Download Pintu App

Bitcoin Price Increase Prediction: Analyst Dave The Wave Reveals Potential Spike in September!

Jakarta, Pintu News – A crypto market watcher known for his precise predictions of a market crash in 2021 is now indicating that Bitcoin (BTC) is showing signs of a significant upswing.

The analyst, who goes by the pseudonym Dave The Wave, has shared his analysis with his 153,000 followers on the X platform, regarding the huge potential that this crypto asset holds.

Elliot Wave Theory: Key to Understanding Bitcoin Price Movement

Dave The Wave uses the Elliot Wave Theory to analyze the price movement of Bitcoin (BTC). This theory states that upward price movements occur in five waves, where the fourth wave is a correction, and the fifth wave brings the price to its peak.

This analysis suggests that Bitcoin (BTC) will reach its local peak in late 2025 or early 2026. According to the analysis, Bitcoin (BTC) has found support around the $107,000 level and is back on track after last week’s decline. Dave The Wave described this condition as a “shakeout before the breakout,” signaling a potential significant price spike.

Also Read: Can Ripple (XRP) Make Investors Millionaires? Here Are the Prospects According to Analysts!

Price Projections and Market Corrections

In his latest prediction, Dave The Wave states that Bitcoin (BTC) has the potential to surge to $180,000 by the end of this year. He emphasized that the recent price drop is only 8%, which is relatively small compared to the 30% correction that has already occurred twice during this bullish period.

This market watcher suggests maintaining a broad perspective on Bitcoin (BTC) price movements. This minor correction should not be a major concern, given the long-term trend that suggests greater upside potential. This confirms the belief that Bitcoin (BTC) still has ample room to grow.

Market Reaction and Implications for Investors

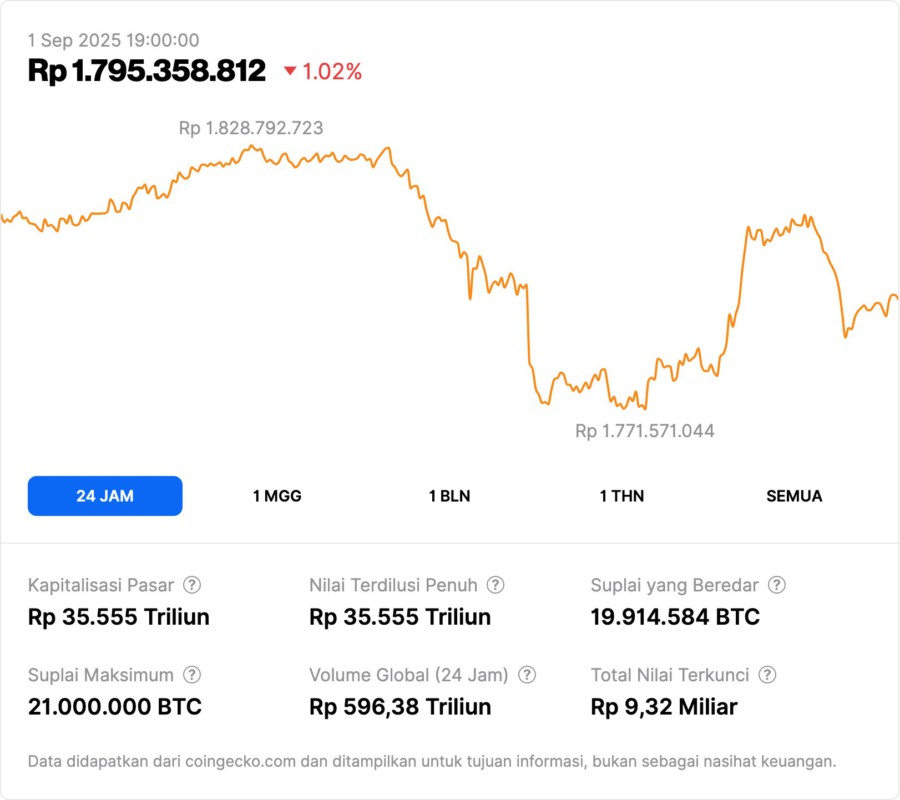

Currently, Bitcoin (BTC) is trading at $108,817. Market reactions to these analyses and predictions can vary widely, but investors who understand market dynamics may see this as an opportunity to take a position before the price experiences the predicted spike.

It is important for investors to closely monitor Bitcoin (BTC) price support and resistance, as well as pay attention to external factors that could affect the market. With a deep understanding of market theory and dynamics, investors can make more informed and profitable decisions.

Conclusion

With in-depth, theory-driven analysis, Dave The Wave provides new insights into the potential future of Bitcoin (BTC). While the crypto market is known for its volatility, analysis like this provides guidance for investors to navigate this often unpredictable market.

Also Read: 4 Interesting Facts Why 1 in 4 Brits are Interested in Crypto Investment for Retirement Funds

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Daily Hodl. Shakeout Before Breakout: Trader That Called May 2021 Collapse Says Bitcoin Is Seeing Classic Impulse Move Up. Accessed on September 1, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.