Download Pintu App

Klarna Shares Surge 33% on NYSE: Market-Shaking Fintech Transformation!

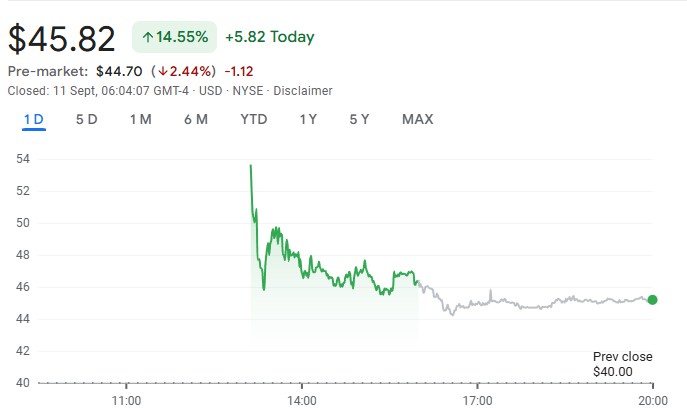

Jakarta, Pintu News – On its debut on the New York Stock Exchange (NYSE), Klarna shares recorded a significant gain of 33%, with an opening price of $52 and closing at $45.82.

Despite a net loss of $153 million in the first half of 2025, the Swedish fintech company managed to raise $1.37 billion through its Initial Public Offering (IPO). This share price increase signifies strong investor interest in Klarna, which managed to price its shares above market expectations.

Impressive Debut in the Stock Market

Klarna managed to record an enterprise value of $17.5 billion upon its stock market debut, a significant recovery from its previous private valuation of $6.7 billion in 2022. This increase demonstrates the market’s high confidence in Klarna’s business model, despite a delayed IPO in April due to tariff-related uncertainties.

The increase in Klarna’s share price is proof that the company’s strategies and innovations have received a positive response from the market. It also marks an important moment for Klarna, which has transformed from an idea to a market leader in buy-now-pay-later (BNPL) payment services.

Also Read: Solana (SOL) Strengthens, Can it Continue to Rise in September 2025?

Financial Performance and Challenges Faced

Although Klarna’s revenue increased to $1.52 billion in the first half of 2025, from $1.33 billion in the same period the previous year, the company saw its net loss increase to $153 million from $38 million. The increase in revenue indicates solid growth, but the larger loss indicates challenges in financial management.

Klarna’s CEO, Sebastian Siemiatkowski, expressed his feelings about this milestone by saying that the moment felt unreal. From a wild idea started in 2005, Klarna has now become a recognized global player in the payments industry.

User Growth and Service Expansion

Klarna recorded impressive user growth with 111 million active users and 790,000 merchant partners. The company processed $112 billion in gross merchandise value over the past 12 months. In the US market, Klarna reported quarterly revenue growth of 33%.

Klarna’s expansion is not only limited to BNPL services, but also to banking services. Klarna has launched debit cards and deposit accounts in the US, with 700,000 Americans already signed up and another 5 million on the waiting list. This shows the high demand from the public for alternative banking services.

Conclusion

The strong market performance of Klarna shares shows that there is a huge institutional appetite for fintech companies that have diversified revenue streams and proven growth models. By continuously innovating and expanding services, Klarna is not only strengthening its position in the global market, but also setting new standards in the digital finance industry.

Also Read: Mid-September XRP Price Outlook, Ready to Surge Again? Check out the Latest Analysis!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Watcher Guru. Klarna Raises $1.37B as Stock Jumps 33% Despite $153M Loss. Accessed on September 12, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.