Download Pintu App

What’s the Outlook for Crypto in September? Historical Data Shows the Following Facts!

Jakarta, Pintu News – After reaching a high peak of $123,731 on August 14, Bitcoin (BTC) has experienced a significant decline. In the past few weeks, the cryptocurrency lost almost 10% of its value, now trading below $110,000. Given the historically unfavorable trend in September, the outlook for this month seems increasingly bleak.

History Shows Potential for Further Decline

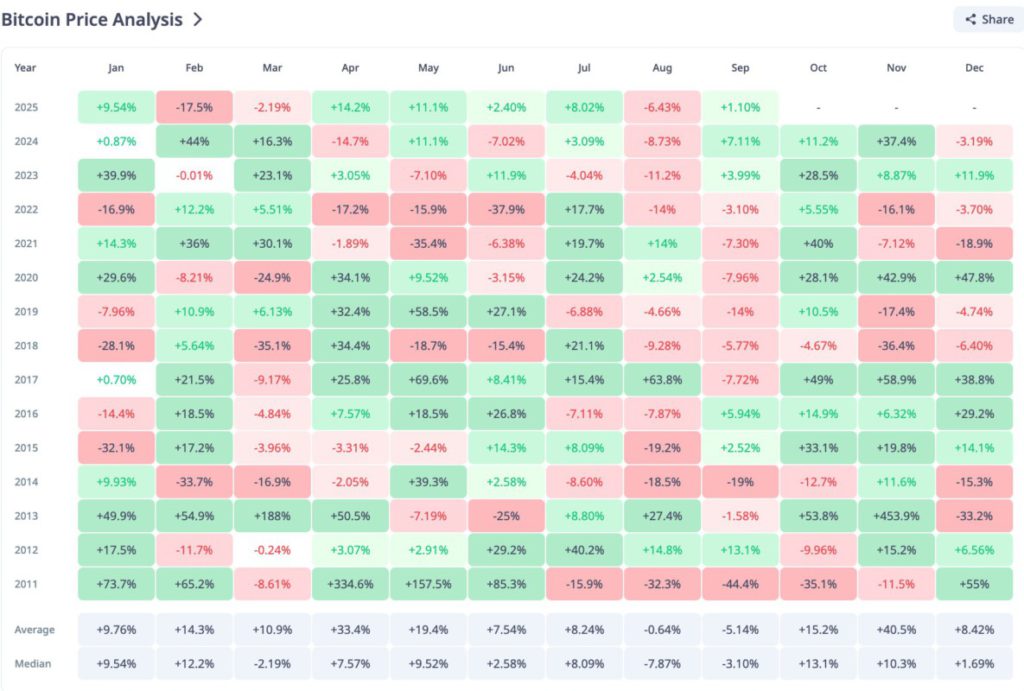

September has historically been one of the weakest months for Bitcoin (BTC), often characterized by negative returns and increased volatility. Data shows that over the past few years, the currency has often recorded declines in September, including an 8% drop in 2020, 7.3% in 2021, and 3.10% in 2022.

Although there were small increases of 4% and 7% in September 2023 and September 2024, the month is expected to return to a downward trend, given the decline in institutional demand and increasingly bearish market sentiment. With consistent declines over the past few years, investors and analysts alike are preparing for the possibility that September will again be a challenging month for Bitcoin (BTC).

Also Read: 5 Facts about Metaplanet’s Crypto Strategy: Save 20,000 BTC Even if the Stock Price Plummets!

ETF Exits and Negative Sentiment Harm Bitcoin

August was characterized by a decline in capital inflows into exchange-traded funds (ETFs) backed by Bitcoin (BTC). According to data from SosoValue, over the 31-day period, outflows from these investment products totaled $751.12 million, ending four consecutive months of steady inflows that had previously supported Bitcoin’s (BTC) price gains in previous months.

This is significant because since the approval and launch of the spot Bitcoin (BTC) ETF, the asset’s push to new record highs has been directly linked to the volume of institutional inflows. Now, with inflows reversing and institutional interest looking tired, the currency may face additional downward pressure in September.

Without consistent support from large-scale ETF demand, the market may struggle to maintain bullish momentum, leaving these assets vulnerable to a sharper correction if retail buyers fail to fill the gap.

Bitcoin bears eye $103,000

With institutional investors and spot traders growing increasingly cautious, this reduced optimism could turn into weaker demand and lower trading volumes for Bitcoin (BTC) this month.

If buying continues to decline, the price of the coin could slip towards $107.557. If the bulls fail to hold the support floor, it could trigger a deeper drop towards $103,931. On the other hand, if demand increases, Bitcoin (BTC) could rebound and rise above $111,961.

Conclusion

Given historical trends and current market conditions, September may not promise much for Bitcoin (BTC) holders. Investors are advised to prepare for possible volatility and consider suitable strategies to manage risk in their portfolios.

Also Read: Check out 4 US Economic Data that Potentially Affect the Crypto Market This Week!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. BTC Price Performance in September. Accessed on September 3, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.