Download Pintu App

Potential Crypto Market Explosion: $7.4 Trillion Ready to Move Post-Fed Rate Cut!

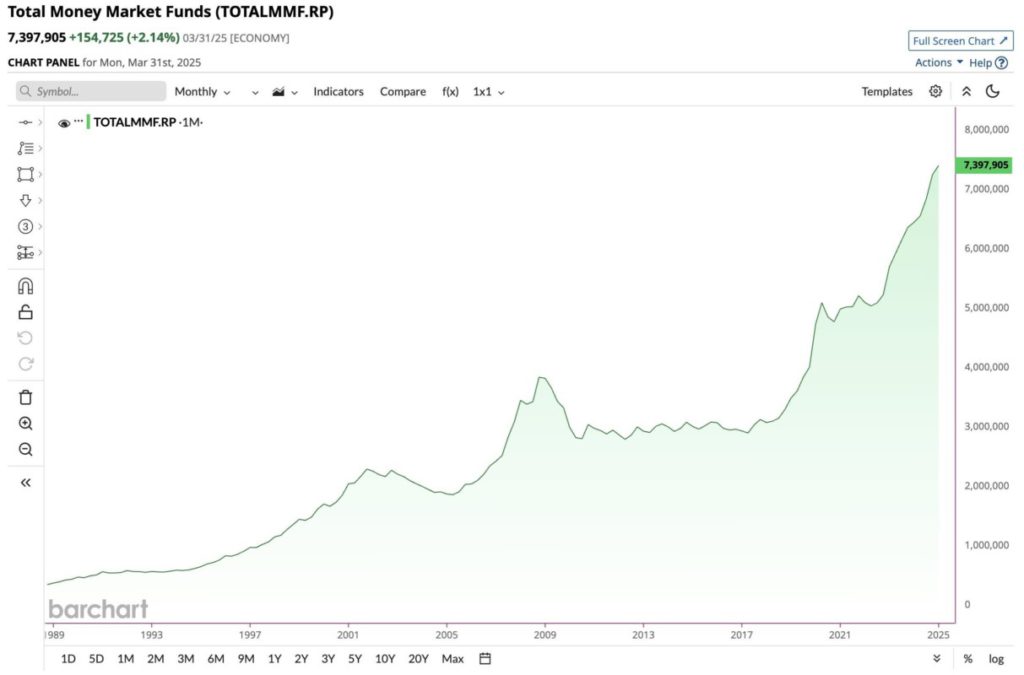

Jakarta, Pintu News – Global markets are showing high uncertainty with a record $7.4 trillion parked in money market funds. This situation signals investors’ cautious attitude towards risky assets, but such a large fund will not stay idle forever.

With the Federal Reserve’s decision on an upcoming interest rate cut, this capital shift could be a catalyst for several sectors, including crypto.

Why Money Market Funds are Important for Risky Assets

Money market funds are investment vehicles that raise funds from investors to invest in high-quality short-term debt instruments such as government securities, certificates of deposit, and commercial paper. These funds are designed to provide stability, liquidity and moderate returns.

This makes them a popular choice for preserving capital while earning better returns than regular savings accounts. As uncertainty increases, investors tend to choose safety over risk, which explains why the amount of funds in the money market reached a record $7.4 trillion.

When investors are looking for safety, money market funds make an ideal shelter. However, interest in these instruments can change with market conditions and economic policies. Data from Barchart shows that the amount accumulated is currently the highest it has ever been, signaling the potential for a major shift if there is a change in investment preferences.

Also Read: Dogecoin vs Shiba Inu: Who Will Win Meme Coin in 2025? Latest Data Answers!

What Happens If the Fed Cuts Interest Rates

An analyst warned that the upward trend in money market funds may not be sustained if the Federal Reserve decides to cut interest rates. A cut of 25 or 50 basis points on September 17 could lower the yields of money market funds, savings accounts, and short-term securities.

While this won’t immediately lead to massive outflows from such funds, it could gradually reduce the attractiveness of holding cash. Interest rate reductions by the Federal Reserve usually have a direct impact on the yields of money market instruments.

If yields become less attractive, investors may start looking for alternatives to increase their potential returns. This could trigger a significant shift of capital from money market funds to other riskier assets.

From Safe Havens to Crypto: Where the $7.4 Trillion Is Going

Earlier, analyst Cas Abbé highlighted that most of the capital in money market funds is tied up in US government securities. If interest rates fall, the yields on these securities will decline, making them less attractive. At that point, this substantial liquidity will start to shift into riskier assets such as stocks and crypto.

The market will now closely monitor the impact of the Fed’s decision. The direction of this unprecedented pile of cash will likely shape the trajectory of risk assets. The coming weeks will be crucial in determining whether this capital will fuel a crypto rally or signal deeper economic concerns.

Conclusion

With a potential interest rate cut by the Federal Reserve, global investors may soon shift their focus from safe instruments to riskier options.

These changes will not only affect the stock market, but could also provide a significant boost to the crypto market. Observation of these capital movements will provide important insights into future market dynamics.

Also Read: 2 Crypto Analysts Predict Cheds to Reach ATH, One of Them Can Reach $9,000!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Money Market Funds: Fed Rate Cut & Crypto Shift. Accessed on September 9, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.