Download Pintu App

Price of 1 Pi Network (PI) in Indonesia Today (9/8/25)

Jakarta, Pintu News – Today, the price of 1 Pi Network (PI) in Indonesia was recorded at around IDR 5,645 (equivalent to $0.3447), marking a move closer to an all-time low.

This has sparked investor concerns, especially as Pi Coin’s correlation with Bitcoin (BTC) has weakened, making the altcoin no longer get a positive boost from Bitcoin’s stable price above Rp1.8 billion.

Plus, a number of technical indicators point to the potential for high volatility, which could accelerate Pi Coin’s price decline if the selling pressure continues.

How much is 1 PI in Indonesia today?

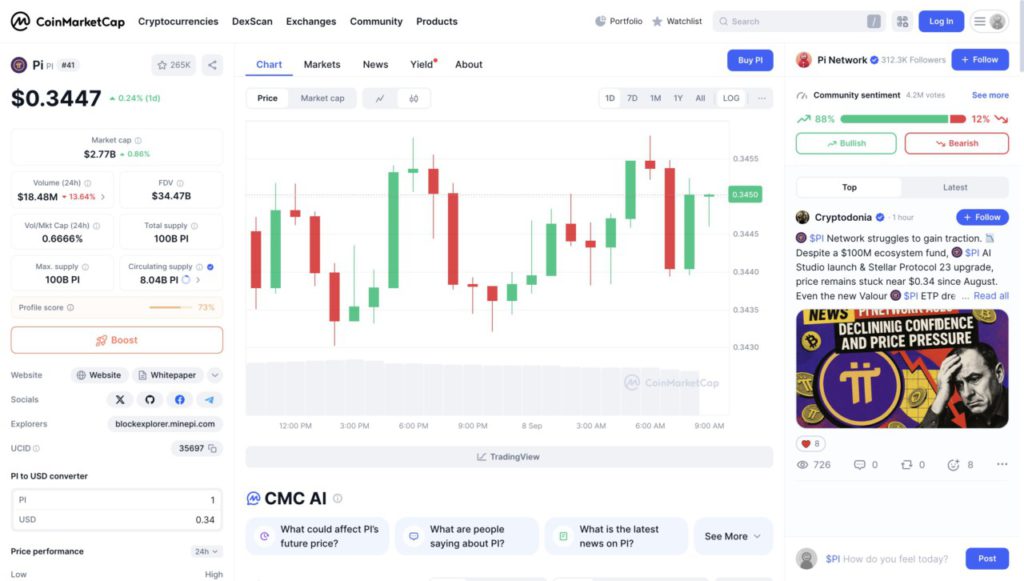

Based on the Pi Coin (PI) price chart above, it can be seen that this crypto asset is trading in the range of $0.3447 or around Rp5,645 per coin. Candlestick movements in the last 24 hours show narrow fluctuations with a fairly tight up-and-down pattern. The price touched a low around $0.3430 (IDR5,616) and a high near $0.3455 (IDR5,651), but is still moving within a thin consolidation range.

Daily trading volume was recorded at $18.48 million (Rp302.2 billion), down 13.64% compared to the previous day. This indicates that market interest in Pi Coin is still weak, despite its market capitalization being in the range of $2.77 billion (IDR 45.3 trillion). Meanwhile, community sentiment based on voting shows high optimism, with 88% bullish and only 12% bearish.

Technically, the candlesticks that appear show more resistance between buyers and sellers without strong dominance. This indicates that the price of Pi Coin is still in a critical area, where a little selling pressure could drop the price near the support level. Conversely, if there is a buying push, Pi Coin has the potential to rebound even though it is limited.

