Download Pintu App

5 Facts about Metaplanet’s Crypto Strategy: Save 20,000 BTC Even if the Stock Price Plummets!

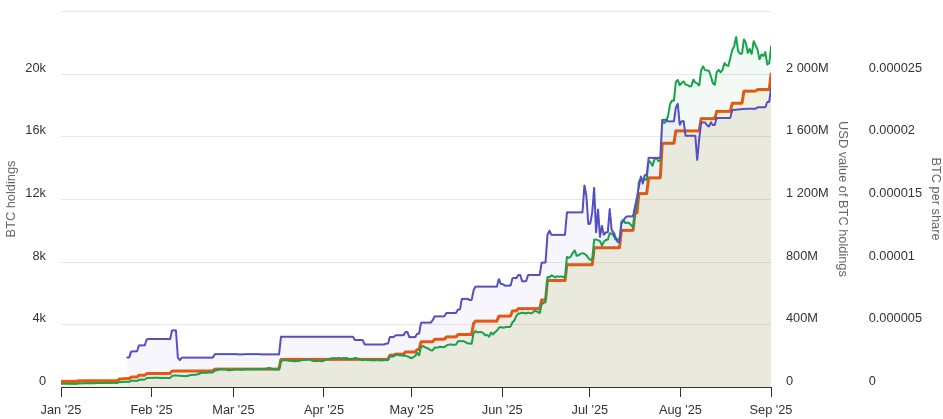

Jakarta, Pintu News – Japanese crypto company Metaplanet has just announced the purchase of 1,009 Bitcoin (BTC), bringing its total holdings to 20,000 BTC. According to a report by Cointelegraph, the acquisition was made for around ¥16.479 billion, which is equivalent to around Rp1.844 trillion (at an exchange rate of 1 USD = Rp16,447).

1. Metaplanet Increases Bitcoin (BTC) Holdings to 20,000 Units

Data from BitcoinTreasuries.net states that Metaplanet is now the sixth largest BTC holding company in the world, and the largest in Japan. The average price of Bitcoin purchased by the company is $102,607 per BTC, or about Rp1.686 billion, with a profit of about 6.75% compared to the market price at the time of writing.

2. New Share Issuance: A Controversial Move Amidst Stock Decline

Alongside the BTC acquisition, Metaplanet also announced the issuance of 11.5 million new shares. This was done in response to an investor called Evo Fund exercising warrant rights to purchase shares of the company.

According to the same report, Evo Fund bought 10 million shares for $5.67 and another 1.5 million shares for almost $6. The total funds raised from this transaction amounted to $65.73 million or around Rp1.081 trillion, which was partly used to pay off bonds worth $20.4 million (around Rp335.5 billion).

3. Metaplanet Shares Down 54% Since June, What’s the Impact?

Despite Metaplanet’s aggressive crypto strategy, its share price has fallen 54% since mid-June 2025. This decline occurred even though the price of Bitcoin itself rose by about 2% in the same period, according to analyst observations.

This situation has a direct impact on the attractiveness of the stock warrants held by Evo Fund. As the stock price falls, there is less incentive to exercise the warrants, which ultimately reduces Metaplanet’s liquidity and their ability to buy further BTC.

4. Metaplanet prepares new funding of up to Rp14.6 trillion

In an effort to maintain liquidity, Metaplanet is not standing still. Last week, the company announced plans to issue public shares in overseas markets to raise ¥130.3 billion or around Rp2.142 trillion.

In addition, Metaplanet is also seeking shareholder approval to issue up to 555 million preferred shares, which could potentially generate ¥555 billion. This suggests that their crypto accumulation strategy will continue despite market pressure.

5. Risks of Crypto Treasury Strategy: Not Always Profitable

Cryptocurrency treasury strategies have indeed grown in popularity since their introduction by companies like Strategy (formerly MicroStrategy). However, this approach also comes with great risks, especially if crypto prices plummet.

According to a report by Cointelegraph, some of the crypto companies that copied this model are now in serious trouble. As the company’s net asset value declines due to BTC price fluctuations, funding opportunities could be closed, ultimately forcing them to forcefully sell BTC to meet debt obligations or margin calls.

Also Read: Bitcoin Price Increase Prediction: Analyst Dave The Wave Reveals Potential Spike in September!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Adrian Zmudzinski/Cointelegraph. Metaplanet Bitcoin holding reaches 20,000 BTC, issues 11.5M shares. Accessed on September 2, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.