Download Pintu App

Uniswap Price Prediction 2025-2031: Will UNI Remain Stable?

Jakarta, Pintu News – Uniswap, a DeFi protocol founded in 2018 by former mechanical engineer Hayden Adams, has become one of the most innovative decentralized exchanges.

With an Automated Market Maker (AMM) system that operates entirely on the Ethereum blockchain, Uniswap allows users to exchange ether (ETH) for ERC-20 tokens without intermediaries. The unique features and utility of the UNI token make it attractive to traders and investors.

Technical Analysis of Uniswap Price

As of September 2025, Uniswap price analysis shows a downward trend. The altcoin’s price dropped to $9.10 in the last 24 hours, losing up to 6.52% of its value. Sellers continue to lead after the decline observed yesterday, with resistance appearing around $10.21.

It also shows that selling pressure is high around the $10 level, as the coin has faced several rejections at that price point. On the daily price chart, the bearish trend in the market is visible.

The UNI/USD rate has dropped to an intraday low of $9.10. The red candlestick on the price chart signals continued selling pressure and a continuation of the downtrend.

Also Read: 5 Reasons Crypto Liquidation Risk Could Break Records in September 2025

Uniswap Technical Indicators: Levels and Action

The distance between the Bollinger Bands determines volatility. This distance widened again after the contraction, causing an increase in volatility. In addition, the upper limit of the Bollinger Bands indicator, which acts as resistance, has shifted to $10.20. Meanwhile, its lower limit, which acts as support, has moved to $9.05.

The Relative Strength Index (RSI) indicator is in neutral territory. Today’s value of the indicator was recorded at 40.21, indicating a downward trend characterized by a descending curve on the RSI chart. Further instability in the market can be expected if the selling momentum continues.

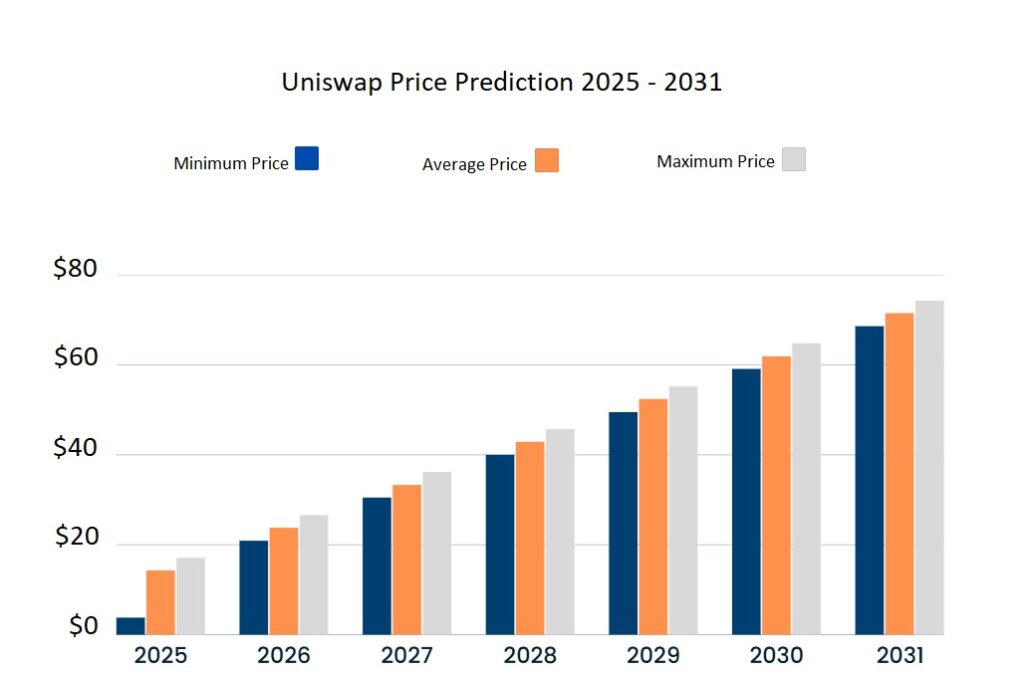

Uniswap Price Prediction for 2025-2031

Uniswap’s price analysis provides a bearish prediction regarding the current market trend, as the coin’s price continues to decline after a sustained bearish wave during the current trading session.

If sellers maintain this momentum, UNI prices may fall below the $9 range. However, Uniswap is considered a good investment as it is a decentralized crypto exchange (DEX) with great potential. It is estimated that Uniswap will reach the level of $36.22 by 2027 and above $74.36 by 2031.

Conclusion

Taking all these factors into account, investors and traders should pay attention to current market dynamics and long-term projections before making an investment decision. Uniswap offers exciting opportunities, but like all crypto investments, risks remain and should be carefully managed.

Also Read: 5 UK-US Crypto Cooperation Agenda that Could Accelerate Stablecoin Adoption

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cryptopolitan. Uniswap Price Prediction. Accessed on September 19, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.