Download Pintu App

Analyst Michael Poppe Predicts Altcoins Could Outshine Bitcoin by Q4

Jakarta, Pintu News – Altcoins are facing volatile market conditions as the third quarter comes to an end, leaving investors worried about what might happen in the fourth quarter.

Typically, September is synonymous with greater caution. However, analyst Michael Van De Poppe thinks this year could be different, with a number of tokens potentially standing out.

History repeats itself? Not really

September is historically known as the weakest month for both Bitcoin (BTC) and altcoins. Data shows that Bitcoin has averaged a decline of around 5% this month, making it the only period that has consistently yielded negative results for the largest cryptocurrency. The decline usually drags altcoins down as well.

Read also: 3 Altcoins that Crypto Whales Are Buying Ahead of US CPI Decision

However, in an interview with the BeInCrypto page, analyst Michael Van De Poppe thinks that this cycle could be different from previous patterns. He argues that altcoins have strong enough conditions to withstand Bitcoin’s seasonal weakness.

“It is true that this cycle is very different from previous cycles, and therefore I believe this trend will continue to be different. In recent years, the market usually corrects in August and then produces a bullish trend in September. I expect the current correction to end soon, which is likely a signal altcoins will outperform Bitcoin. I also believe the fourth quarter will be bullish,” Michael explained.

FOMC Interest Rate Decision

One factor driving market optimism is the upcoming Federal Open Market Committee (FOMC) meeting. The US central bank is expected to cut interest rates for the first time this year.

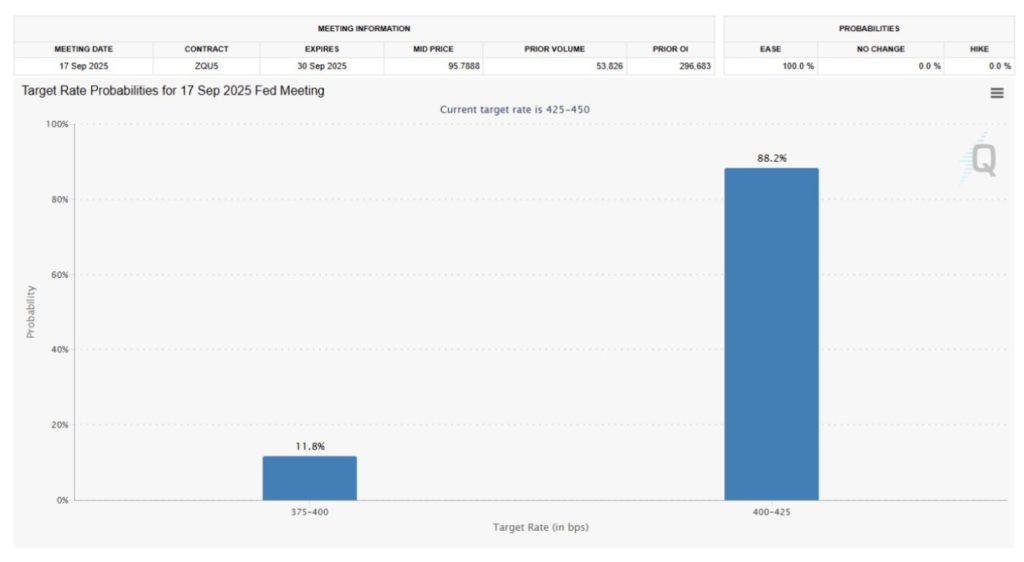

Currently, interest rates are in the range of 4.25% – 4.50%, and are projected to be cut by 25 basis points to 4.00% – 4.25%.

According to the CME FedWatch Tool, the odds of this happening are 88%, which reinforces investor confidence. If the cut does happen, financial conditions will loosen, liquidity will increase, and high-risk assets like cryptocurrencies will receive support. For altcoins, this could trigger inflows from investors looking for growth opportunities.

“So far, the business cycle and monetary expansion have not favored risky assets like altcoins to surge. However, when interest rate cuts and monetary expansion take place, Ethereum as a prime mover is expected to draw strength from the rest of the crypto market. The current stage of the cycle can be compared to the fourth quarter of 2019 or the first quarter of 2020,” Michael Van De Poppe explained.

$10 Billion Worth of Token Unlocks Await

Adding to the air of cautious optimism, Bitcoin and altcoins in September are expected to see token unlocks worth nearly $10 billion.

Typically, the release of a large number of tokens puts pressure on the price as it increases the supply in the market. This often suppresses upside potential and even triggers a sell-off.

Read also: 2 Bullish Signals Point to an Impending XRP Price Surge

This time, however, positive sentiment in the broader market as well as potential support from macroeconomic factors could cushion the impact. With the improved atmosphere, altcoins have the opportunity to absorb the additional supply.

“Almost every time an unlock happens, those tokens are usually immediately rolled over through new OTC contracts. So, the real impact of an unlock is almost zero. Even so, it is likely that a coin that is not facing an unlock will outperform a coin that is facing an unlock. This is important to consider when building a personal investment strategy,” Michael Van De Poppe told BeInCrypto.

Altcoins to Watch Out For

In an interview with BeInCrypto, Michael Van De Poppe highlighted that in the coming days, potentially prominent altcoins come from the DeFi, DePIN sectors, as well as the Ethereum (ETH) ecosystem.

“I think those three sectors will have the best performance. We’ve already seen signs earlier this season, for example Chainlink which is starting to show positive movement, plus a big expansion on the stablecoin side,” Michael explained.

Chainlink (LINK) price recorded a 5% increase on September 10, trading at $23.64. The altcoin is looking to confirm $23.40 as a strong support level. If successful, this could provide stability while encouraging investors to take LINK to higher levels.

The Parabolic SAR indicator, which was previously above the candlestick, has now moved down near its bottom. This shift signals an active uptrend on Chainlink. With such momentum, LINK could potentially rally towards the $25.81 resistance, strengthening its recovery path.

However, if the bearish conditions in the crypto market persist, LINK could struggle to maintain its momentum. Failing to hold the $23.40 level could drag its price down to $22.06 or lower, while invalidating the altcoin’s short-term bullish outlook.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Analyst Suggests These Altcoins Will Likely Outperform Bitcoin in Q4. Accessed on September 11, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.