Download Pintu App

Linea Airdrop Officially Released, Here’s the Fun Facts and Challenges

Jakarta, Pintu News – The Linea Airdrop launch finally became official on September 9, 2025, becoming one of the largest token distributions on the Ethereum (ETH) network in recent years.

This long-awaited moment in the crypto community brings a unique tokenomic system and distribution without allocation to venture capital (VC) or insiders. Despite technical issues and complaints of high transaction fees, the launch remains an important experiment in the cryptocurrency world.

What is Linea?

According to CCN, Linea debuted its mainnet in 2023, and is now releasing the LINEA token, which is claimed to be the most significant launch since the early days of Ethereum (ETH). The development team is also introducing the largest ecosystem fund in the history of blockchain-based projects, which is notable for providing no initial allocation to the team or investors.

A total of 9.36 billion LINEA tokens were distributed to approximately 749,000 eligible wallets, making it one of the largest Ethereum-based airdrops. Recipients were given 90 days to claim the tokens, so active participation is required to avoid forfeiting their rights.

Read also: SEC Launches Project Crypto, Paul Atkins Highlights Crypto Market Rules

Technical Challenges at Launch

The launch of this airdrop did not go entirely smoothly. Leading up to the Token Generation Event (TGE), Linea’s main sequencer experienced a performance glitch that halted block production for about an hour. Once the problem was fixed, the network returned to normal.

However, some users expressed disappointment that the distribution was perceived to favor Binance Alpha program participants and BNB holders over other users. In addition, long lines and soaring gas fees during the claims process led many to question the network’s preparedness for the surge in activity.

Read also: Who are the World’s Most Ethereum (ETH) Holders?

Tokenomics Details and Deflation Mechanism

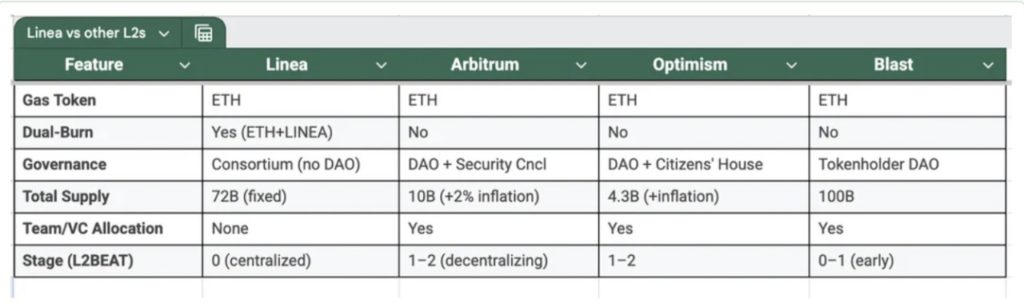

Linea presents a different tokenomic than other Layer-2 projects such as Arbitrum or Optimism. LINEA’s total supply is set at 72 billion tokens, with about 22% or approximately 16 billion tokens released at launch.

Of this amount, 85% is allocated to ecosystem development: 9% for airdrops, 1% for strategic builders, and 75% for the ecosystem fund. The remaining 15% belongs to Consensys and will be locked in for five years.

Another peculiarity is the dual-burn mechanism designed to support deflationary properties. In this model, 20% of Layer-2 fees are burned directly as ETH, while the remaining 80% is used to purchase LINEA on the open market and then burned. This strategy creates constant buying pressure, while differentiating Linea from similar projects that have not adopted a similar system.

Initial Price Analysis

Since its launch, LINEA’s price dropped 27% to reach a low of $0.22 (Rp3,612). The token then experienced a brief bounce, but lost its momentum again by breaking the short-term support trend line. If the selling pressure continues, the price could drop towards the $0.019 (Rp312) level based on the external 1.61 Fibonacci retracement.

As price history is still limited, technical analysis of LINEA needs to be done with caution. Future price movements are likely to be heavily influenced by the adoption rate of the ecosystem and the effectiveness of the deflation mechanism offered.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Linea Airdrop Finally Delivers – Here’s All The Details. Accessed September 12, 2025

- Featured image: Linea Build

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.