Download Pintu App

Dogecoin Falls 4% Today (Sept 16) — Could It Still Climb to $0.42?

Jakarta, Pintu News – After months of sluggish price movements, Dogecoin (DOGE) is back in the spotlight. In the last seven days, its price has jumped 25%, surpassing many other cryptocurrencies in the top 10.

Initially, the token’s value briefly touched $0.30 before dropping back down to $0.28. However, the price spike wasn’t the only thing that happened – a number of other important metrics also saw an increase.

Here’s a look at what else has been spiking, as well as what might happen next to the cryptocurrency’s value. Before we get into that, let’s take a look at Dogecoin’s current price movements.

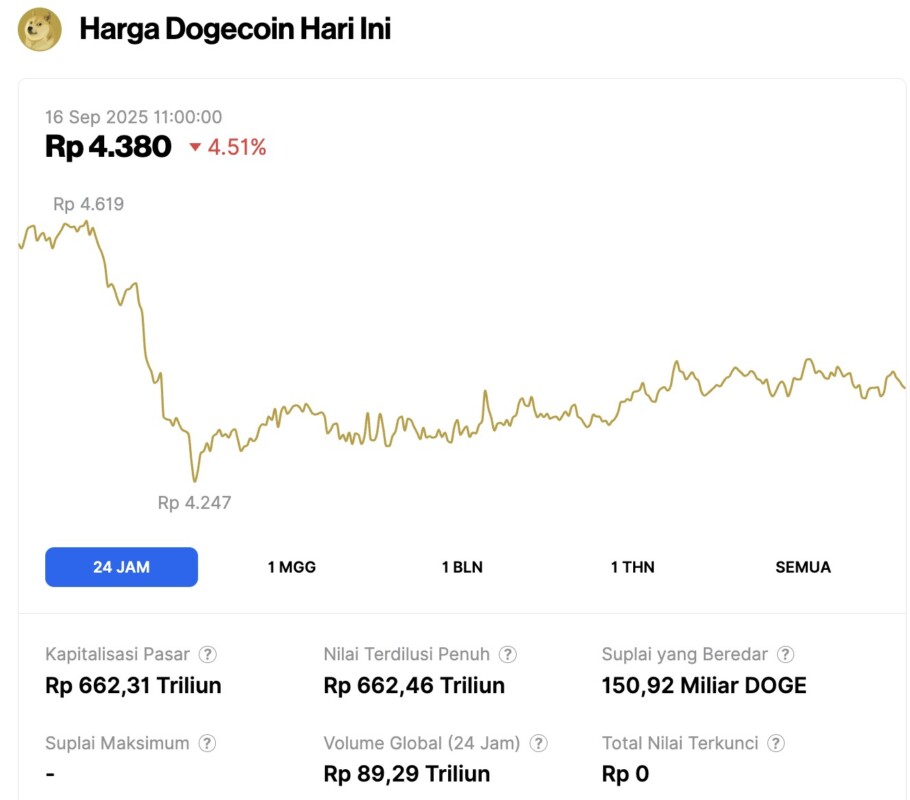

Dogecoin Price Drops 4.51% in 24 Hours

On September 16, 2025, Dogecoin’s price fell by 4.51% over a 24-hour period, trading at $0.2679, or roughly IDR4,380. During the same timeframe, DOGE fluctuated between IDR4,247 and IDR4,619.

As of writing, Dogecoin holds a market capitalization of around IDR662.31 trillion, with a 24-hour trading volume reaching approximately IDR89.29 trillion.

Read also: Ethereum Falls 2% on September 16, But Tom Lee Still Sees a Bright Future

Dogecoin Derivatives Demand Surges

As of September 15, Dogecoin’s Open Interest (OI) has increased to $2.28 billion – the highest figure since December 17, 2024. The rise in OI indicates that more capital is flowing into the DOGE derivatives market, where traders are opening new contracts instead of closing old ones.

When the OI rises along with the price – as it is currently doing – it usually signals bullish momentum, as more traders support the uptrend. However, this increase also indicates higher leverage in the system, which can increase volatility.

If market sentiment suddenly changes, a wave of liquidation could trigger sharp price movements in either direction. Although DOGE has experienced a slight decline recently, it is unlikely that there will be a major correction. Instead, OI is likely to remain above $2 billion.

If these conditions hold, the Dogecoin price has the opportunity to retest the $0.30 level, possibly even trading higher in the next few weeks.

Market Peak is Still Far Away

Apart from Open Interest (OI), the Market Value to Realized Value (MVRV) ratio also gives a similar signal. Currently, the ratio stands at 1.35.

This metric compares DOGE’s market value to the average price at which investors last bought their coins. If the number is above 1, it means that the average DOGE holder is in a profitable position.

Read also: Bitcoin Hits $115K on September 16 — Could a Bigger Recovery Be on the Horizon?

Historically, market peaks usually occur when the MVRV is in the range of 3.11 to 4.53, as outsized gains often prompt massive profit-taking.

With MVRV currently sitting at 1.35, Dogecoin’s price still has room to grow before entering what is considered overheated territory.

DOGE Price Prediction: Aiming for $0.42

From a technical perspective, the daily chart shows that the price of DOGE continues to print higher lows, which is the hallmark of an uptrend.

However, recently the chart has also displayed two consecutive red histogram bars, hinting at a brief pause in momentum.

Even so, the Directional Movement Index (DMI) indicator is still showing strong bullish signals. Currently, the +DMI (green) stands at 36.24 – well above the -DMI (red) of only 10.24, signaling that buyers are still dominating the market.

Meanwhile, the Average Directional Index (ADX) is at 26.67, indicating a bullish trend that is strengthening.

If this trend continues, the Dogecoin price has a chance to retest the $0.30 level. In a strong bullish scenario, the market value of this memecoin could even go up to $0.42.

However, if demand for DOGE weakens, this prediction may fall. In such a case, the Dogecoin price could potentially drop to $0.24.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Dogecoin (DOGE) Open Interest Rockets $2B Amid Explosive Price Action – Bull Run Intact. Accessed on September 16, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.