Download Pintu App

Ethereum Holds Steady at $4,300 Today – Is a $5,000 Surge Next?

Jakarta, Pintu News – The price of Ethereum (ETH) managed to stay at the $4,300 level in trading today, September 8, 2025, even though the crypto market is showing high volatility.

Investors are now looking ahead with anticipation: will ETH be able to break the psychological $5,000 mark in the near future? Technical analysis and market sentiment point to some indicators worth paying attention to, as well as some risks that could affect the direction of price movements.

Ethereum Price Up 0.15% in 24 Hours

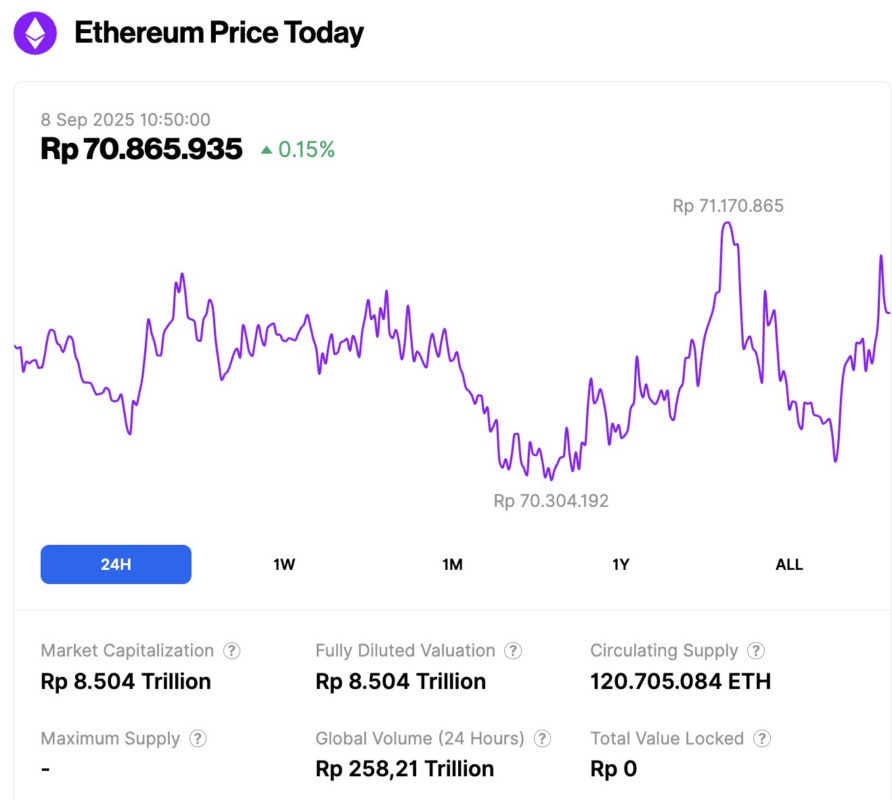

On September 8, 2025, Ethereum (ETH) traded around $4,314 (approximately IDR 70,865,935), marking a modest 0.15% increase over the past 24 hours. During this period, ETH’s price fluctuated between a low of IDR 70,304,192 and a high of IDR 71,170,865.

As of now, Ethereum’s market capitalization stands at roughly IDR 8,504 trillion, while its daily trading volume has risen 8%, reaching IDR 258.21 trillion over the last day.

Read also: 5 Reasons Why Chainlink (LINK) Price May Rise

Ethereum Stablecoin Inflows Reach $6.7 Billion

According to Crypto News, Ethereum is attracting significant liquidity. In the past week alone, the network recorded stablecoin inflows of $6.7 billion, an amount greater than what many blockchains have achieved in years.

This makes Ethereum’s total stablecoin base now exceed $145 billion, more than half the overall market, cementing its position as the settlement layer for dollar-backed tokens.

This is important because stablecoin inflows are often perceived as “ready capital”, which can be rotated into ETH or other assets once market sentiment changes.

On the other hand, demand from institutions is also picking up. Ether ETFs, especially spot products from BlackRock, show consistent growth in assets under management, signaling that regulated structures are now an entry point for professional investors.

Macro Conditions and Network Support

On the macro front, the US economy is slowing down, and expectations of an interest rate cut by the Fed later this year are increasing.

Looser financial conditions tend to benefit crypto markets, while the momentum of stablecoin policy in Washington further strengthens Ethereum’s legitimacy as the backbone of dollar tokens.

Layer-2 networks also continue to increase transaction capacity and reduce fees, further strengthening ETH’s long-term adoption potential.

Highlights:

- $6.7 billion of new stablecoins went into Ethereum in just one week.

- Ethereum now holds more than 50% of the global stablecoin supply.

- ETF inflows and policy certainty supported the growth of institutional investors.

Read also: Bitcoin vs Ethereum: Weekly Highlights, Price Action, and Key Milestones!

Ethereum: Technical Setup Toward $5,000

As of September 7, Ethereum’s price outlook is neutral, with ETH trading around $4,305 and consolidating within a descending triangle pattern that has capped gains since late August. Sellers face resistance at $4,490, while buyers maintain triple-bottom support around $4,250.

The 50-day moving average (50-SMA) at $4,363 is the short-term resistance, while the 200-SMA at $3,885 is the long-term trend reference. The RSI at 47 is neutral and not yet oversold, so there is room for a potential breakout.

If ETH breaks $4,490 strongly, the path opens up towards $4,665 and the $4,865 zone, which is close to its all-time high. Bullish patterns such as engulfing or three white soldiers could confirm the upward momentum.

On the flip side, if the $4,250 support fails to hold, the downside risk towards $4,070 and possibly further to $3,940-$3,785 increases.

For traders, the setup is clear: entering a long position above $4,490 with a stop below $4,250 could target $4,665-$4,865 in the short term. With large stablecoin inflows, ETF demand, and improving macro conditions, the potential for Ethereum to break $5,000 this cycle is getting stronger.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. Ethereum Price Prediction: Record Stablecoin Inflow Puts $5,000 ETH Price Target in Play. Accessed on September 8, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.