Download Pintu App

The Top 3 Crypto Narratives Set to Dominate the Altcoin Scene in 2025

Jakarta, Pintu News – Growing risk appetite among crypto investors is making new narratives more interesting. Several external factors have the potential to push certain narratives into the spotlight by 2025, although they are not currently receiving much attention.

So, what are these narratives and why do they matter? Are there risks for investors who allocate capital to them? The following sections will discuss them in more depth.

1. Tokenized Gold Coins

The price of gold in 2025 continues to set new records. This trend is a strong foundation for tokenized gold projects to attract investors.

Read also: Ethereum Foundation Opens a New Era with Decentralized AI Teams!

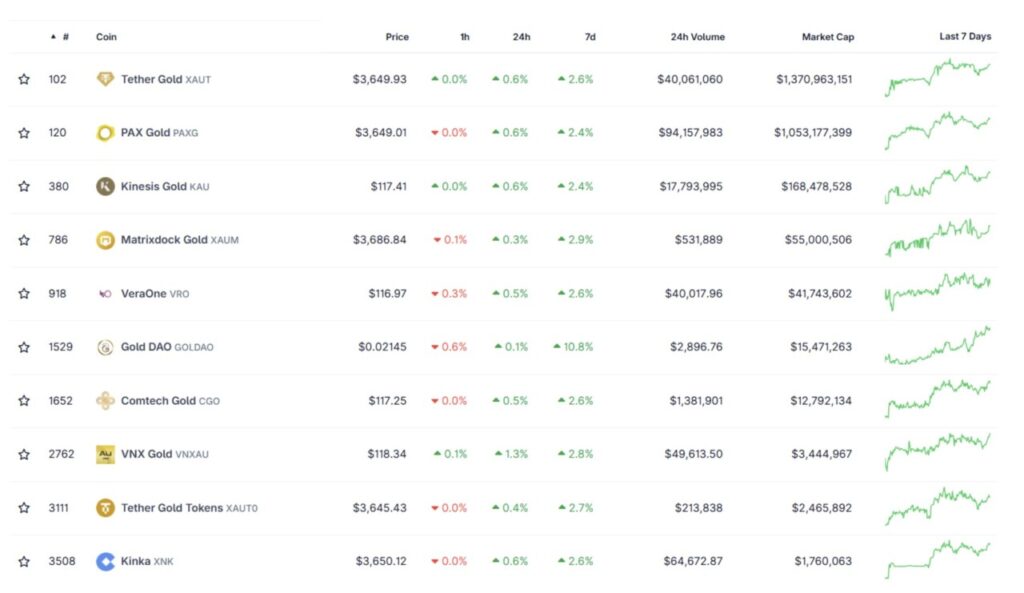

Currently, the number of altcoins in this sector is still very limited. According to data from Coingecko, there are less than 20 tokens in this category. Among them, Tether Gold (XAUT) from Tether and PAX Gold (PAXG) from Paxos lead in terms of market capitalization.

The biggest challenge for projects in this area is the requirement that each token must be backed by physical gold held by the issuing organization. This requirement makes it difficult for startups and small businesses to participate.

While the concept of tokenized gold is not new, experts predict that rising gold prices will make the sector even more attractive going forward.

With global economic uncertainty driving demand for safe-haven assets, tokenized gold offers the benefits of portfolio diversification as well as integration with Web3 technologies.

In July, BioSig Technologies, Inc. and Streamex Exchange Corporation announced a growth funding deal of up to $1.1 billion to launch a gold-backed cash management strategy. Streamex will tokenize gold using the Solana (SOL) blockchain.

“Tokenized gold will beat Bitcoin. After all, who needs US dollar stablecoins when you can have coins that represent real gold holdings?”- comment from economist Peter Schiff

2. Robotics Tokens

According to data from Statista, the global robotics industry is experiencing rapid growth. The market value is expected to reach $73.01 billion by 2029, with a compound annual growth rate (CAGR) of 9.49% during the period 2025 to 2029.

This growth is driven by the increasing demand for automation in the manufacturing, healthcare, and logistics sectors-especially in large markets such as the United States (projected to be worth $10.45 billion by 2025), China, and Japan.

The integration of artificial intelligence and machine learning is further enhancing robotics capabilities and driving a new wave of innovation.

The combination of robotics and crypto is potentially the next big trend, similar to the convergence between AI and crypto that occurred in early 2023. Robotics tokens could represent ownership in robotics companies or be used as a funding tool for innovative projects.

Coingecko now has a dedicated category for Robotics Tokens, but the sector is still in its infancy, with a total market capitalization of only around $300 million.

Simon Dedic, Founder & Managing Partner at Moonrock Capital, is optimistic about the future of crypto and robotics integration.

Read also: A Bold Prediction: Nvidia’s AI Stock Could Soar to $10 Trillion Within 5 Years

“Crypto x robotics will be retail investors’ bet on the biggest and most disruptive secular growth trend ever. Imagine being in the right place at the right time to invest in the trillion-dollar industry of the future-with a market valuation of just $244 million and fully liquid. Only in crypto is this possible,” said Simon Dedic.

3. A Tokenized Card Game

The market for tokenized card games is showing early signs of transformation. According to Bitwise, this sector has the potential to grow rapidly, similar to how Polymarket revolutionized the prediction market.

Tyler Neville, co-host of the show Forward Guidance, highlighted a chart comparing the investment performance of various assets between 2005 and around 2025. The chart included Pokémon cards, Meta Platforms stock, baseball cards, and the S&P 500 index.

Jokingly, he asked if hedge funds could start applying P/E (Price-to-Earnings) ratios to Pokémon cards. The joke carries a serious meaning: while collectibles like Pokémon cards don’t generate income, more and more investors are seeing them as legitimate investment assets amid currency devaluation and financial market volatility.

Short-term signals also show a spike in trading volume for tokenized card game projects such as Phygitals and Collector Crypt during September.

Overall, these three narratives – tokenized gold coins, robotics tokens, and digital card games – offer great potential as they combine traditional assets, advanced technology, and digital cultural trends.

However, how long these narratives will last and how much capital will flow in will largely depend on various factors, ranging from the quality of the projects to investor interest.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

- Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Under-the-Radar Crypto Narratives That Could Dominate the Altcoin Season. Accessed on September 19, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.