Download Pintu App

Dogecoin (DOGE) Surge: Is It the Right Time to Invest?

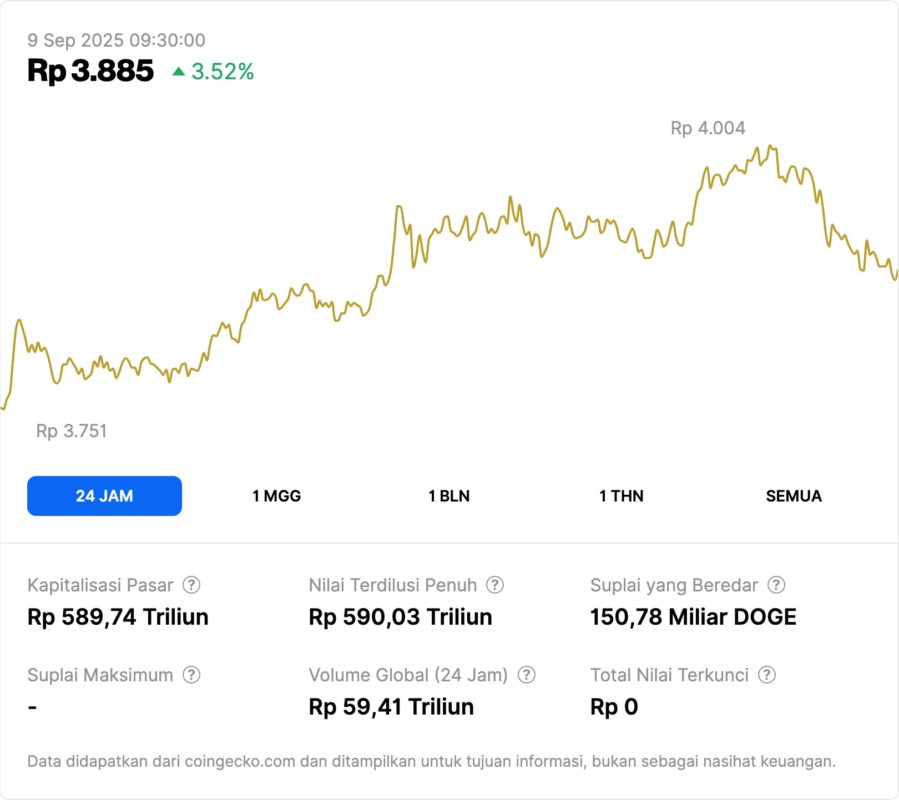

Jakarta, Pintu News – Dogecoin (DOGE) has recently shown a controlled increase within a tight daily trading range. The support area at $0.213 to $0.214 was successfully defended by buyers tenaciously, while the resistance zone at $0.220 to $0.221 continued to be pressured by sellers.

An increase in momentum was seen when trading volume exceeded the session average, but a decrease in momentum at the end of the session kept the price stuck below resistance.

Dogecoin (DOGE) Technical Analysis

The price pattern of Dogecoin (DOGE) shows the formation of higher lows signaling further upside potential. Nonetheless, strong resistance in the range of $0.220 to $0.221 remains a significant barrier. Volume analysis shows that there was an increase in participation on the rebound, indicating higher buying interest at that price level.

It is important to note that despite the increase in volume, the decrease in momentum at the end of the session could be an indicator that market participants are still hesitant to push the price past the resistance. Therefore, monitoring candlestick patterns and trading volume is crucial in determining the next direction of Dogecoin (DOGE).

Also Read: Analysis of Ripple (XRP) Transaction Surge, XRP Price Potential to Rise in September 2025?

Comparison with Other Cryptocurrencies

In a broader context, Dogecoin (DOGE) is not alone in experiencing price fluctuations. Other cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH) have also shown similar volatility. However, Dogecoin (DOGE) is unique in terms of its community and the fundamental factors that support it.

A comparison of the trading volume between Dogecoin (DOGE) and other major cryptocurrencies can offer additional insights into the overall market sentiment. For example, an increase in volume on Dogecoin (DOGE) that is not shared by other cryptocurrencies could indicate a particular interest in Dogecoin (DOGE) that may be triggered by factors external or internal to the community.

Dogecoin (DOGE) Investment Outlook

Given the current trend, investors may be interested in considering Dogecoin (DOGE) as part of their portfolio. However, it is important to conduct an in-depth analysis and consider the associated risks. Dogecoin (DOGE) offers exciting opportunities, but as with all investments, caution should be exercised.

Constant monitoring of market news and developments is key to capitalizing on emerging opportunities. With high volatility, the timing of buying or selling Dogecoin (DOGE) is crucial. Investors are advised to use effective risk management strategies to optimize their investment returns.

Closing: Conclusions and Future Expectations

Dogecoin (DOGE) continues to attract attention in the cryptocurrency space. With strong support in certain areas and resistance still holding, opportunities for price increases are still wide open. However, market participants should remain wary of any sudden changes.

In conclusion, Dogecoin (DOGE) offers exciting opportunities but also requires a deep understanding of market dynamics. With the right strategy and a good understanding of technical analysis, Dogecoin (DOGE) can be a valuable addition to an investment portfolio.

Also Read: 4 Reasons El Salvador Moved IDR11 Trillion in Bitcoin: Protection or Sell Signal?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. Doge Price Action Builds Higher Lows While Resistance Holds. Accessed on September 8, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.