Download Pintu App

Aave V4 Is Ready to Launch, Set to Revolutionize Cross-Chain Liquidity in DeFi

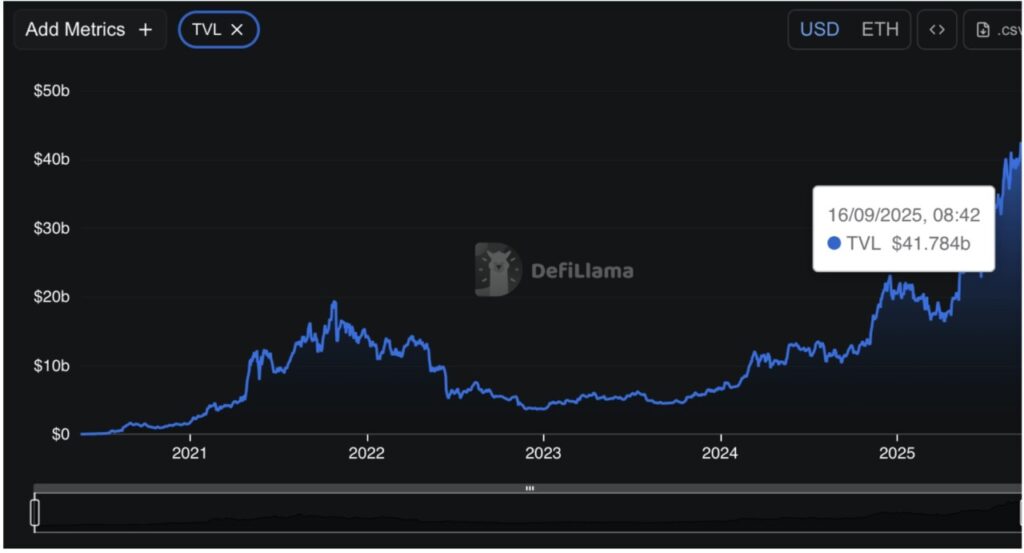

Jakarta, Pintu News – Aave Labs (AAVE) has announced the official launch schedule for Aave V4, which is scheduled to launch in the fourth quarter of this year. With total value locked (TVL) reaching a record high of $41.7 billion, Aave is strengthening its position as the market leader in DeFi lending. This latest version promises a number of significant improvements that will change the way users interact with crypto assets across chains.

Introduction to Aave V4: A Big Leap in DeFi

Aave V4 is designed to increase scalability and flexibility in the DeFi ecosystem. By introducing the Cross Chain Liquidity Layer (CCLL), Aave V4 allows users to seamlessly mortgage assets on one blockchain and borrow on another.

The technology uses Chainlink’s Cross-Chain Interoperability Protocol to facilitate cross-chain transactions. This support is not only limited to Ethereum Virtual Machine (EVM) compatible blockchains but also extends to non-EVM blockchains such as Aptos.

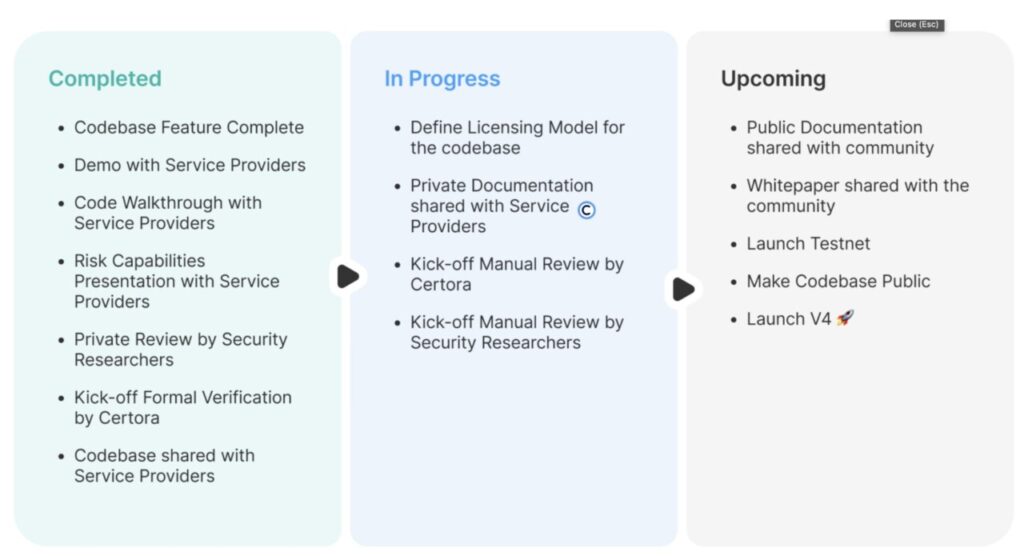

Prior to the full launch, Aave Labs will release public documentation, a testnet with the new user interface, and a public codebase. This will allow the community and service providers to test the V4 workflow, ensuring that all functions operate optimally before the official launch.

Read also: New US Strategy: Adopting Bitcoin as a National Strategic Asset

Aave V4 Advantages and Innovations

One of the key advantages of Aave V4 is its ability to aggregate liquidity from multiple blockchains. This enables broader access to liquidity, which is crucial in the highly dynamic world of DeFi.

With a more modular design, Aave V4 offers greater flexibility for users to manage their assets across multiple blockchains more efficiently. In addition, Aave V4 also improves the security and efficiency of the protocol.

By maintaining a focus on security, Aave ensures that user assets remain safe, while providing a better and more intuitive user experience. These improvements not only increase user confidence but also strengthen Aave’s position as a market leader in the DeFi lending sector.

Also read: Tom Lee Predicts BTC, ETH, and NASDAQ 100 to Soar Post-Fed Rate Cut!

Aave’s Dominant Position in the DeFi Market

As of September, Aave has recorded a TVL of $41.7 billion, which is almost half of the DeFi sector’s total TVL of $84.1 billion. This figure demonstrates Aave’s dominance in the DeFi lending market, reaffirming its position as the market leader.

With the launch of Aave V4, it is expected that Aave will expand its dominance even further. The improvements brought by Aave V4 are expected to attract more users and service providers into the Aave ecosystem. With stronger cross-chain capabilities and enhanced user experience, Aave V4 is poised to set a new standard in DeFi lending and borrowing.

Conclusion

With the launch of Aave V4, Aave Labs has not only improved their technology but also strengthened their position as an innovator in the DeFi sector. Seamless cross-chain integration and improved security and efficiency are steps forward that will bring more stability and liquidity to the DeFi market. Users can now look forward to a more integrated and efficient system to manage their crypto assets.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News. Aave Gears Up for Aave V4 Launch, Bringing Unified Cross-Chain Liquidity to DeFi. Accessed on September 17, 2025

- Featured Image: Crypto Economy

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.