Download Pintu App

Is HYPE Headed to Coinbase? VanEck Advances Plans for Hyperliquid Staking ETF in the US

Jakarta, Pintu News – As reported by Coingape, digital asset manager VanEck is reportedly applying for a spot staking-based Hyperliquid ETF (HYPE) in the United States. The asset management firm will also launch an equivalent HYPE exchange traded product (ETP) in Europe.

VanEck executives believe that the launch of this ETF could pave the way for the listing of HYPE’s native cryptocurrency on Coinbase. HYPE’s price has been on a strong rally with a weekly gain of 23%, and is currently trading at $56.

VanEck to Launch Hyperliquid ETF with Staking Facility

Crypto asset manager VanEck is planning to launch a Hyperliquid ETF that comes with a staking yield facility. VanEck is placing a big bet on Hyperliquid’s growth, especially as the decentralized exchange prepares to bring its native stablecoin, USDH, to market.

Read also: Altcoin Season Index Signals New Opportunities — But Analysts Urge Caution

Matt Maximo, senior investment analyst of digital assets at VanEck, stated that Hyperliquid remains a key focus for the company’s liquid funds this year. Meanwhile, Kyle Dacruz, director of digital asset products at VanEck, revealed that the company is considering allocating a portion of the net profit of its investment products for the buyback of HYPE tokens.

Currently, Hyperliquid makes buybacks that are almost equivalent to their entire platform revenue. VanEck’s entire executive team is now paying close attention to Hyperliquid, especially since the decentralized exchange is starting to rival big players like Binance in crypto derivatives trading.

VanEck CEO, Jan van Eck, recently praised Hyperliquid’s decentralized technology and governance.

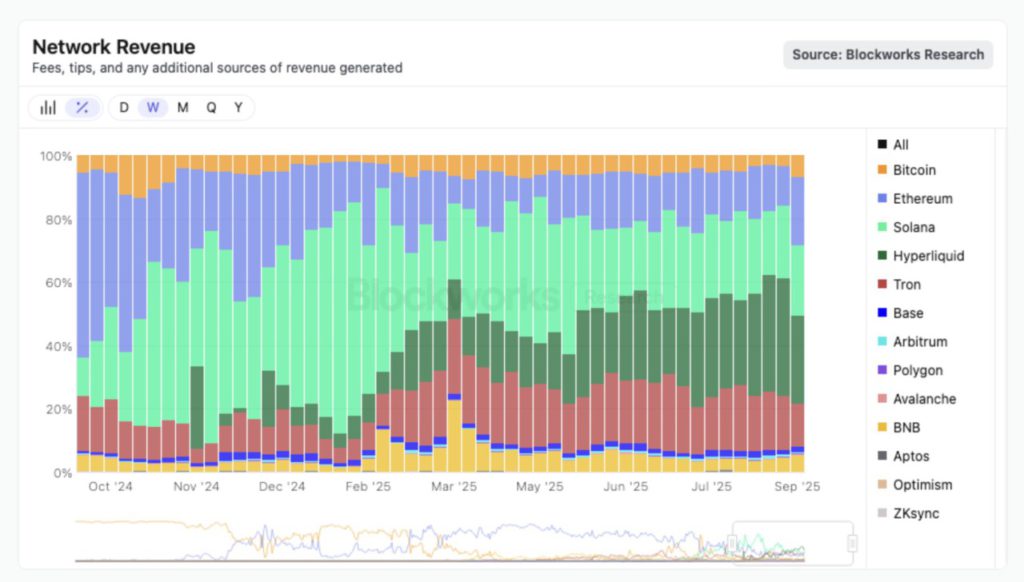

Hyperliquid has managed to execute billions of dollars worth of trades very quickly and with minimal disruption, thus gaining investor confidence. Based on data from Blockworks Research, Hyperliquid led in terms of network revenue among all blockchains for almost four consecutive weeks.

HYPE Potentially Soon Listing on Coinbase

VanEck executive Kyle Dacruz stated that he considers Hyperliquid ETFs to be very important amid high demand.

Read also: Could the Dogecoin ETF Launch Boost Pi Network’s Price? Here’s Why

He added that a HYPE staking ETF could increase US investors’ access to the token, as well as potentially encourage HYPE listings on top-tier crypto exchanges like Coinbase.

However, the launch of the HYPE staking ETF is still subject to regulatory approval from the US Securities and Exchange Commission (SEC). To date, the SEC has not granted staking-related permission, even for Ethereum ETFs proposed by large asset managers such as BlackRock and others.

On the other hand, asset manager 21Shares had already launched Hyperliquid ETPs in the European market back in August.

Meanwhile, the price of HYPE continues to set new record highs, rising another 3% today to reach $56. In a 23% rally over the past month, HYPE has surpassed some of the big projects such as Chainlink (LINK), Sui (SUI), and is now aiming for a spot on the crypto top 10 list by market capitalization.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Vaneck Hyperliquid ETF: Everything to Know. Accessed on September 12, 2025

- Coingape. Vaneck Pushes for Staked Hyperliquid ETF in US, Expects Hype Coinbase Listing Soon. Accessed on September 12, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.