Download Pintu App

PEPE Coin Price Prediction: With $25 Million Whale Move, Is a Breakout to $0.00002 on the Horizon?

Jakarta, Pintu News – The Pepe (PEPE) price has entered a crucial phase, characterized by narrowing price movements as accumulation signals emerge. Recent whale activity further reinforces this narrative, with large wallets moving large amounts of tokens off the exchange.

Although the long-term outlook is not entirely clear, signs of optimism are beginning to appear, citing Coingape’s report.

PEPE Price Action: Can This Coin Break Through the Narrowing Triangle Pattern?

As of September 17, the market price of PEPE is currently at $0.00001090, moving near the lower boundary of a triangular consolidation pattern. On the daily chart, the Pepe Coin price is still within the narrowing triangle structure, signaling a potential breakout.

Read also: Surging Social Interest and Growing Demand: Is Solana (SOL) Ready to Soar?

The token has bounced off the $0.00000914 support level several times, which has been an important floor over the past few months. On the other hand, any upside attempts were stifled around $0.00001269 and $0.00001488, which became strong resistance zones.

If this meme coin manages to break the neckline at $0.00001269, the bulls have a chance to push the price towards the middle area at $0.00001488, even up to the projected target at $0.00002000.

However, if it fails to hold above $0.00001050, the selling pressure could increase again and bring the price back down to $0.00000914.

The long-term price prediction for PEPE Coin still shows potential for more expansion, especially if the accumulation phase continues. Therefore, although the short-term pattern shows compression pressure, the long-term picture still points to a continuation of the bullish trend if key resistance levels are successfully broken.

Whale Abandons Robinhood and Spot Taker CVD Signals Show Buyer Control

Whale Alert confirmed that as much as 2.3 trillion PEPE – worth around $25 million – was moved from Robinhood to an unknown wallet. Large moves like this often signal a shift away from exchange-based liquidity towards long-term storage potential, which goes hand in hand with a gradual accumulation phase.

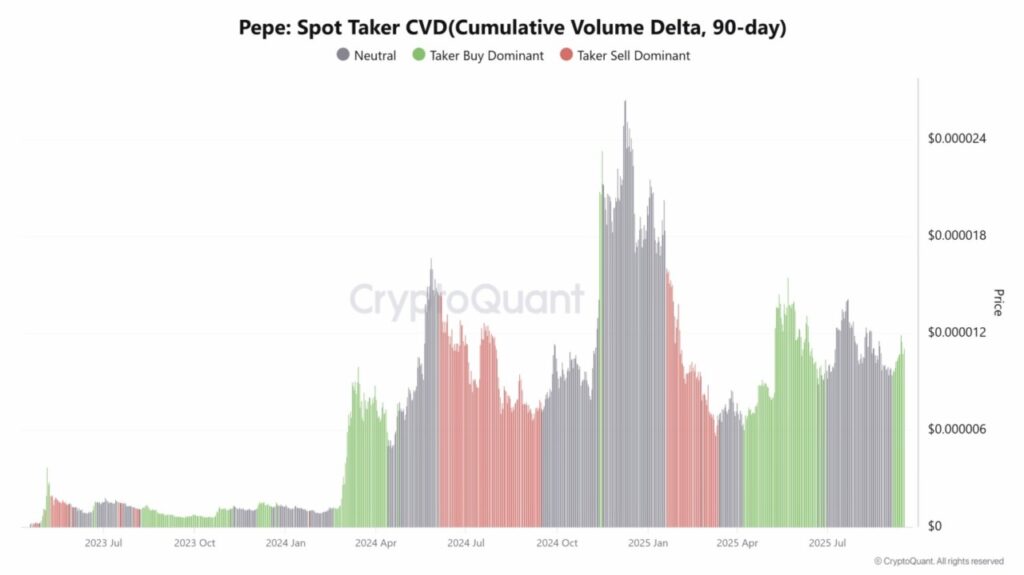

If whales continue to withdraw assets from exchanges, the decrease in available supply could be an impetus for price increases. At the same time, the Spot Taker CVD data from CryptoQuant shows the dominance of the buy side, signaling that market participants have been actively placing aggressive buy orders over the past 90-day period.

The combination of asset exits from exchanges by whales and strong buying volumes reinforces the bullish outlook for PEPE Coin, while strengthening its narrative as one of the leading meme coins.

Read also: BNB Hits All-Time High as Market Cap Soars to $133 Billion — Is the $1,000 Milestone Next?

Also, in conjunction with the narrowing triangle pattern, this accumulation seems to be the foundation for a potential breakout.

However, if the buying pressure starts to weaken and the whales start moving assets back to the exchanges, this scenario could lose validity in the short term.

Will the Bulls Take Control?

Technical charts, asset transfers by the pope, and the dominance of buying on CVD data all point to a bullish outlook. Although short-term volatility is still present, long-term projections still emphasize the upside potential.

A breakout above the $0.00001588 level would further strengthen the narrative towards the $0.00002000 target. Overall, the price of PEPE is currently at a tipping point, where the bulls’ conviction is likely to dominate the market soon.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. How Pepe’s $25M whale move could trigger its next breakout. Accessed on September 18, 2025

- CoinGape. Pepe Price Prediction: As Whale Moves $25M from Robinhood, Is a Breakout to $0.0002 Next? Accessed on September 18, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.