Download Pintu App

3 Strong Reasons Why Dogecoin (DOGE) Price Surge Could Continue

Jakarta, Pintu News – Three strong reasons suggest that the Dogecoin (DOGE) price surge has the potential to continue in the near future. The main factors include speculation regarding the legalization of altcoin ETFs like DOGE by the SEC, continued support from whales who continue to accumulate, as well as technical momentum indicating a potential bullish breakout from the current price pattern. Here is the full analysis from Ananda Banerjee, crypto analyst at BeInCrypto!

Buying Trend during Price Decline Strengthens

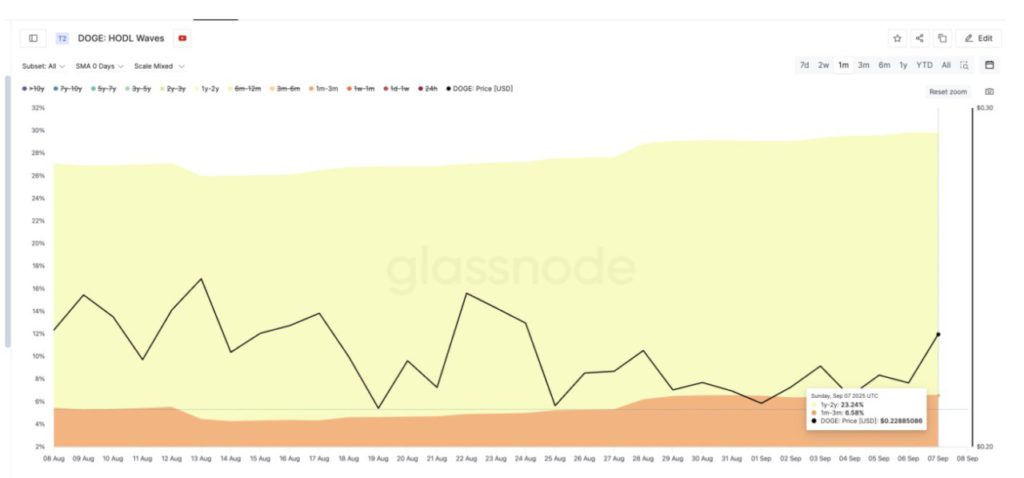

One of the most powerful indicators of market strength is through the analysis of HODL waves, which measures how long a coin is held before it is moved again. In the past month, the group holding coins between 1 to 2 years increased their share from 21.65% to 23.24%.

This group is known as the most bullish buyers as they usually buy with high conviction. An increase in this group indicates greater confidence in the long-term potential of Dogecoin (DOGE).

When long-term investors add to their holdings, it is often an indication that they see value or potential that has not been fully appreciated by the market.

Read also: 5 Green Crypto Projects September 2025

The Pattern Indicates a Potential Dogecoin (DOGE) Price Rise

Aside from the HODL waves, the Money Flow Index also shows buying activity when the price drops. Further technical analysis shows that there is potential for a higher Dogecoin (DOGE) price increase. This pattern is often interpreted as a bullish signal by traders and market analysts.

The breakout pattern formed on the Dogecoin (DOGE) price chart suggests that if this trend continues, there is a high probability that the price will continue to rise. This provides an opportunity for investors to consider Dogecoin (DOGE) as part of their investment portfolio.

Read also: Fed Rate Cut Prediction Triggers Crypto Market Optimism, Here Are the Details!

Expert Analysis and Predictions

Reporting from BeInCrypto, Experts have noticed this positive trend and many have started to adjust their price predictions for Dogecoin (DOGE). The consistent rise over the past three months suggests that there is a strong push that will probably continue.

Adding to the strength of the analysis, the exponential moving averages (EMA) indicator shows a bullish signal. The EMA works by averaging out the price data and giving more weight to the most recent candles. On the chart, the 20-period EMA (red line) had broken above the 200-period EMA (dark blue line) when the breakout occurred.

This condition is commonly referred to by traders as a “golden crossover”, which is a signal that market momentum is picking up. In addition, there are two other potential crossovers that are forming: The 50 EMA (orange line) is about to cross the 100 EMA (light blue line), and the 100 EMA is also approaching the 200 EMA. If all of these confirmations happen, Dogecoin (DOGE) could potentially be pushed towards the $0.248 level (around Rp4,055) or even higher.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Dogecoin Price Bounce: Four Reasons. Accessed on September 9, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.