Download Pintu App

As DOGE Holders Hold Firm, Could 2025’s High Be Within Reach?

Jakarta, Pintu News – The leading meme coin, Dogecoin (DOGE), has surged by 21% in the past week, driven by improving overall market sentiment and rising investor confidence.

On-chain data shows a consistent pattern of long-term investors choosing to continue hodling their assets. This pattern reflects strong confidence and indicates a potential continuation of the upward trend in prices.

Dogecoin Holders Lock Their Assets

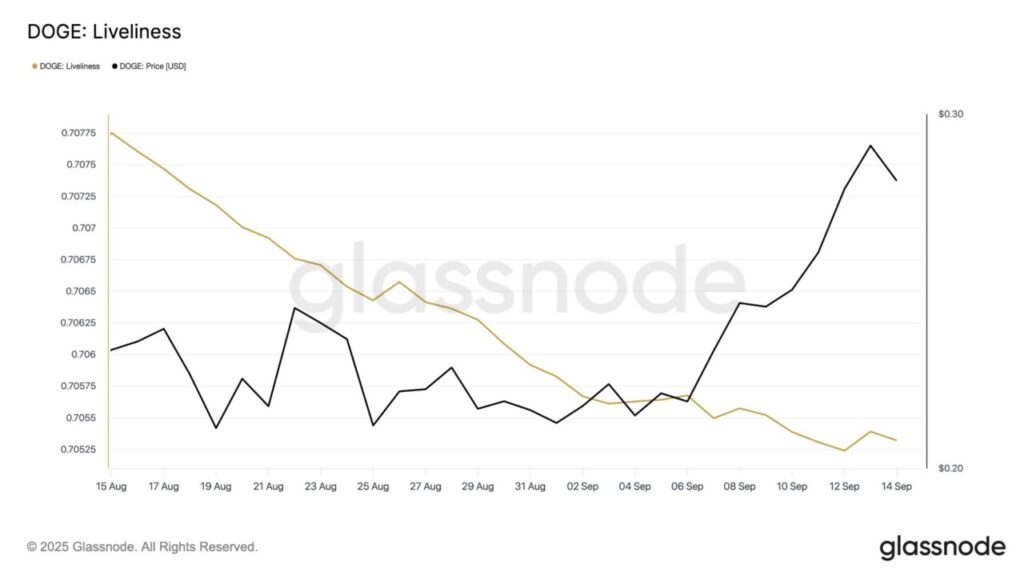

One of the key metrics highlighting this renewed optimism is the “liveliness” of the coin, which measures the extent to which long-term holders (LTH) are using or spending their coins.

Read also: Crypto Analysts See Bullish Run Ahead for Dogecoin After Open Interest Tops $6 Billion

According to data from Glassnode, DOGE’s liveliness has declined consistently over the past month. This decline indicates a slowdown in sales activity from these long-term investors.

Currently, the value of the metric stands at 0.705, indicating that many long-held DOGEs are now inactive or sitting untraded.

This supports the narrative that DOGE holders have strong conviction to hold on to their assets, potentially pushing up prices in the short term.

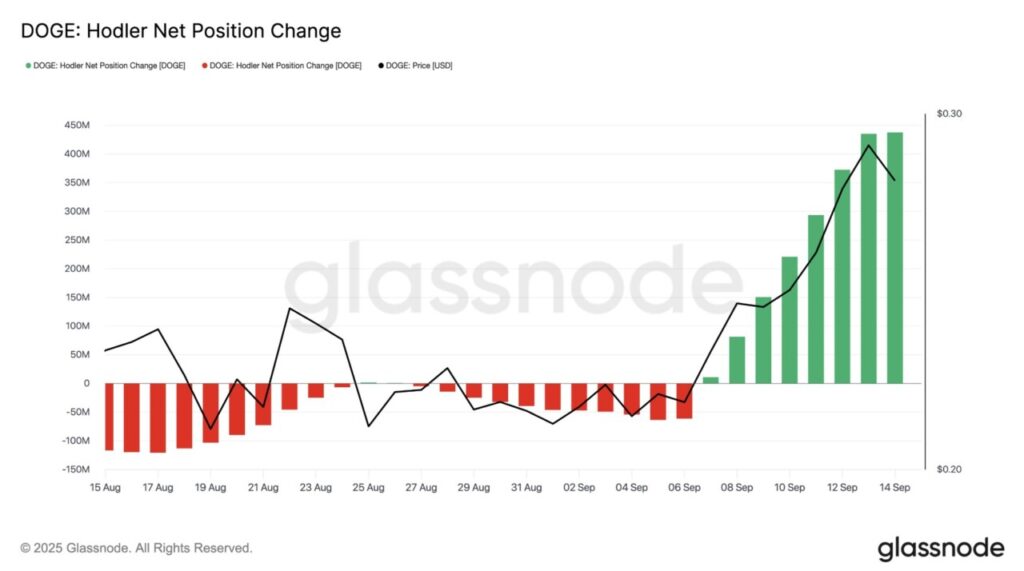

Additionally, DOGE’s Hodler Net Position Change metric also showed a steady increase since September 7. This confirms that more and more coins are being moved into long-term storage.

According to Glassnode, this metric tracks the net position of long-term holders over a period of time, to see if they are increasing or decreasing their exposure to the asset. A positive value indicates more coins going into the hodler’s wallet.

For DOGE, this trend is bullish, as it reduces the supply circulating in the market and reflects the high confidence of committed investors.

Can DOGE Holders Break $0.29 Before Price Correction?

The current wave of accumulation strengthens the chances that the upward trend in DOGE prices will continue. If this trend holds, DOGE has the potential to break the resistance level at $0.29 and advance towards $0.33, which was the last high price in January.

Read also: Are the First Dogecoin and XRP ETFs in the US Launching This Week? Here’s What You Need to Know!

However, based on the daily chart (15/9), DOGE’s Money Flow Index (MFI) indicator shows that momentum is currently in overbought territory. This could be a signal that a potential price correction is imminent. Currently, the MFI stands at 80.29.

Generally, the MFI moves within a range of 0 to 100. A reading above 80 indicates an overbought condition (potential decline), while below 20 indicates an oversold condition (potential increase).

When the indicator is in the overbought zone as it is now, it suggests that buying pressure may have peaked, and a short-term correction or price consolidation is likely to occur. If this correction scenario occurs, DOGE risks dropping below the $0.2583 support level.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Doge Price Rally Driven by Holder Accumulation. Accessed on September 16, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.