Download Pintu App

Gold Expected to Reach $3,700 per Troy Ounce by End of 2025, According to Goldman Sachs Research

Jakarta, Pintu News – Gold, a precious metal that has been used as a financial asset for thousands of years, is back in the spotlight among traders, investors and central banks.

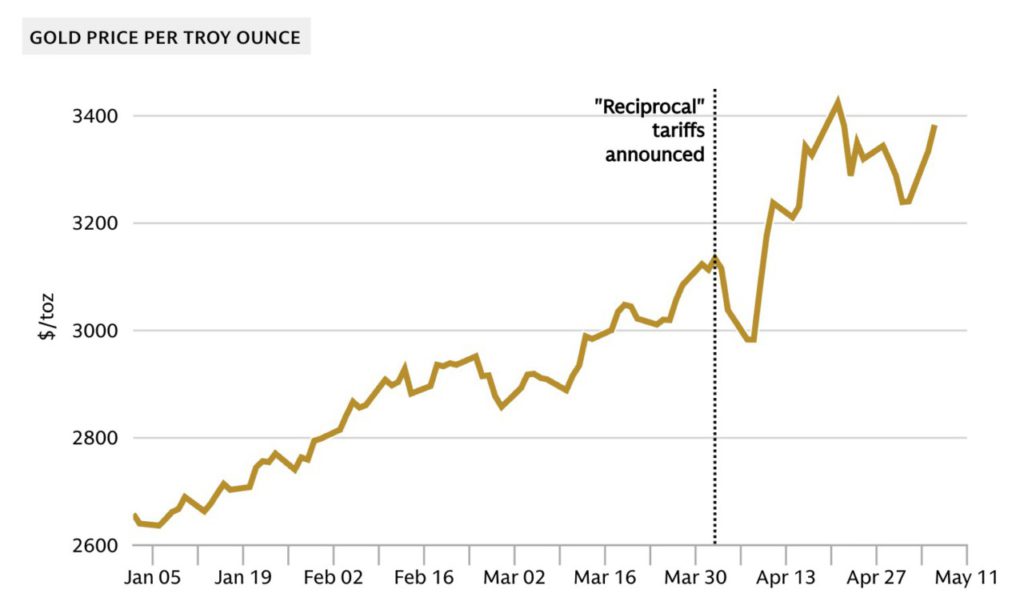

Despite being known for its price fluctuations, gold has continued to set new price records in recent years. Since March, there has been a significant increase in gold holdings by investors, fueled by concerns over economic conditions and market volatility.

Check out the full analysis below!

Analysis and Predictions from Goldman Sachs Research

Goldman Sachs Research predicts that gold prices will reach $3,700 per troy ounce by the end of 2025, up from $3,220 on May 15. This rise is driven by massive buying by central banks that continues every month.

Moreover, it is expected that ETF investors will increase their holdings in anticipation of interest rate cuts and rising recession fears. In a recession scenario, Goldman Sachs Research even estimates that gold prices could reach up to $3,880 per troy ounce.

Private investors may also turn to gold for diversification from US assets, especially if traditional equity portfolio hedges such as US Treasuries continue to underperform during the equity downturn.

Also read: 6 Factors that Could Boost Crypto Prices in September 2025

The Role of Central Banks and ETFs in Gold’s Rally

Since 2022, purchases by central banks have been a key factor in the increase in gold prices. However, now ETF investors are also starting to join the gold rally. Both parties are competing for the same bullion, which is expected to push gold prices even higher.

Thomas from Goldman Sachs Research emphasizes that while central bank purchases were the main factor before, now the participation of ETF investors cannot be ignored. These two factors together will push gold prices to higher levels than before.

Also read: Can Ripple (XRP) Price Reach $100?

Impact of Asset Rotation and Investment Diversification

In the event of a small rotation from US assets to gold, this could have a large impact on gold prices given the relative market size. Currently, global gold ETF holdings are only about 1% of total US Treasuries outstanding and 0.5% of the S&P 500 market capitalization.

This diversification becomes increasingly important when traditional hedges such as US Treasuries do not provide sufficient protection during equity market downturns. This points to greater potential for gold as a diversifying asset in global investment portfolios.

Conclusion

With strong support from central bank buying and increased participation from ETF investors, the outlook for gold prices looks very positive. Predictions of prices reaching new records indicate analysts’ high confidence in the precious metal as a stable and profitable investment asset in uncertain times.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Goldman Sachs. Why Gold Prices Are Forecast to Rise to New Record Highs. Accessed on September 6, 2025

- Fetaured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.