Download Pintu App

DOGE Surges 5% Amid Whale Accumulation — Could a 50% Jump Be Next?

Jakarta, Pintu News – Dogecoin (DOGE) is currently trading at $0.25, recording a 44.4% gain in the last three months. In the last 24 hours alone, DOGE gained more than 5%, fueled by enthusiasm ahead of the launch of the Dogecoin ETF ($DOJE) scheduled to go live today.

On a weekly basis, the Dogecoin price has risen 16%, and in the past month it has risen about 12%. Short- and medium-term signals are both showing strength, and the technical chart hints at the potential for a further rally of almost 50% – if the momentum from the ETF remains strong.

However, behind the massive accumulation of one major holding group, there is one risk that should not be overlooked. This risk could halt the rally, or even reverse the trend direction to bearish. Traders are advised to remain aware of this factor before getting too euphoric following the current price rally.

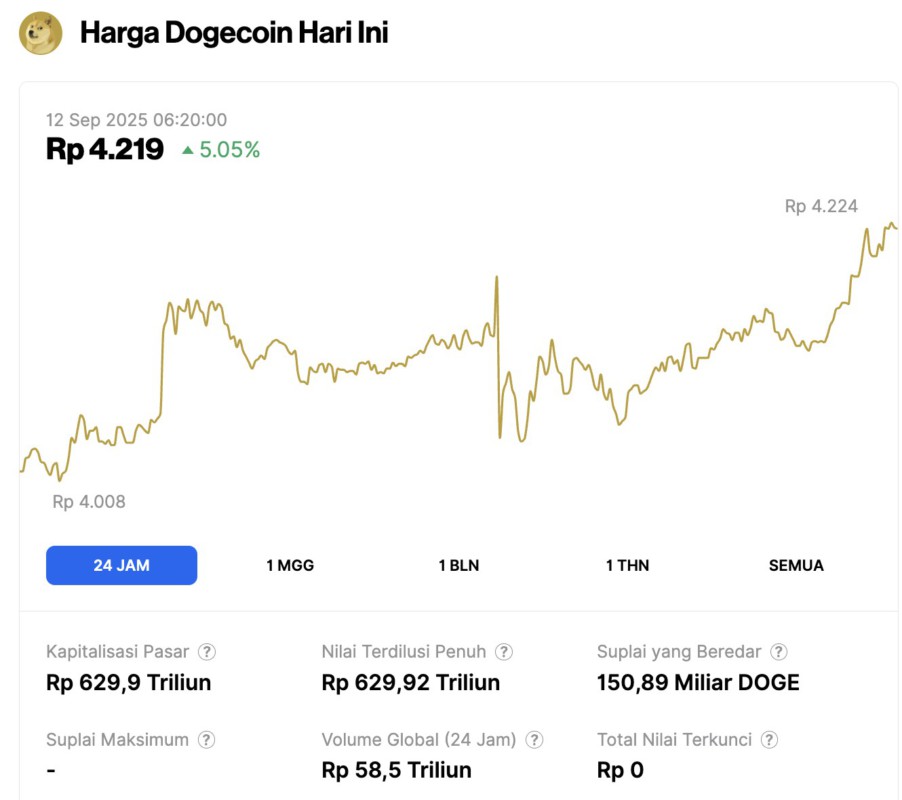

Dogecoin Price Rises 5.05% in 24 Hours

On September 12, 2025, Dogecoin’s price rose by 5.05% over the past 24 hours, reaching $0.2566 — approximately IDR 4,219. During that time, DOGE traded within a range of IDR 4,008 to IDR 4,224.

At the time of writing, Dogecoin’s market capitalization is estimated at around IDR 629.9 trillion, with a 24-hour trading volume of approximately IDR 58.5 trillion.

Read also: 3 Altcoins that Crypto Whales Are Buying Ahead of US CPI Decision

Whales buy DOGE ahead of ETFs, but risk of correction is getting more real

One of the main drivers of the recent Dogecoin (DOGE) price rally has been whale activity – wallets holding over 1 billion DOGE.

