Download Pintu App

Bitcoin Hits $116K Today — On-Chain Indicators Flash Bullish, Is $122K Next?

Jakarta, Pintu News – Over the weekend, the main cryptocurrency, Bitcoin (BTC), moved below the crucial resistance level of $115,892 after twice failing to break through it in previous trading sessions. This restrained price movement indicates a possible consolidation phase is forming.

Nevertheless, the on-chain indicators are still showing signals of increasing bullish momentum, which hints that a stronger rally may be on the horizon.

Then, how is the current Bitcoin price movement?

Bitcoin Price Up 0.63% in 24 Hours

On September 15, 2025, Bitcoin’s price reached $116,253, or approximately IDR 1,905,607,053, marking a slight 0.63% increase over the past 24 hours. During this period, BTC traded between a low of IDR 1,880,354,400 and a high of IDR 1,914,369,271.

At the time of writing, Bitcoin’s market capitalization is estimated at around IDR 38,085 trillion, with 24-hour trading volume rising by 16% to reach IDR 521.98 trillion.

Read also: 3 Low-Cap Altcoins Crypto Whales Are Quietly Accumulating — What’s Going On?

Bitcoin Hits Resistance

Readings from the BTC/USD daily chart show that Bitcoin has struggled to break and hold above the $115,892 level in the last two trading sessions. This level is now a major barrier to further upside movement.

But interestingly, despite short-term doubts, on-chain data shows that market forces are still growing.

According to data from Glassnode, the number of Bitcoin wallet addresses with balances greater than zero has reached its highest point so far this year. To date, it stands at 54.37 million wallet addresses.

A non-zero balance wallet refers to a Bitcoin address that holds a small amount of BTC, signaling active participation in the network.

As the number of these wallets increases, it reflects growing interest from both retail and institutional investors, as well as deeper network adoption-factors that could push up BTC prices in the near future.

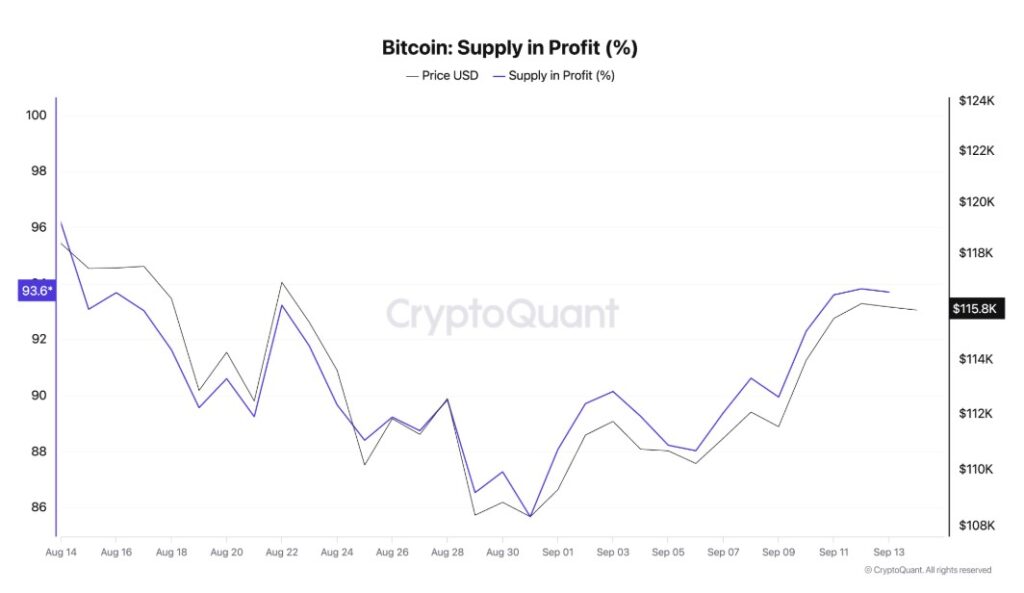

Adding to the positive sentiment, data from CryptoQuant shows that 93.6% of the total circulating Bitcoin supply is currently in profit. Historically, this trend is often followed by a strong bullish phase.

In a recent report, CryptoQuant analysts under the pseudonym Crypto Avails explained that the long-term average of this metric is usually in the range of 75%, so the current figure is well above normal.

Read also: Avalanche’s $1 Billion Treasury Initiative Strengthens – Will AVAX $55 Target Be Reached?

At 93.6%, the analyst thinks this trend reflects the market’s high optimism and still strong momentum.

“The market is definitely in bull mode. This might scare some people who think ‘everyone’s in profit, it’s time to get out,’ but I see it in a positive light – it’s keeping the enthusiasm alive,” Crypto Avails said.

Breaking the $115,892 Level Could Push Bitcoin Toward $122,000

With ever-increasing on-chain activity and previous levels of profitability often followed by price rallies, BTC seems to be gearing up for the next leg up.

If Bitcoin manages to convincingly break the $115,892 resistance level, it could trigger a rally towards $119,367. If the buying pressure gets stronger at that level, BTC has the potential to continue its rise to touch $122,190.

However, if the pressure from the sellers (bearish) starts to dominate, BTC could resume its sideways trend and even drop to the support level at $111,961.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

- Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Stalls at $115,000, But On-Chain Activity Says “Not for Long” Accessed on September 15, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.