Download Pintu App

Ethereum Price Dips as Crypto Whales Shift Over $20 Million in ETH

Jakarta, Pintu News – Ethereum (ETH) has decreased by around 3% in the last 24 hours (16/9), and is currently trading at around $4,513. This decline comes amid increased activity in the crypto market.

On-chain data from Lookonchain shows that Ethereum whales are actively moving more than $20 million worth of ETH from exchanges such as Binance, FalconX, Kraken, and Bitget. Let’s get into more details.

Ethereum Whale Buys ETH

Lookonchain reported a number of large withdrawals on Monday, September 15, 2025. In just 40 minutes, a new wallet with address 0x4d43 withdrew 4,208 ETH worth approximately $19.5 million from Binance.

Read also: Ethereum Falls 2% on September 16, But Tom Lee Still Sees a Bright Future

Another new wallet, 0x9D99, withdrew a total of 5,297 ETH (approximately $24.7 million) from Binance and Bitget. Meanwhile, another whale address, 0x7451, moved 13,322 ETH (approximately $61.6 million) from FalconX.

Kraken was the exchange with the largest withdrawal, where wallet 0x9d2E withdrew around 21,925 ETH worth around $102 million. Overall, the accumulated ETH by these whales amounted to more than $208 million.

Why is Ethereum Price Falling?

The movement of the Ethereum whales comes at a time when the ETH price has decreased by about 3% in the last 24 hours, and is now trading at around $4,513 (IDR 73,991,026).

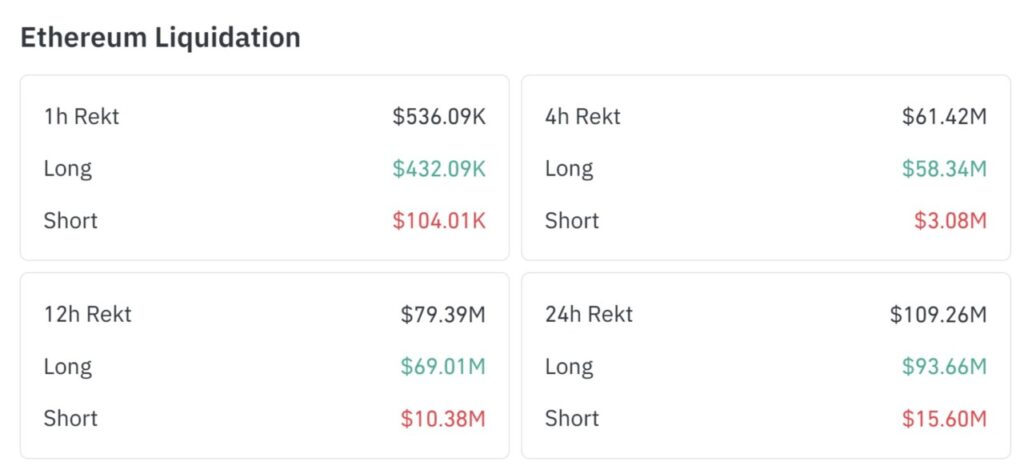

This price drop is due to a wave of liquidations in the derivatives market. Data from CoinGlass shows that more than $108 million worth of ETH positions have been liquidated in the last 24 hours. Around 86% of the long (buy) positions incurred losses.

Another factor contributing to the price drop is regulatory uncertainty, which affects market sentiment. A decision on whether BlackRock can include a stake in its Ethereum ETF has been postponed.

The US Securities and Exchange Commission (SEC) postponed the decision until October 30. Similar proposals from 21Shares and Grayscale also saw their deadlines extended.

Read also: Which Coins Have Crypto Whales Been Buying, Selling, and Holding Lately?

What Does Ethereum Whale Activity Mean?

Currently, the crypto market is interpreting the withdrawal of ETH from exchanges as a bullish signal. It suggests that the tokens are being collected for long-term storage, not for sale in the near future.

However, the decline in Ethereum price amidst this whale accumulation activity reflects the tug-of-war in the market between long-term confidence due to whale accumulation and short-term selling pressure due to cautious sentiment and liquidation.

Overall, although retail traders suffered losses due to the liquidation of long positions, the confidence of the whales remains prominent. If weak hands are driven out of the market, there is a chance for Ethereum to recover.

This recovery could be driven by positive news surrounding ETF staking or if the Fed actually starts cutting interest rates, which is expected to happen as soon as this week.

For now, the market remains in a tug-of-war between fear and opportunity. Ethereum whales are taking advantage of the price drop to accumulate, while retail traders are getting squeezed by a wave of liquidation.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ethereum Whales Move Over $200M from Exchanges as Price Drops 3%. Accessed on September 16, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.