In the last 24 hours alone, the whale group increased its holdings from 71.67 billion to 71.90 billion DOGE. With the current price at around $0.25, that accumulated value equates to over $57 million.

However, behind this massive buying spree comes a risk signal that cannot be ignored. The Net Unrealized Profit/Loss (NUPL) indicator, which measures how much of the supply is in profit, is now at 0.36 – the highest in a month, up from 0.25 on September 1.

Historically, when the NUPL hits local peaks like this, Dogecoin often experiences a quick correction. For example, on August 22, the NUPL briefly touched 0.34 – and shortly after, the price of DOGE fell from $0.24 to $0.21 in just a few days, down almost 12%. A similar pattern occurred on August 13 and 17, where NUPL spikes were followed by profit-taking that depressed the price.

This is the reason why traders remain cautious. Although whales look optimistic and continue to accumulate, the spike in NUPL suggests that selling pressure due to profit-taking could still emerge and potentially weaken the ongoing rally.

Dogecoin ETF ($DOJE): Today’s launch brings a breath of fresh air

The long-awaited Dogecoin ETF ($DOJE) officially begins trading today, September 11, 2025 – likely during US stock market hours (09:30-16:00 ET). The fund is issued by REX Shares in collaboration with Osprey Funds, and distributed by Foreside Fund Services – the team that also previously brought the Solana Staking ETF ($SSK) to market.

Unlike the Bitcoin and Ethereum spot ETFs that require explicit approval from the SEC under the Securities Act of 1933, the DOJE ETFs are filed under the Investment Company Act of 1940. This “40 Act” legal framework allows ETFs to be launched without having to wait for a lengthy approval process from the SEC.

If there is no rejection from the SEC within a certain period, the ETF registration automatically takes effect. This mechanism gives REX and Osprey an edge as the first launchers in the meme coin category.

Read also: Shiba Inu LEASH V2 Migration Begins Soon: Check out the Important Details!

Shares of this ETF will be traded on NYSE Arca, an exchange that is also home to the majority of other crypto ETFs. Retail investors can buy it through major brokers such as Fidelity, Charles Schwab, and Robinhood, as $DOJE will trade like any other regular stock or ETF.

Simply search for the stock code (ticker) $DOJE when the market opens. This ETF has an expense ratio of 1.5% and is required to place at least 80% of its assets in Dogecoin.

However, as it follows the rules of the 1940 Act, it will also hold a number of other regulated securities as part of its portfolio diversification.

Interestingly, Bloomberg’s ETF analyst Eric Balchunas called DOJE “the first US ETF to hold something with no real utility,” – highlighting how unique this move by Wall Street is in embracing a token that was originally created as a joke.

This ETF is not only a watershed moment for Dogecoin, but also a new milestone in the integration of memecoin into the mainstream financial system.

Dogecoin price hints at triangle pattern breakout, but needs confirmation

Technically, Dogecoin (DOGE) currently appears to be breaking out of a symmetrical triangle pattern – a pattern that usually signals a big move after the price has broken out of one side of the triangle, either up or down.

As of September 11, 2025, the direction of the breakout is trending upwards, but confirmation will only be valid if the daily candle closes above the upper border of the triangle or above the $0.246 level. If this breakout is confirmed, then the upside target of this pattern is around $0.381.

The target is calculated based on the vertical distance between the deepest swing high and swing low in the triangle pattern, and then projected from the breakout point.

However, before DOGE can reach $0.381, it needs to break two key resistance levels at $0.270 and $0.287. These two zones could potentially become rally inhibitors if the buying volume is not strong enough to sustain it.

Although the technical signals are supportive, the risk of correction due to profit-taking pressure still lurks, especially considering the Net Unrealized Profit/Loss (NUPL) indicator is currently at a high level. If selling pressure increases, this breakout could fail.

If such a scenario occurs, Dogecoin risks a 10-12% correction, as it did after the previous NUPL peak in August. A drop below $0.224 would signal a weakening of the trend and erase the short-term bullish momentum currently building.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Dogecoin Price Eyes 50% Rally on ETF Frenzy, But One Risk Remains. Accessed on September 12, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.