Download Pintu App

2 Bullish Signals Point to an Impending XRP Price Surge

Jakarta, Pintu News – Citing a report by BeInCrypto, Ripple’s XRP (XRP) has recorded a rise of nearly 10% in the past seven days and is currently trading at around $3.

This surge is in line with the overall increase in crypto market activity, which was also marked by a 1% rise in global market capitalization over the same period.

The price increase reflects the re-emergence of bullish sentiment, where both price movements and data from the derivatives market indicate continued momentum.

Leverage increases, EMA breakout confirms uptrend

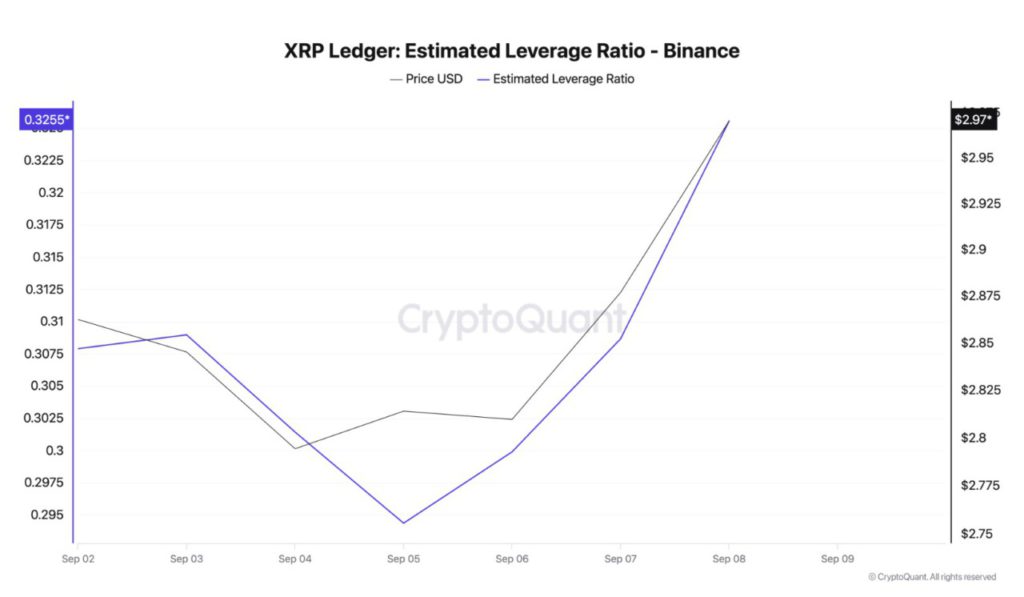

According to data from CryptoQuant, XRP’s Estimated Leverage Ratio (ELR) on Binance rose to a weekly high of 0.325, an increase of about 6% in the last seven days. This increase signifies growing investor confidence as well as increased risk appetite in the market.

Read also: Soaring Meme Coin Market: A Deep Dive into SHIB, DOGE, PEPE, and TRUMP Prices

ELR itself measures the average leverage used by traders in completing transactions on crypto exchanges. The calculation is obtained by dividing the open interest of an asset by the asset’s reserve on the exchange.

If the ELR decreases, it means that traders are starting to use less leverage because they are more cautious about the asset’s short-term prospects. Conversely, a rising ELR indicates that traders are emboldened to open more leveraged positions, reflecting stronger conviction and a willingness to bear higher risk.

For XRP, this ELR uptrend signals increased market confidence and the potential for positive momentum to continue, as leveraged traders support the token’s short-term rally.

Moreover, XRP’s rally has also pushed its price through the 20-day Exponential Moving Average (EMA) on the daily chart, further confirming the bullish outlook. At the time of writing, the 20 EMA is at around $2.91, serving as dynamic support below XRP’s price.

As a short-term trend indicator, the 20 EMA reflects the average price over the past 20 days with more weight on recent movements. When the price moves above the 20 EMA, it signals a shift towards bullish momentum.

With the XRP price holding above this level, there is a stronger indication that buyers are taking control of the market and sentiment is leaning towards the positive.

Read also: 3 Altcoins that Crypto Whales Are Buying Ahead of US CPI Decision

XRP aims for $3.22 level if $3.12 resistance turns into support

Currently, XRP is still moving below the $3.12 resistance area. If buying pressure strengthens and the level is successfully broken and turns into new support, the price has the potential to continue rising towards $3.22.

However, in case of increased profit-taking, the opposite scenario could occur. The price of XRP risks dropping through the 20-day Exponential Moving Average (EMA) and testing lower levels around $2.87.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 2 Bullish Signals Suggest XRP Price Is Ready for Its Next Leg Up. Accessed on September 11, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.