Download Pintu App

4 Clear Signs That Altcoin Season Could Be on the Horizon in September 2025

Jakarta, Pintu News – The market capitalization of altcoins is currently only a few percent away from its all-time record high. Many analysts believe that its value could surge even higher in September.

There are a number of reasons that suggest that altcoin season has entered an acceleration phase, where almost every altcoin purchase has the potential to generate profits.

What are the signs? The following are some of the key observations and explanations, citing the BeInCrypto report.

1. Altcoin Trading Volume Share Surpasses ETH and Bitcoin

Maartunn analysts recently observed that altcoin trading volumes increased sharply in September, while BTC and ETH volumes actually decreased. This rare signal suggests that capital flows are starting to shift to altcoins.

Read also: Altcoin Season is Back! Crypto Market Explodes to $4 Trillion

Data from CryptoQuant also supports these findings. In September, altcoins’ share of spot volume increased, while ETH and BTC’s share actually shrank.

Specifically, altcoins accounted for 37.2% of the total volume, while ETH and BTC only accounted for 31.8% and 30.9% respectively.

This change is often a sign of liquidity rotation from Bitcoin and large-cap assets to medium and small altcoins-a confirmation that altcoin season is entering an accelerated phase.

“Altseason clues? Ethereum spot volume declined in the past week, while altcoin volume increased,” Maartunn said.

This decline in ETH’s volume share is in line with the familiar capital rotation cycle in the crypto market: capital usually flows into Bitcoin first, then into Ethereum (ETH), and finally extends to altcoins in general.

Maartunn also added that 8 out of 10 indicators in CryptoQuant’s bull/bear score are currently showing bearish signals for Bitcoin.

Meanwhile, Bitcoin market dominance also declined along with BTC prices throughout September. On the other hand, altcoin market capitalization continued to increase, further reinforcing the view that capital flows are now more in favor of altcoins.

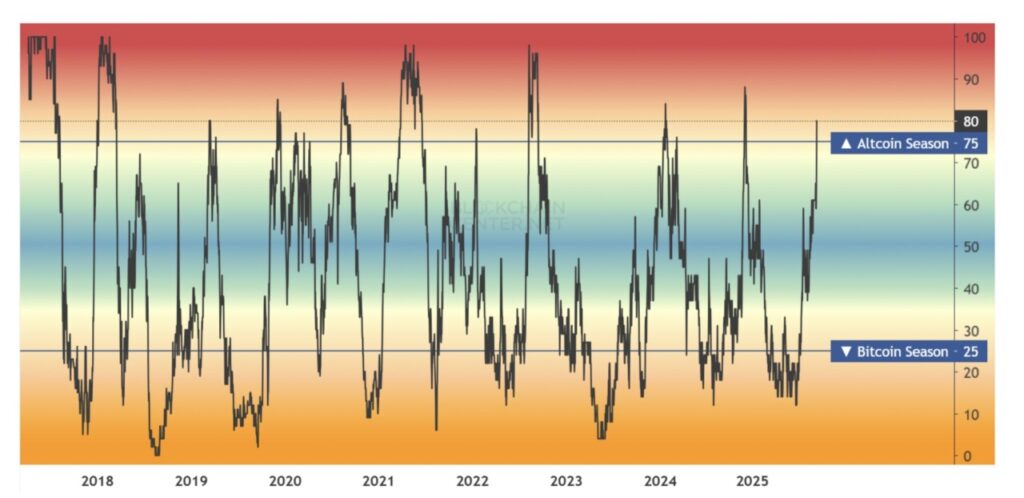

2. Altcoin Season Index Reaches Highest Level in 2025

The second sign confirming altcoin seasonality is the spike in Blockchain Center’s Altcoin Season Index (ASI), which reached 80 points – the highest level so far in 2025. This indicates that the market is currently in the altseason phase.

ASI measures the performance of the top 50 coins (excluding stablecoins) against Bitcoin in the last 90 days. With 75% of these altcoins outperforming BTC, this index shows that altcoins are currently dominating the market.

During the acceleration phase, ASI could even touch the 100 mark before the cycle ends, as it did during previous altseason peaks. This reflects investors’ increased interest in high-risk assets such as altcoins.

Analyst Lau noted that the acceleration phase in the altcoin season could last between 17 to 117 days.

“Historically, the average duration of the altseason is about 17 days, with the longest on record reaching 117 days. Now we just have to wait to see how long this cycle will last,” Lau said.

3. TOTAL3 Forms a Large Bullish Triangle Pattern

The third sign comes from technical analysis. TOTAL3 – the total market capitalization of altcoins (excluding BTC and ETH) – has formed a large bullish triangle pattern over the past four years, and is now on the verge of a breakout.

Read also: Top 10 Biggest Crypto Whales Right Now, According to Arkham Intelligence

The chart shows that TOTAL3 is testing its all-time monthly high, with volume increasing and price continuing to press the resistance area.

If a breakout occurs, it will be a strong signal that the altcoin season is entering a major acceleration phase – similar to the 2019-2021 cycle.

Simon Dedic, founder of MoonrockCapital, calls this pattern the most important structural signal today.

“Imagine claiming the market has already peaked, when TOTAL3 is about to break out of a 4-year wedge pattern and is preparing to print the highest monthly close in crypto history,” said Simon Dedic.

If TOTAL3 manages to break the $1.16 trillion level and set a new record, it will increase investor confidence in altcoins.

As there is no historical resistance level above this point, the potential for further rallies will entirely depend on the FOMO (fear of missing out) of retail investors.

4. Exchanges like Upbit, Coinbase, and Bithumb are aggressively adding to the list of altcoins

The increased liquidity of altcoins has triggered a wave of new token listings on various crypto exchanges throughout September.

- Upbit adds almost one new token every day – including LINEA, Pump.fun (PUMP), HOLO, OPEN, Worldcoin (WLD), FLOCK, and RED – to maintain a market share of 50.6%, ahead of Bithumb which is at 46%.

- Bithumb lists EUL, WLFI, LINEA, and PUMP tokens.

- Coinbase added Kamino (KMNO), DOLO, LAYER, SPX6900 (SPX), AWE, and WLFI to its platform.

The addition of this new token list not only increases the liquidity of altcoins, but also attracts the interest of speculators and boosts trading volumes.

The occurrence of a feedback loop between listing news and a surge in trading volume further accelerates the momentum of the ongoing altcoin season.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

- Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 4 Signs the Altcoin Season Is Accelerating in September. Accessed on September 19, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.