Download Pintu App

Pi Network Takes a Hit with 7% Decline — What’s Next for PI?

Jakarta, Pintu News – At the end of August 2025, Pi Network was on the rise again, gaining more than one percent and briefly trading at $0.385. Since hitting a low of $0.3303 on August 25, the token has rallied more than 16 percent, raising hopes that the momentum could push the price towards the one-dollar mark.

However, there will be a large release of around 149 million tokens scheduled in September. This additional supply could put pressure on the market.

Then, how is Pi Network’s current price movement?

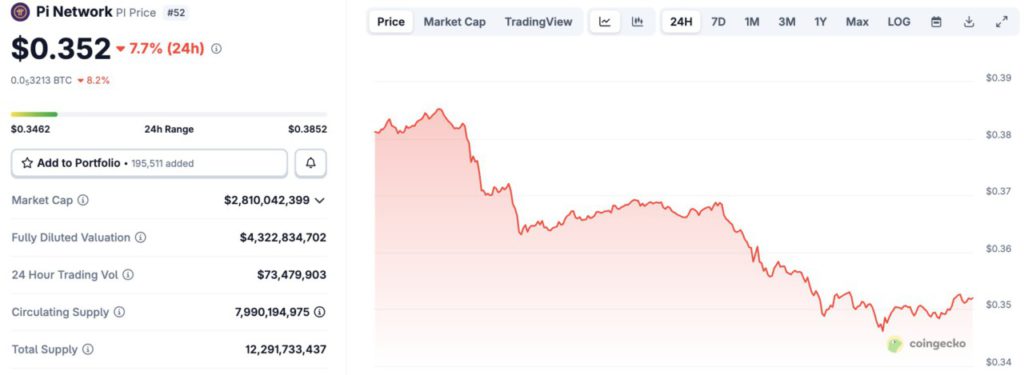

Pi Network Price Drops 7.7% in 24 Hours

On September 1, 2025, the price of Pi Network was recorded at $0.352, a 7.7% decrease from its daily high of $0.3852. If converted into today’s rupiah ($1 = IDR 16,415), then 1 Pi Network is IDR 5,778.

Read also: Major Bitcoin Investors Are Turning to Ethereum — Is a $10,000 ETH on the Horizon?

Currently, Pi Network’s market capitalization stands at approximately $2.81 billion, while its 24-hour trading volume stands at $73.47 million.

Pi Network Price Outlook

According to Coinpedia, Pi Network’s liquidity is also a concern. Daily trading volume has been steadily declining since mid-May, and currently stands at around $43.8 million. Weak liquidity makes it harder for the market to absorb selling pressure and increases the risk of sharp price fluctuations.

Technically, the Pi is still trapped in a descending channel pattern that has been forming since May, maintaining a bearish general trend. Indicators are also showing a negative market tendency, with the Relative Strength Index (RSI) value standing at 38-signaling weak momentum-while the MACD indicator is still flat, indicating confusion among traders.

If bearish pressure continues to dominate, Pi could again test its all-time low around $0.322. Conversely, if the recovery continues consistently, the token may attempt to break the resistance level at $0.400.

Why Pi is Recovering

Analyst Kim Wong stated that Pi’s recovery is not just a technical bounce, but also driven by various new developments in its ecosystem.

The token was just listed on Swapfone on August 25, and more importantly, the launch of the SEK-denominated Pi exchange-traded product (ETP) by Valour in Europe was a major driving factor.

Improvements to the protocol and the launch of Linux-based nodes also boosted confidence in the network, while market conditions that had been heavily oversold created opportunities for investors to re-enter. The combination of all these factors has helped Pi recover some of its lost value.

The importance of Valor’s ETP Pi

Valor, founded in 2019, is a regulated financial company focused on bridging the world of traditional finance with digital assets. Currently, it offers 85 exchange-listed investment products linked to more than 30 cryptocurrencies.

Read also: Grayscale Officially Files Polkadot and Cardano ETFs with the SEC!

For a token like Pi that has relied heavily on the community since its inception, entry into the ETP investment product market is a big step towards institutional recognition and wider mainstream adoption.

Can Pi Network Return to $1?

Quoting Coinpedia’s report, Pi’s likelihood of hitting $1 again will depend on the balance between bearish market pressures and positive adoption catalysts. On the one hand, the upcoming supply release and declining trading activity are still pressures for the price.

But on the other hand, the listing on exchanges, the development of the ecosystem, as well as the presence of the Valor ETP open up new opportunities for growth in Pi value.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Pi Network News: Will Price Hit $1 in September? Unlocks Vs New ETP. Accessed on September 1, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.