Download Pintu App

Dogecoin Climbs to $0.23 Amid $2 Million Whale Accumulation — Is a Bull Run Underway?

Jakarta, Pintu News – On September 8, Dogecoin (DOGE) experienced a 7.7% increase. The meme coin’s price chart shows that DOGE’s volatility decreased dramatically over the weekend, and the recent price increase hints at a possible bullish move to come.

Accumulation by whales, increased supply from short-term holders, and the breakout from the triangle pattern also reinforced the potential for Dogecoin’s bullish movement.

Then, how is the current Dogecoin price movement?

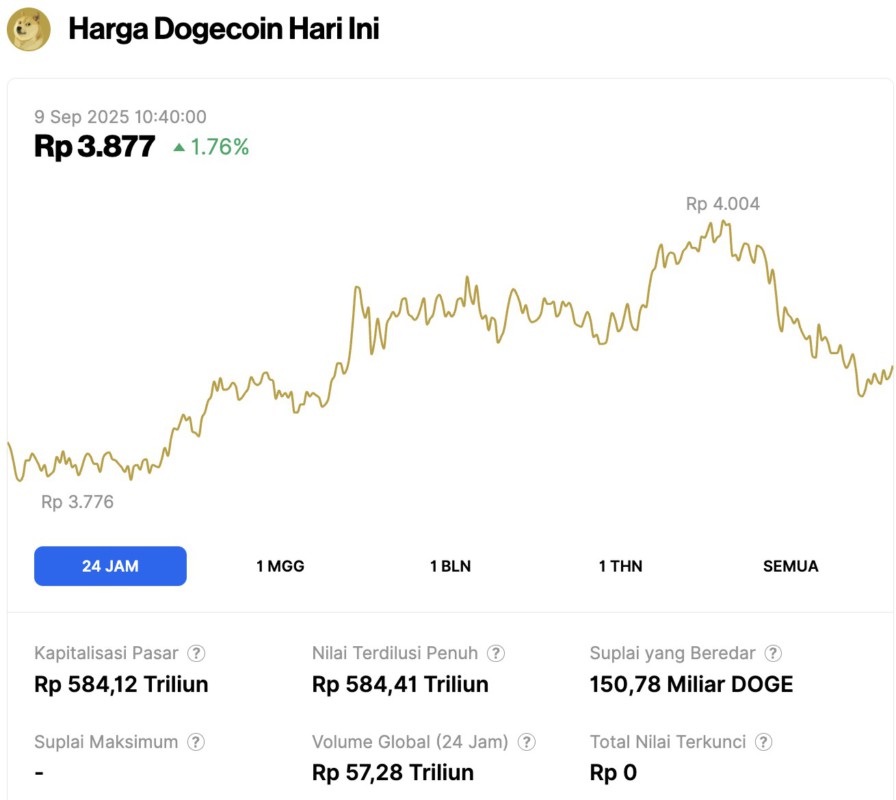

Dogecoin Price Rises 1.76% in 24 Hours

On September 9, 2025, Dogecoin saw a 1.76% increase over the past 24 hours, trading at $0.2357, or approximately IDR 3,877. During this period, DOGE fluctuated between IDR 3,776 and IDR 4,004, reflecting moderate intraday volatility.

At the time of writing, Dogecoin’s market capitalization is estimated at IDR 584.12 trillion, with a 24-hour trading volume of roughly IDR 57.28 trillion.

Read also: 4 Crypto that Gained Over 50% Today

Whale Accumulates $2.25 Million DOGE

On September 7, a whale withdrew 10.366 million DOGE worth about $2.25 million from Binance. This wallet had previously been dormant for two years.

This kind of accumulation by whales is a positive signal for Dogecoin. Moreover, if this accumulation continues and demand increases, it could trigger a price rally.

In a post on platform X, Trader Tardigrade noted that Dogecoin appears to be breaking out of a triangle pattern on the 4-hour chart. After a consolidation phase over the past week, this movement is expected to be followed by a strong bullish trend.

However, the $0.224 level is cited as an important short-term resistance area.

If DOGE is able to break this level, then the next target is in the range of $0.24 this week.

DOGE Short Term Holders Increase

Alphractal founder Joao Wedson also noted that supply from short-term holders (STHs) has started to increase, reflecting an accumulation phase. Historically, an increase in supply from STHs often corresponds with strong bullish conditions for DOGE.

Read also: Somnia (SOMI) Eyes $1.20 Following Binance Listing and $1.5M Reward Campaign

As such, long-term investors may be interested in adding to DOGE holdings, despite the volatility that remains. It also shows that the price increase will not be a straight line without obstacles.

Finally, the Bollinger Bands indicator on the 12-hour chart shows a narrowing around the price candles over the past three days. However, the indicator started widening after DOGE experienced a sudden spike in price.

Since bottoming out at $0.212 on Saturday, September 6, Dogecoin has gained 9.71% in just 36 hours.

Dogecoin Price Analysis

The On-Balance Volume (OBV) also showed an upward trend over the past ten days, indicating increased buying pressure. This OBV finding also reinforces other evidence supporting a potential short-term bullish trend for DOGE.

However, it should be noted that Dogecoin is still moving within a certain price range (marked in white) since last March. The upper limit of this range at $0.25 will be a major challenge to the ongoing bullish attempts.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Dogecoin price prediction – Whales’ buying spree, a new breakout, and odds of hitting $0.25. Accessed on September 9, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.