Download Pintu App

Altcoin Season Index Signals New Opportunities — But Analysts Urge Caution

Jakarta, Pintu News – Aside from macroeconomic risks, one of the main obstacles to Bitcoin’s (BTC.D) dominance comes from the altcoin market. Technically, Bitcoin (BTC) did manage to break several resistance levels in quick succession, with the latest being around $112,000.

However, BTC’s dominance has not been able to fully recover, with it only recording a recovery of less than 60% of total capital inflows, as well as closing the week with a red candle.

Citing the AMB Crypto report (11/9), the current altcoin market capitalization (TOTAL2, without BTC) actually increased by 3.58%, indicating that capital is still flowing into high-risk assets such as altcoins.

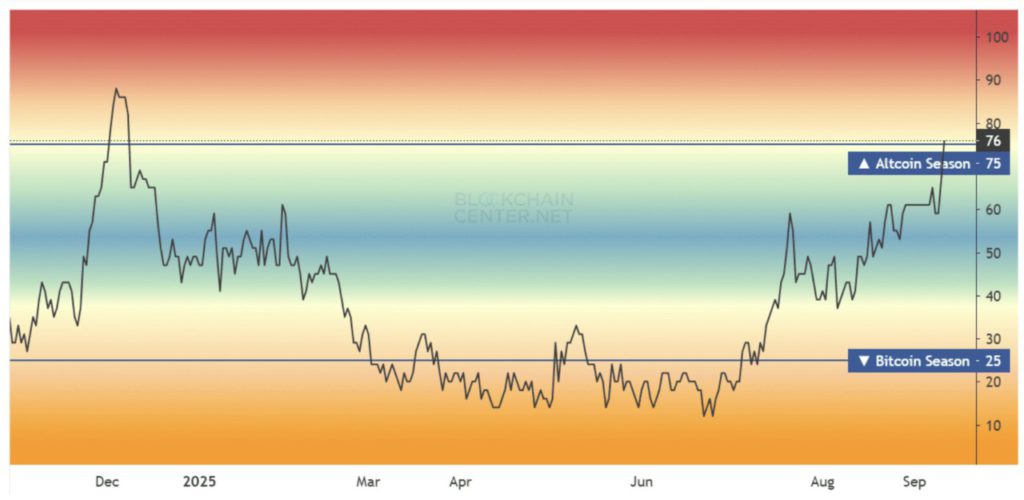

Altcoin Season Index Jumps to 76

The result? The Altcoin Season Index jumped 13% to 76 in just one day-officially marking the beginning of the first full altcoin season since the previous election campaign period.

Read also: Ethereum Price Hits $4,500 – Gaining Momentum, Could ETH Be on Track to Break $7,000?

This also confirms the persistent ‘risk-off’ behavior in capital flows into BTC. Simply put, traders are now more interested in pursuing the huge profit potential of assets outside of Bitcoin.

Example: Dogecoin (DOGE). While Ethereum (ETH) appears stuck at resistance levels, with the ETH/BTC ratio failing to break 0.04, the DOGE/BTC ratio has surged nearly 10% in less than two weeks, aiming for resistance around 0.0000024.

Interestingly, the current market cycle mirrors the pattern that occurred during the previous election: meme coin mania is back on the rise, BTC (BTC.D) dominance continues to decline, and ETH/BTC remains stuck at the same level.

Given that the Altcoin Season Index also experienced a breakout in 2024 under similar conditions, could we be witnessing a repeat of the same scenario?

Traders Are Advised to Stay Vigilant

During the previous election cycle, Bitcoin (BTC.D) dominance recorded its worst weekly decline in two years.

In early December, the Altcoin Season Index surged to 88, which coincided with BTC.D falling by 10 points to 54%. However, when BTC.D rose back to 65% in mid-June, the Altcoin Season Index plummeted to 12.

Read also: Bitcoin Soars to $115,000 on September 12 — Whale Investors Jump Back In!

Altcoins were battered, as many over-leveraged positions were liquidated. Now, data from Coinalyze shows that Bitcoin’s Open Interest (OI) dominance is only 38%, meaning that leverage in the altcoin market is currently 50% higher than BTC – a sign that many traders are stacking positions in altcoins simultaneously.

In short, the Altcoin Season Index seems to be nearing its peak again (blow-off top). But this time there is an important difference: BTC.D has printed two lower lows since its peak at 65%. Unlike the pattern during the last election-when capital finally flowed back into Bitcoin-now funds continue to flow into altcoins, keeping BTC.D depressed.

Why is this important? According to AMBCrypto, investors are staying away from Bitcoin, making its movements tend to be flat andchoppy. As long as this pattern continues, the Altcoin Season Index will remain in the spotlight, potentially even challenging its high of 88 again.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Ambcrypto. Altcoin Season Index Hits 76 as BTC-D Slips Yet Risks Still Remain. Accessed on September 12, 2025

- The Crypto Basic. Altcoin Season Heats Up as Bitcoin Dominance Loses Macro Uptrend Level. Accessed on September 12, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.