Download Pintu App

3 Signs Suggest Dogecoin’s $0.41 Breakout Is Only Delayed, Not Impossible

Jakarta, Pintu News – The Dogecoin (DOGE) price is starting to show breakout signals, although significant movement has not been seen so far.

As of September 19, DOGE was trading flat above the $0.27 level. On the 12-hour chart, Dogecoin is forming a fairly strong bullish technical pattern, with a potential upside towards $0.41 – or about 46% of the current price.

However, this movement seems to be delayed due to the market’s still weak reaction to the latest sentiment, creating a “calm before the storm” situation that could trigger a major price surge in the near future.

Check out the full explanation to see why this rally is likely only delayed, not canceled, citing BeInCrypto’s report.

Whale and big holders add to Dogecoin holdings

After the euphoria surrounding the Fed’s potential rate cut started to die down and the launch of the Dogecoin ETF on the CBOE (Chicago Board Options Exchange), the big DOGE holders started to move.

Read also: 5 Cryptos Gaining Attention as Trading Activity Heats Up

Wallet groups holding between 100 million and 1 billion DOGE increased their holdings from 26.7 billion to 27.4 billion DOGE in just 24 hours – from September 17 to 18 to be exact.

That means an accumulation of around 700 million DOGE (worth approximately $196 million) in just one day. This spike suggests that whales are taking positions and betting on a potential price increase.

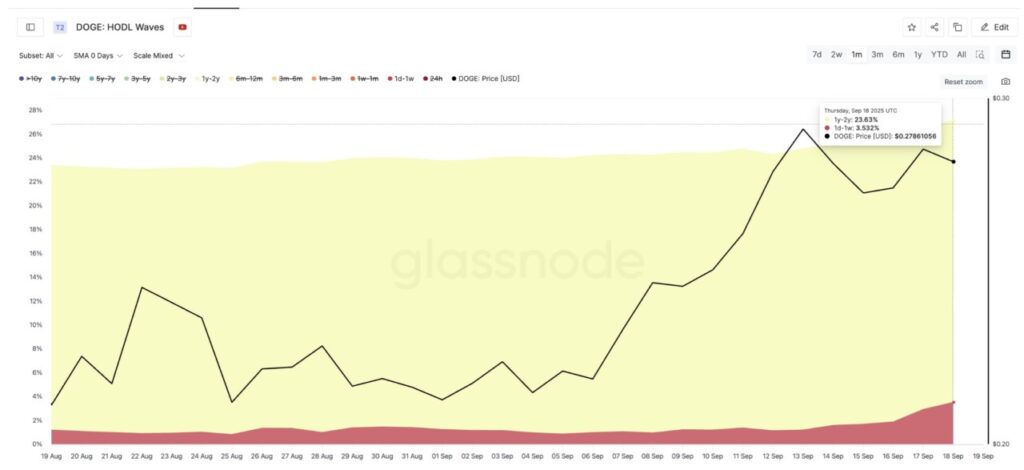

HODL Waves data, which tracks supply distribution based on length of time held, also revealed the conviction of two extreme groups of holders. The group of very short-term holders (1 day – 1 week) increased their holdings from 0.84% on August 25 to 3.53% as of September 18, most likely driven by the enthusiasm surrounding the ETF.

Interestingly, at the same time, the group of long-term holders (1-2 years) – who had already recorded huge gains after DOGE rose 166.5% in the past year – also increased its proportion from 22.19% to 23.63%.

This unusual combination, where both short-term traders and long-term holders are adding positions simultaneously, is a strong signal that positive sentiment is growing behind the scenes.

However, as usual, the actions of whales and large holders often take time before they are actually reflected in price movements. This could be one of the reasons that contributed to the delayed Dogecoin price breakout.

Dogecoin Price Chart Shows 46% Breakout Getting Closer

Despite being supported by accumulation from whales and holders, the Dogecoin price has not managed to break the key resistance at $0.29.

Read also: 3 Altcoins Gaining Attention This Week — What’s Driving the Buzz?

This level is the upper limit of the bullish flag pattern that is forming. As long as there is no daily close above this point, the potential for a breakout is still on hold.

The launch of the Dogecoin ETF on the CBOE has also not prompted an immediate surge in new demand. Prices tend to move sideways, indicating that the ETF hype may have been “anticipated” by the market beforehand – this is one of the reasons for the delay in price increases.

Nonetheless, the bullish flag pattern is still valid. If Dogecoin manages to close daily above $0.29, its projected technical movement points to a target of $0.41, or about 46% higher than current levels.

However, before getting there, Dogecoin needs to break the resistance between at $0.31 and $0.33 based on Fibonacci levels. Meanwhile, the main support is at $0.25. If the price drops below this level, the bullish structure could be invalidated – at least for a while.

In short, the breakout signal was delayed, not canceled. With whales continuing to add billions of DOGE, short-term traders starting to enter, and long-term holders staying put, the opportunity for price increases is still wide open.

If momentum picks up again, Dogecoin still has room to climb up to 46% towards $0.41.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Reasons Why Dogecoin Price Breakout To $0.41 Is Just Delayed – Not Denied. Accessed on September 22, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.