Download Pintu App

Bitcoin vs Ethereum: Weekly Highlights, Price Action, and Key Milestones!

Jakarta, Pintu News – The first week of September brought quite a challenging price action for Bitcoin (BTC) and Ethereum (ETH), influenced by demand, market trends, and macroeconomic events.

While these fluctuations are temporary and triggered by various factors, they also provide clues as to the direction of future movements. With that in mind, let’s take a look at BTC and ETH price movements, headlines, and recent milestones.

Bitcoin vs Ethereum Price Movement Over the Week

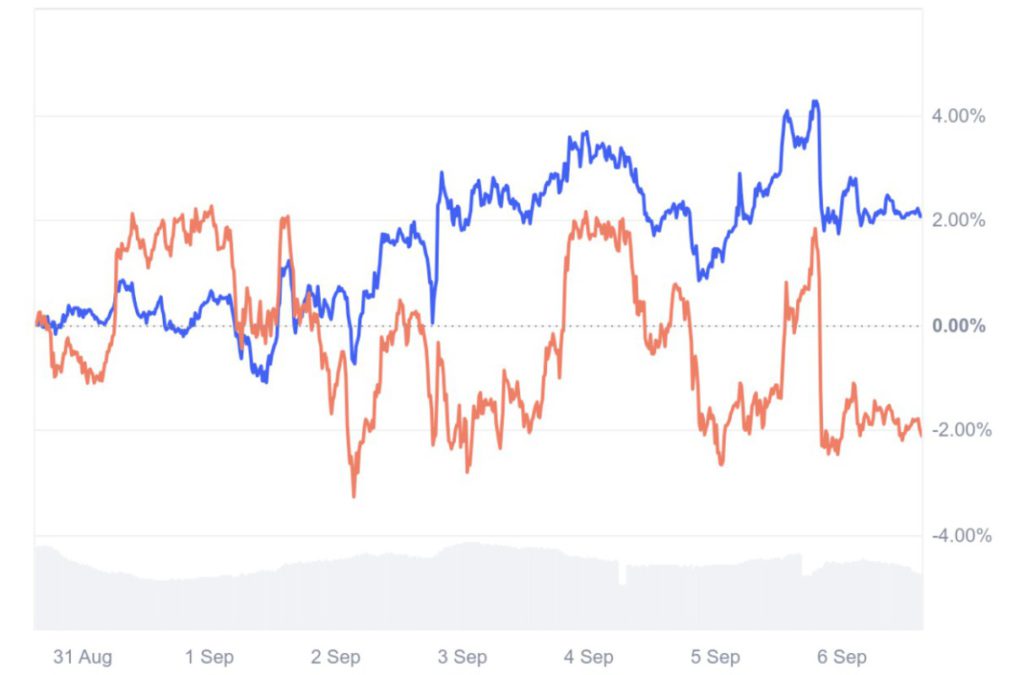

Throughout the week (September 1-6), Bitcoin, Ethereum, and the crypto market as a whole experienced turmoil. Bitcoin saw an increase of about 2% on a weekly basis, with the price moving in the range of $107.25K to $113.39K, and is currently trading at $110.7K.

Read also: The Rise of Crypto: 5 Surprising Things You Can Buy Today!

Meanwhile, the price of Ethereum moved between $4.26K to $4.49K, recording a 1.79% decline during the week.

This volatility coincided with the release of US economic data, including jobless claims data and others. This made investors more cautious in trading as the data could affect the interest rate decision of the Federal Reserve.

Important Bitcoin News and Milestones This Week

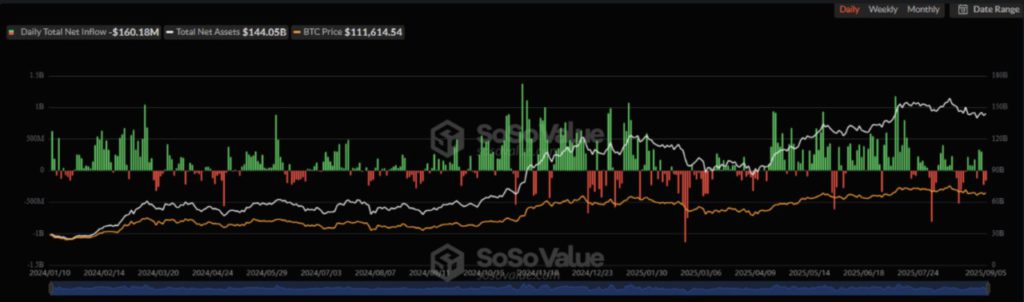

Although Bitcoin faced turmoil, its recovery above the $110K level remained in the spotlight this week. In addition, demand for ETFs also resurfaced earlier in the week, with the US spot Bitcoin ETF recording net inflows of $333 million on September 2 and $301 million the following day.

Throughout the week, net flows were +$246 million, a significant figure despite being almost half of the previous week.

In these 7 days, MARA added 705 BTC to its coffers, Strategy bought 4,048 tokens, and other similar actions indicate continued institutional demand.

Even regulatory developments are starting to move, as the SEC and CFTC announced that they will hold a joint roundtable on September 29.

Through this crypto roundtable, their goal is to harmonize the regulatory framework, provide clarity on crypto regulation in the US, and other matters.

Important Ethereum News and Achievements This Week

The spot Ethereum ETF in the US saw a significant drop in inflows, with net flows this week registering -$787 million. Previously, ETH ETFs had dominated the market and even surpassed BTC in terms of inflows several times, but this time the trend has changed.

Read also: Bitcoin vs. Ethereum: Why They’re Both Exciting in 2025

Even so, Ethereum’s price has been relatively stable compared to other assets, driven by positive news surrounding ETH. One of them is the prediction from Bloomberg’s James Seyffart that the “Altcoin Season” is underway.

He highlighted large accumulations in the coffers of large companies, such as BitMine, which added 38,708 ETH worth $167 million just days after its $358 million buyout.

With this move, the total ETH holdings in the company’s coffers have now risen above $8 billion.

Bitcoin vs Ethereum: Who Won This Week?

As the first week of September comes to an end, Jim Cramer’s bumpy market predictions for the month seem to be coming to fruition. Most noteworthy was the shift in investor sentiment, which favored Bitcoin ETF inflows while pushing Ethereum ETFs into outflows.

In this context, Bitcoin performed better than Ethereum, as it managed to sustain price gains while recording net inflows. However, it’s also worth noting that Ethereum showed more stability earlier, before eventually losing out to market pressure.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin vs Ethereum Weekly Showdown: Price Moves, Major Wins and Key News. Accessed on September 8, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.