Download Pintu App

Bitcoin Struggles to Hold $111,000: 3 Key Reasons Behind the Recent Drop

Jakarta, Pintu News – Bitcoin’s (BTC) recent movements have left traders in a dilemma. On the one hand, massive outflows from exchanges suggest that investors are choosing to keep their coins for the long term.

On the other hand, a sudden change in Delta’s Spot Volume on Binance triggered a sharp sell-off, dropping the price from $113,000 to $110,000 in an instant.

While retail buyers are increasingly active, institutions seem to be liquidating assets. In the absence of new inflows from ETFs, these moves are driven more by organic demand than by big capital.

Then, how is the current Bitcoin price movement?

Bitcoin Price Up 0.14% in 24 Hours

As of September 8, 2025, Bitcoin is trading at $111,108, or approximately IDR 1,819,648,728, marking a modest 24-hour gain of 0.14%. Over the past day, BTC dipped to a low of IDR 1,814,252,929 and climbed as high as IDR 1,832,375,344, showing relatively stable price movement.

At the time of writing, Bitcoin’s market capitalization is hovering around IDR 36,197 trillion, while its 24-hour trading volume has surged 28% to reach IDR 404.4 trillion — indicating renewed activity and interest in the market.

Read also: Ethereum Holds Steady at $4,300 Today – Is a $5,000 Surge Next?

Binance Delta Spot Volume Turns Positive

According to AMB Crypto, Bitcoin’s latest movement was actually triggered by a change in the Spot Volume Delta on Binance. Since mid-August, this delta has been in the negative zone, keeping BTC stuck in a narrow price range.

However, after September 2, buying activity on Binance increased, and on September 5, the delta jumped into the positive zone, almost reaching $1 billion. Typically, patterns like this signal that retail buyers are coming in, while institutions are taking advantage of the liquidity to exit.

Following this pattern, Bitcoin immediately fell from $113,000 to $110,000 shortly after the delta turned positive, showing that when the price fails to rise despite strong buying pressure, a correction almost always occurs.

Outflows from Exchanges Show Stable Demand

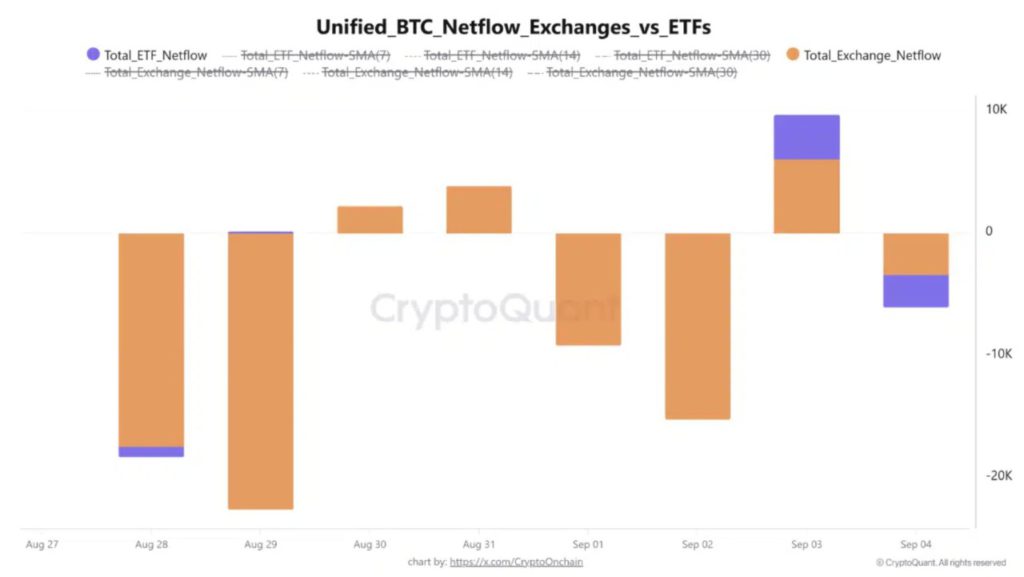

Furthermore, last week’s Bitcoin cash flow data showed a clear difference between the behavior of retail and institutional investors.

Large outflows from exchanges on August 28 and 29, and again on September 2, suggest that investors are moving coins to their personal wallets. This signals a strong conviction to hold assets.

Meanwhile, ETF data tells a different story. Sharp inflows on September 3 were immediately offset by outflows the next day, so ETF net demand remained flat.

While institutions remain hesitant, organic demand from direct holders shows resilience. In short, Bitcoin’s latest strength comes more from holders who believe in self-custody than from Wall Street.

Read also: Ethereum Price Held at $4,300 Today (8/9/25): Can ETH Go to $5,000?

BTC Remains Stable

As of September 7, Bitcoin was trading around $110.7K, showing a bit of momentum after last week’s drop.

During this period, BTC was in a sideways consolidation phase, with the movement getting tighter in the $110K-$111K range. The RSI index was around 45, putting BTC in neutral to slightly bearish territory.

Meanwhile, the OBV is flat, indicating the absence of strong inflows that could prompt a breakout. If demand does not pick up, Bitcoin is likely to continue its consolidation in the short term.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Bitcoin slides even as buyers step in: 3 factors behind BTC’s drop. Accessed on September 8, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.