional accumulation and price appreciation. Bitmine Immersion Tech became the largest institutional holder with 1.7 million Ethereum (ETH). The company started accumulating Ethereum (ETH) on June 20 this year and has accumulated $8 billion worth of Ethereum (ETH) within two months.

In second place, SharpLink Gaming owns 797,700 Ethereum (ETH), with their massive purchase beginning on June 8, coinciding with Ethereum’s (ETH) price increase of 55.34%.

Read also: Rumor or Fact: Is it true that OKX and MEXC will delist Pi Network (PI)?

Future Projections and Their Impact on Ethereum Price

Some analysts consider this trend a bullish indicator for future price appreciation. Bitmine has publicly committed to acquiring enough Ethereum (ETH) to reach 5% of the total circulating supply, which would entail purchasing an additional approximately 4 million Ethereum (ETH).

A recent report from Standard Chartered estimates that digital asset-focused companies may account for up to 10% of the total supply of Ethereum (ETH), signaling that heavy buying by these companies is still in its early stages.

Conclusion

With the increasing dominance of institutions in Ethereum (ETH) holdings and optimistic growth projections, the market may witness more integration of crypto assets in traditional investment portfolios. This will not only enhance the stability and liquidity of Ethereum (ETH) but also its potential as a globally recognized investment asset.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Institutions and ETFs Now Control Over 9% of Ethereum Supply. Accessed on August 29, 2025

- Featured Image: FX Empire

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.