Download Pintu App

Jupiter (JUP) Price Spike at the End of August 2025: Will the Uptrend Last?

Jakarta, Pintu News – The cryptocurrency market is always full of interesting dynamics, and this time the Jupiter cryptocurrency (JUP) is in the spotlight. With a significant price increase and a 62.5% jump in daily trading volume, many market participants are wondering if this is the beginning of a sustainable uptrend.

Significant Increase in Jupiter (JUP)

The native token of this decentralized exchange (DEX) platform, Jupiter (JUP), has recorded considerable gains recently. Based on recent data, the daily trading volume of this token increased sharply, registering an increase of 62.5%.

Nonetheless, price chart analysis shows that a strong uptrend has yet to be fully established. Daily Active Addresses, as reported by Santiment, have shown an increase since mid-June, while network growth has also been on the rise.

Also Read: 3 Reasons Why Altcoins Are Predicted By Analysts And Tapiero To Explode And Surpass Bitcoin (BTC)

Technical Analysis and Price Predictions

On the daily chart, it was found that Jupiter (JUP) is trading within its established long-term range. This range is between $0.33 to $0.63 with the midpoint at $0.48, which is currently being contested by buyers and sellers.

As it stands, the available evidence suggests that the sellers have the upper hand, with the price closing the daily session at $0.454 on August 25. The MACD indicator hovering around the zero line suggests a definite absence of momentum, while the CMF indicates significant capital outflow.

Potential Upcoming Price Movements

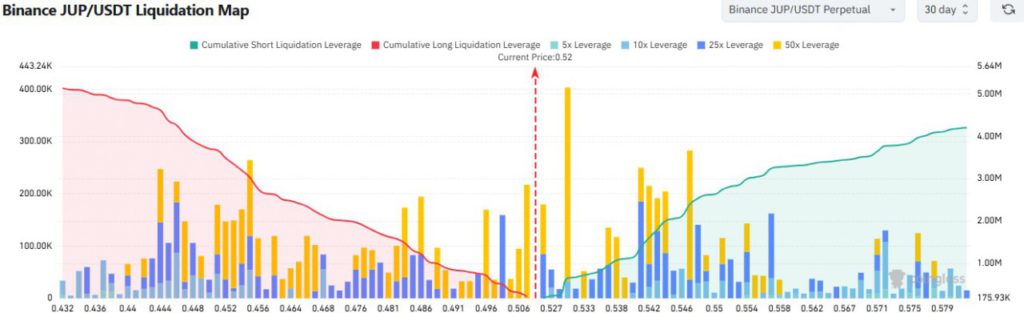

The liquidation map highlights the $0.542 to $0.548 area as an interesting zone. A concentration of liquidation of short positions in this area could trigger a price bounce towards $0.55, which has been a local resistance level for the past two weeks.

On the other hand, the liquidation of long positions is lower and clustered around the $0.48 mark. Hence, a possible price drop to $0.48 followed by a bounce to $0.548 is a scenario that traders should watch out for.

Conclusion

With all the data and analysis available, the chances of Jupiter (JUP) achieving a sustainable uptrend are still in question. Investors and traders should pay close attention to key indicators and market news to make informed decisions in the face of volatility. The significant increase in trading volume may provide some opportunities, but should also be balanced with careful technical analysis.

Also Read: 3 Reasons Why Tom Lee Predicts Ethereum (ETH) Could Touch IDR196 Million by the End of 2025

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as Bitcoin price today, XRP coin price today, Dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Jupiter (JUP) surges amid 62% daily volume spike; can bulls hold?. Accessed on August 29, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.