Download Pintu App

Ethereum Holds Steady at $4,300 Today — Is a Surge to $5,000 Next or Is a Pullback Coming?

Jakarta, Pintu News – Ethereum (ETH) closed the month of August with a strong performance, recording a gain of more than 23% over the 31-day period.

The leading altcoin now looks set to continue its September rally, supported by on-chain data showing a decline in sell-offs and increased market confidence in its short-term performance.

Then, how is Ethereum’s current price movement?

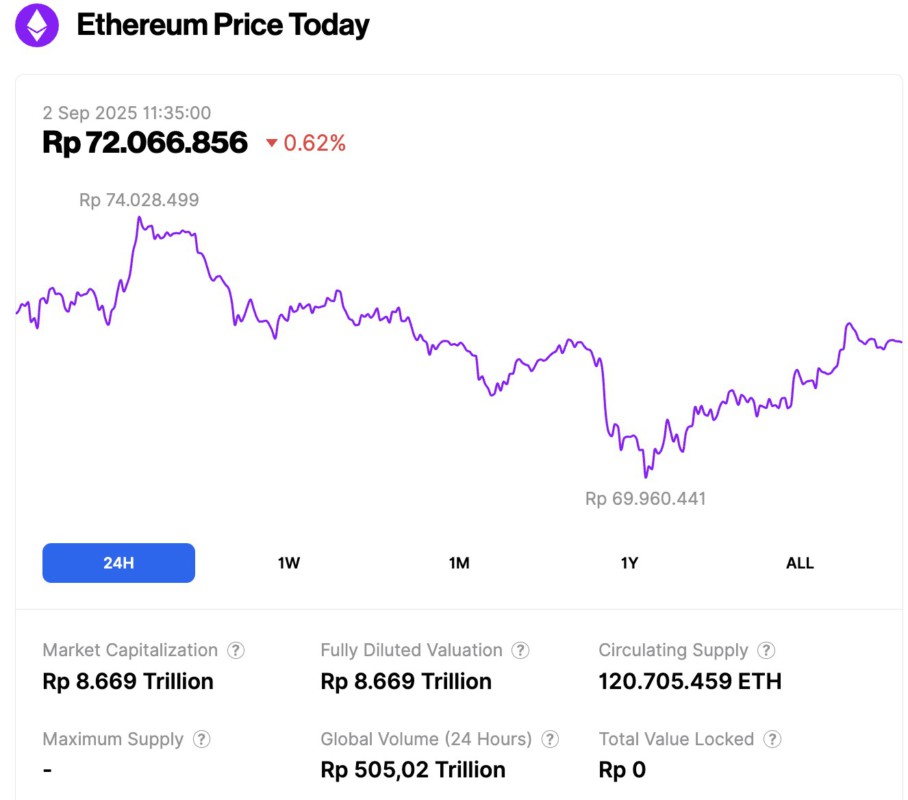

Ethereum Price Drops 0.62% in 24 Hours

As of September 2, 2025, Ethereum was trading at approximately $4,378 (around IDR 72,066,856), marking a slight 0.62% dip over the past 24 hours. During this period, ETH fluctuated between a low of IDR 69,960,441 and a high of IDR 74,028,499.

At the time of writing, Ethereum’s market capitalization stands at roughly IDR 8,669 trillion, while its 24-hour trading volume has surged by 30% to reach IDR 505.02 trillion.

Read also: Trump-Backed WLFI Token Officially Debuts on Binance Alongside USD1 Launch on Solana

Ethereum Balance on Exchanges Plummets to Lowest Level Since 2016

According to data from Glassnode, the total amount of ETH stored in exchange addresses has now dropped to its lowest level since 2016. To date, approximately 16 million ETH – worth approximately $70.37 billion – are stored in exchange-owned wallets.

The decline in ETH balances on exchanges suggests that investors are increasingly choosing to move their assets to personal wallets, instead of keeping them on trading platforms. This shift is usually associated with reduced selling pressure.

With fewer coins available for sale on the market, there is a supply squeeze that can push prices up – provided demand remains strong.

For ETH, this pattern reflects the increasing confidence of coin holders, who seem to prefer to hold their assets in expectation of further price increases. This strengthens the likelihood that the price rally will continue this month.

In addition, ETH’s ever-increasing long/short ratio also reinforces the positive outlook. Based on data from CoinGlass, the ratio currently stands at 1.0096, which shows that more traders are going long than short.

The long/short ratio measures the ratio between the number of traders who bet an asset’s price will rise (long) and those who expect the price to fall (short). A ratio above 1 indicates a predominance of long positions, signaling bullish market sentiment. Conversely, a ratio below 1 reflects a predominance of bearish sentiment.

Read also: Bitcoin Surges to $110,000 on September 2nd — Where Could It Go Next?

The rise in ETH’s long/short ratio indicates increasing optimism among market participants. This indicates that more and more traders believe ETH is capable of maintaining an upward trend in the next few weeks.

$5,000 Closer or Correction to $4,221?

If buying pressure continues to increase, ETH has a chance to break the nearest resistance level at $4,664. If it manages to pass this level, the path to the previous record high price of $4,957 will be open.

The continued dominance of the bullish trend could make the possibility of ETH breaking the $5,000 level even greater.

However, if demand starts to weaken, this bullish projection may fail to materialize. In that scenario, ETH prices are at risk of correcting down to around $4,221.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Exchange Holdings Hit 9-Year Low as $5,000 Breakout Looms. September 2, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.