Download Pintu App

Top 4 Crypto Catalysts of the Week, Did You Know?

Jakarta, Pintu News – The crypto market experienced a significant increase last week, with the total market capitalization of all cryptocurrencies again reaching over $4 trillion. With renewed hopes of interest rate cuts by the Federal Reserve and the Gemini IPO, here are some of the major catalysts that will affect the crypto market this week!

Federal Reserve Decision

Economists interviewed by Reuters stated that the US central bank had cut interest rates by 25 bps after a meeting that started Tuesday, September 16, and ended Wednesday, September 17. The chances of a rate cut increased after the US released weak jobs numbers this month.

The report showed that the economy added only 22,000 jobs in August, while the unemployment rate rose to 4.3%. Historically, stocks and crypto markets tend to perform well when the Federal Reserve cuts interest rates as this usually encourages risky sentiment among investors.

For example, Bitcoin (BTC) and most altcoins hit record highs during the pandemic when interest rates were cut to zero and quantitative easing took place. However, the risk is that upcoming interest rate cuts may already be priced in, which could lead to a drawdown.

Read also: Grayscale Launches XRP, SOL and ADA ETFs, Ready to Trade Today?

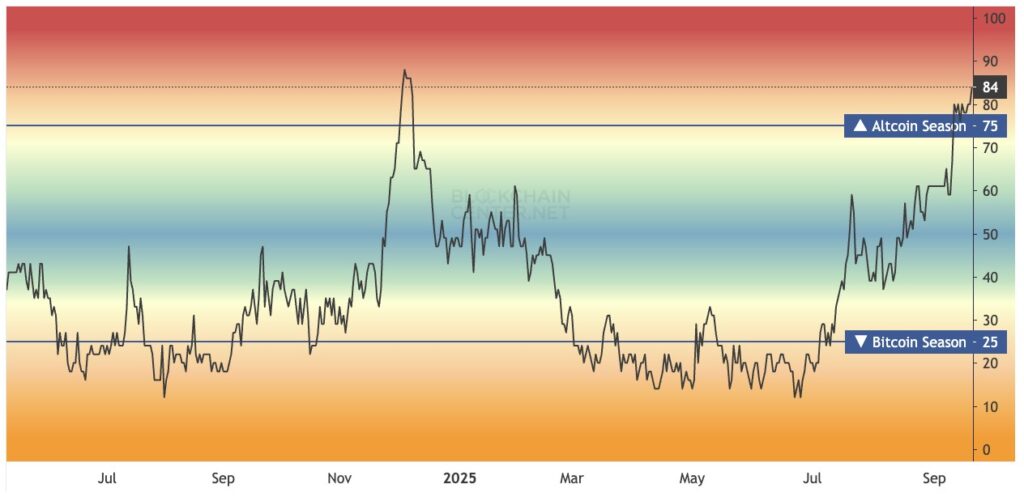

Altcoin Season Index Increases

Another major catalyst for the crypto market this week is the increase in the Altcoin Season Index, which has moved above 80. Top altcoins such as MYX Finance, MemeCore, OKB, Pudgy Penguins, Cronos, Story, and Mantle have driven this increase. An increase in the Altcoin Season Index could drive more investors to these coins this week, leading to a strong performance.

However, in some cases in the past, the entry into the altcoin season has led to drawdowns as investors booked profits. For example, most altcoins experienced a drawdown in late July after the index surged to 55.

Read also: BNB Chain Dominates RWA, Price Predicted to Break $1,300?

Launch of Dogecoin and Ripple ETFs

Another major catalyst for the crypto market will be the launch of the first Dogecoin (DOGE) and Ripple (XRP) ETFs, which are likely to be launched on Thursday. These ETFs are from Rex-Osprey, whose ETF was approved a few months ago.

These funds will differ from standard ETFs as they are based on the Investment Company Act and may be more expensive. This ETF comes as market participants await a major crypto ETF, which is likely to be approved in October.

Also read: Gold Trump Statue Holding Bitcoin Appears in Front of US Capitol, What Does It Mean?

Unlock Big Tokens

The crypto market will also react to the upcoming token unlock. Arbitrum, the second largest layer-2 network, will unlock over $49.9 million worth of tokens on Monday.

ApeCoin will release over $9.69 million worth of coins, while Zetachain will unlock $8.6 million worth of coins. Other big unlocks this week will involve Melania, LayerZero, Velo Finance, and Kaito.

Conclusion

With various catalysts potentially affecting the market, this week is expected to be an important and possibly volatile week for the crypto market. Investors and market watchers should pay attention to the Federal Reserve’s decision, the movement of the altcoin season index, as well as the launch of new ETFs that could bring new dynamics to the market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News. Top Catalysts for the Crypto Market This Week. Accessed on September 20, 2025

- Featured Image: Generated by Ai

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.