Download Pintu App

Dogecoin ETF Excitement Fades as Whales Pull Back and Traders Race to Sell

Jakarta, Pintu News – The leading meme coin, Dogecoin (DOGE), has struggled to gain momentum despite the excitement surrounding the expected launch of a US-listed Dogecoin ETF this week.

On-chain data shows a decrease in activity from whale investors as well as an increase in coin sales on various exchanges, indicating the possibility of further price declines in the next few days.

DOGE Declines as Whales Hold Back and Traders Start Selling

The market is currently awaiting the launch of Rex-Osprey’s Dogecoin ETF (DOJE) scheduled for tomorrow. The ETF is expected to give traditional investors direct access to Dogecoin’s price movements.

Read also: DOGE Up 5% Today: CleanCore Buy Triggers Bull Flag Breakout Signal

However, DOGE’s price performance was sluggish ahead of the key moment, signaling a lack of enthusiasm from traders.

Based on data from on-chain analytics platform Nansen, accumulation by large investors (whales) has decreased significantly in the past week. Wallet holders with DOGE holdings worth more than $1 million don’t seem too convinced by the ETF’s narrative, even reducing their holdings by more than 4% over the past week.

Decreased accumulation by large holders usually signals weakening market sentiment. This reduced demand from large players could reduce buying pressure, which in turn could potentially lead to stagnation or price declines in the near term.

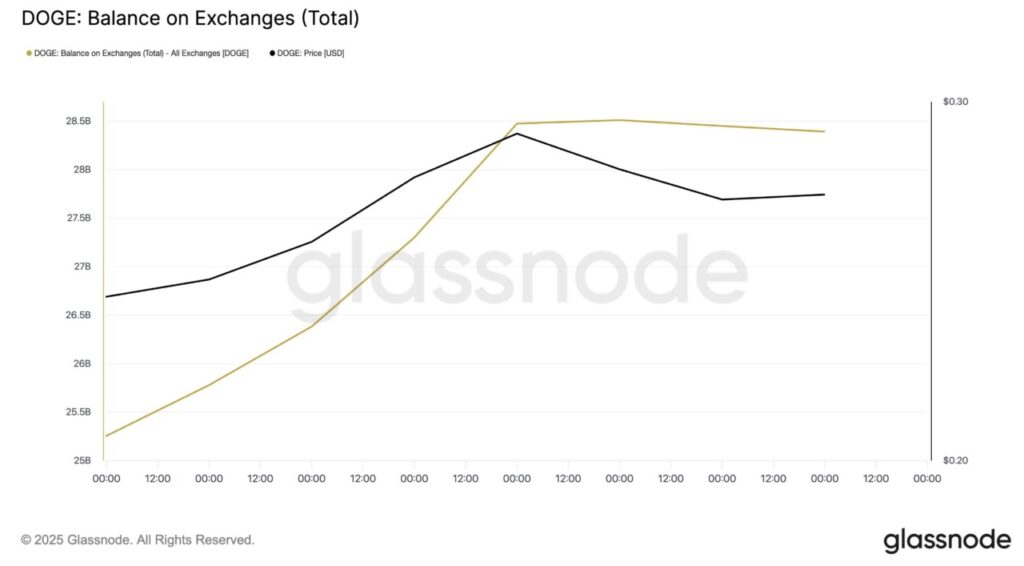

In addition, DOGE reserves on exchanges have also been steadily increasing over the past week. This indicates that more and more traders are moving DOGE to exchanges with the intention of selling.

As of September 17, DOGE’s balance on exchanges stood at 28 billion coins, up about 12% in the last seven days.

A rise in balances on exchanges usually indicates that asset holders are more inclined to sell rather than hold. A large influx of coins into the market could increase supply, and if not matched by sufficient demand, this could put downward pressure on the price of DOGE.

DOGE could Drop to $0.20 if Support Level is Broken

While the launch of the ETF could still potentially be a positive catalyst, current on-chain data suggests that traders are bracing for further weakness instead of an upward rally. If this scenario plays out, Dogecoin price is likely to test the support level at $0.2583.

Read also: Is Shiba Inu Price About to Skyrocket? Exchange Reserves Plunge Amid SHIB ETF Launch Rumors

If the support level is broken, the price of DOGE has the potential to drop deeper towards the $0.2018 area.

However, if renewed demand for DOGE increases, this bearish scenario could be invalidated. If the bulls regain control of the market, they could push the price up through the $0.2980 level.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Doge ETF Buzz Falls Flat. Accessed on September 18, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.