Download Pintu App

After 6 Years of Silence, Ethereum Whales Resurface — A Bullish Signal for ETH?

Jakarta, Pintu News – Ethereum (ETH) is having trouble maintaining its upward trend after touching a high of $4,800. Currently, its movement is mostly consolidating in the range of $4,200 – $4,600. As of September 7, the ETH price was at $4,303, down about 3.52% in the past week.

As the market started to weaken, investors – especially whales – were seen shifting or moving their asset holdings.

Long-dormant Ethereum whale makes a comeback

According to data from Lookonchain, an Ethereum whale that has been inactive for 6 years resurfaced and moved 58,938 ETH worth $254 million. Of these, about 21,178 ETH (worth $91.54 million) were sent to Bitfinex, indicating that they are likely to be sold.

Read also: Ethereum Holds Steady at $4,300 Today – Is a $5,000 Surge Next?

When whales begin to offload assets amidst relatively stable market conditions, this can be interpreted as a form of profit-taking or exit strategy, which also reflects reduced confidence in the current market momentum.

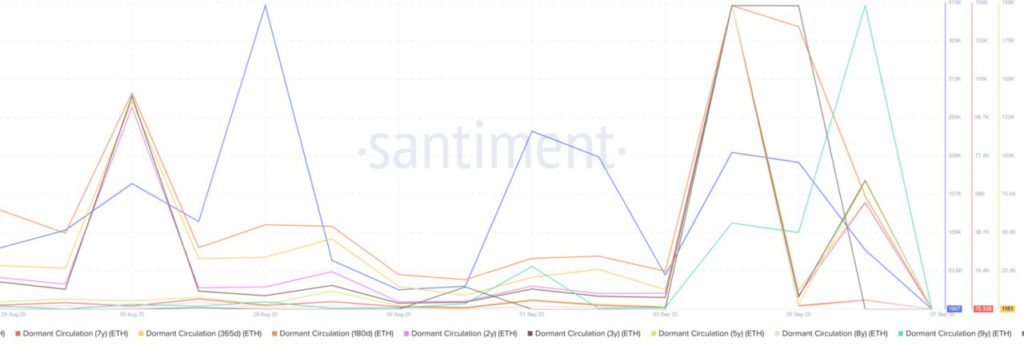

However, data from Santiment shows that the dormant circulation of ETH is actually decreasing across various long-term storage pools. This indicates that the sell-off is more selective than mass capitulation.

For example, the circulation of Dormant Circulation in the 180-day group dropped dramatically from 189 thousand ETH to only 1,500 ETH. A similar decline was also seen in the 2-5 years group, from 18.8 thousand ETH to 1.7 thousand ETH.

In conclusion, long-term holders of Ethereum are not panic selling, but rather leaning towards a measured profit-taking strategy.

Buyers Still Dominate the Market

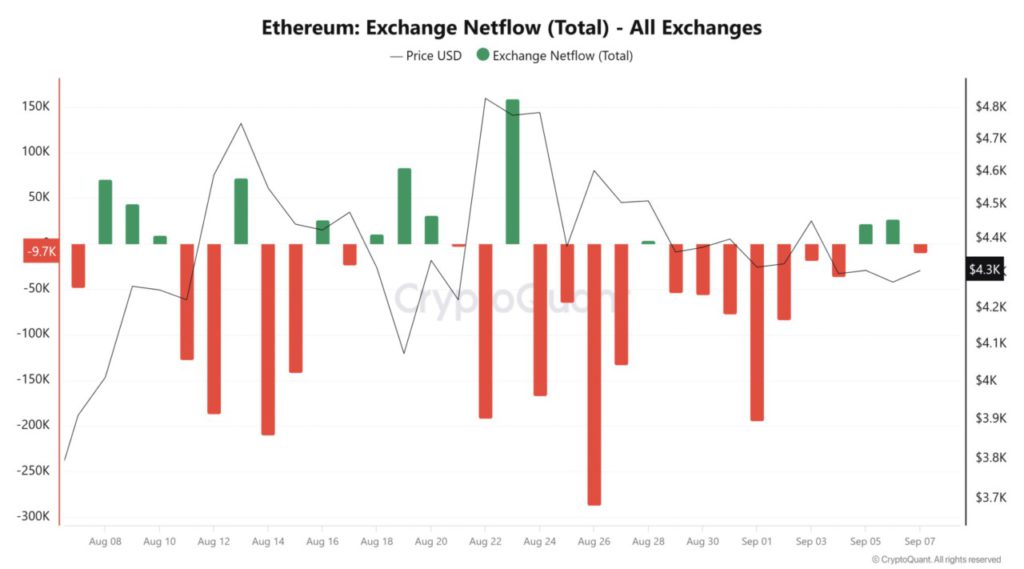

Although there are old whales coming up to sell, the market trend remains dominated by buyers.

Data from CryptoQuant shows that exchange outflows reached 89,200 ETH, higher than inflows of 79,450 ETH.

As a result, ETH’s Exchange Netflow fell into negative territory for the first time in two days. As of September 7, Netflow stood at -9.7K, signaling an increase in outflows-a clear indication of aggressive Spot accumulation.

Read also: Pi Coin Sees a Modest Gain Today, Yet Faces Significant Hurdles Ahead

Momentum Signals Start to Support

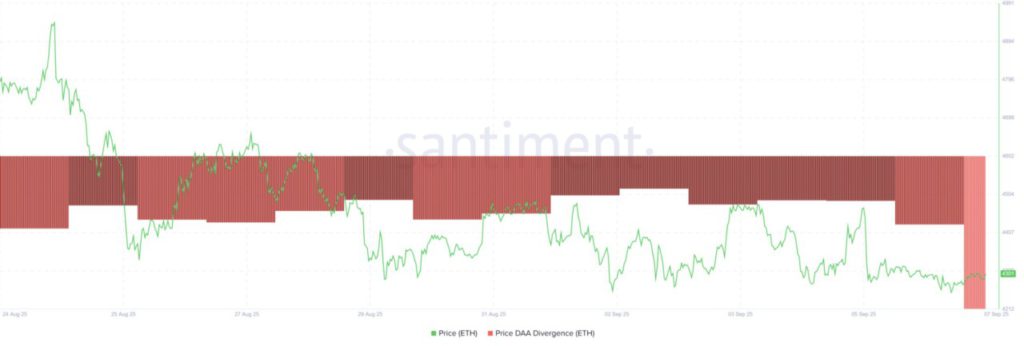

Analysis from the AMBCrypto page reveals that the sell-off of whales was successfully absorbed by buyers, so the price of ETH is relatively stable.

On the other hand, Santiment notes that the Price DAA Divergence is still in the positive zone, which means on-chain demand is weakening despite signs of market accumulation. As such, momentum metrics are the next important indicator to watch.

Some technical indicators:

- ADX drops to 18.3

- DMI is bullish with Positive Index at 18.48

- Relative Vigor Index (RVGI) remains above the signal line around -0.1129

If the buying pressure continues, ETH has the potential to break $4,500 again and test the resistance level at $4,800.

However, if on-chain demand does not recover, the price risks falling below $4,200, with $4,078 as the next support level.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Ethereum whale moves $254 mln after 6 years: Are buyers taking over ETH? Accessed on September 8, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.