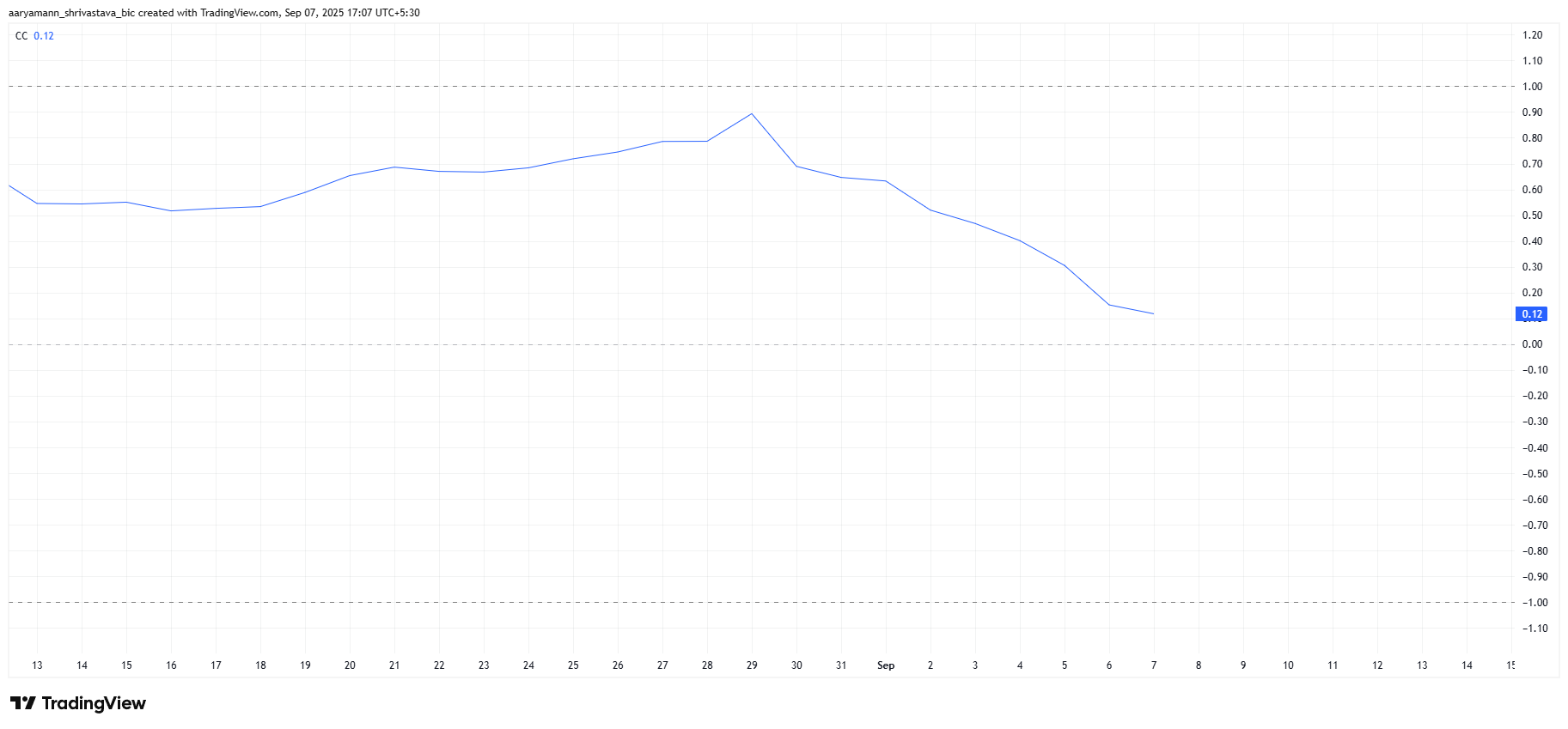

Pi Coin and Bitcoin Correlation Weakens

One of the factors fueling market concerns is Pi Coin’s weakening correlation with Bitcoin. Currently, the correlation level is only at the level of 0.12, which indicates that Pi Coin’s movements are no longer following the direction of the world’s largest cryptocurrency. This is considered counterproductive, because Pi Coin should be able to get a boost from the strength of Bitcoin, which is still stable above the important support level of Rp1.8 billion.

On the contrary, this weakness actually shows the decline in investor confidence in Pi Coin. As other altcoins try to hang on to the momentum from Bitcoin, Pi Coin is instead stuck in a bearish trend. This difference in market direction adds a big question mark regarding the sustainability of Pi Coin’s appeal in the eyes of the crypto community.

Also read: 3 Latest Crypto Airdrops September 2025

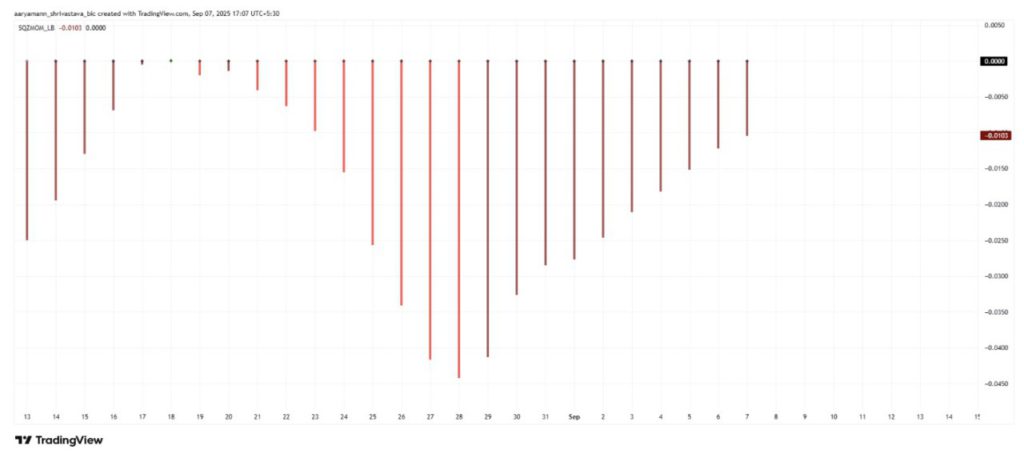

Technical Indicators Point to Potential Volatility

In addition to the correlation issue, the technical indicators are also signaling potential major volatility in the Pi Coin price. The Squeeze Momentum Indicator is currently displaying a black dot, which usually signals the presence of a “squeeze” phase or suppression of volatility before prices explode in either direction. If this pressure is released, the price of Pi Coin could move sharply in the direction of overall market sentiment.

However, in a bearish market, a potential spike in volatility is more likely to accelerate a decline than trigger a recovery. Without any new capital flows or positive sentiment support, this squeeze release could potentially be the catalyst that brings Pi Coin’s price to a new low. Crypto investors are faced with heightened risk if this trend continues.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Pi Coin Price Nears All-Time Low, And Even Bitcoin Can’t Save It Anymore. Accessed September 8, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.