Download Pintu App

Bitcoin as the Trigger: Could HBAR Trader Liquidations Reach IDR 572 Billion?

Jakarta, Pintu News – Hedera (HBAR) appears to have reached a saturation point in its price decline and is now showing signs of recovery. Although the cryptocurrency market in general is still experiencing fluctuations, Hedera is showing potential for a strong rebound.

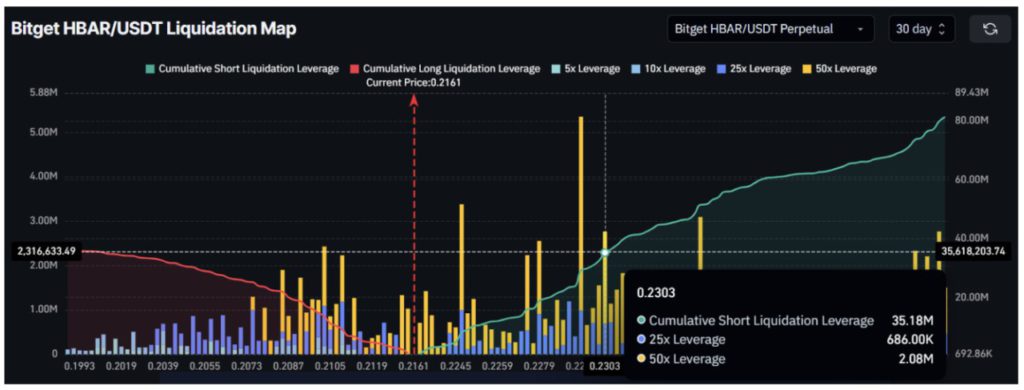

Recent analysis suggests that there are over $35 million of short positions that could be liquidated if HBAR reaches a price of $0.230. This phenomenon could trigger a large-scale short squeeze, potentially driving further bullish momentum in the market.

Hedera Traders’ Concerns

The current liquidation map shows that a huge risk lurks for traders holding short positions on Hedera (HBAR). If the price of HBAR manages to reach $0.230, a massive liquidation of over $35 million worth of short positions could occur.

This would trigger a short squeeze, which could dramatically push the price of HBAR even higher. This phenomenon will not only affect traders who speculate on price drops, but could also provide opportunities for investors looking for entry points to capitalize on market momentum.

Read also: Crypto Whale Strategy in Bitcoin and Ethereum Trading, What Can We Learn?

HBAR Price Barriers

Currently, Hedera (HBAR) is trading at $0.216, just below the $0.218 resistance level. This level has proven difficult to break in recent days. If HBAR manages to cross this resistance, there is great potential to build momentum towards higher price targets. Breaking this resistance will be critical to determining the direction of HBAR’s price movement in the short term.

Read also: 3 Events in the Crypto Market This Week, Have You Read?

Potential Recovery and Bullish Momentum

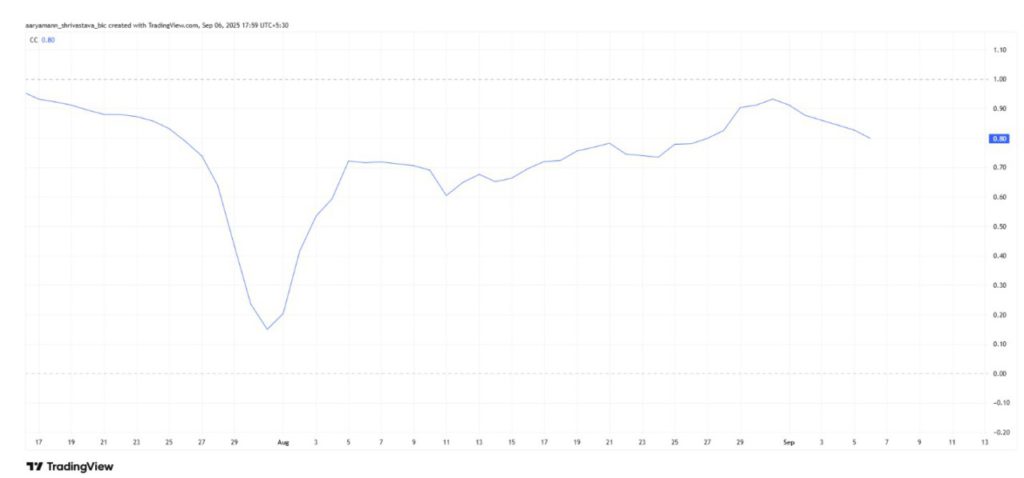

Despite facing some obstacles, Hedera (HBAR) is showing strong signs of recovery. A price increase above key resistance levels could trigger a broader bullish wave in the market.

This will not only benefit HBAR holders, but could also affect the overall market sentiment towards other altcoins. Constant monitoring of market indicators and trading volumes will be key to predicting further price movements.

Conclusion

With the potential for major liquidation and price recovery, Hedera (HBAR) is at a critical crossroads. Investors and traders should pay close attention to the current market dynamics and be prepared for possible changes. Investment decisions should be based on in-depth analysis and a solid understanding of the risks involved.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Hedera Hashgraph (HBAR) Traders Face Liquidation Risk as Bitcoin Dominance Rises. Accessed on September 8, 2025

- Featured Image: Crypto Rank

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.