Download Pintu App

Michael Saylor’s Firm Strategy Scoops Up 850 Bitcoin Despite Market Downturn

Jakarta, Pintu News – Strategy, formerly MicroStrategy (MSTRX), continues to strengthen its action in accumulating BTC by announcing its latest weekly Bitcoin (BTC) purchase.

The move comes amid significant declines in the major crypto asset as well as MSTR shares, which have now fallen to their lowest level in five months.

Strategy Buys 850 BTC Worth $99.7 Million

In a press release, the Strategy company announced that it had purchased 850 BTC for $99.7 million, at an average price of $117,344 per Bitcoin. The company also recorded a BTC return of 26% and now owns a total of 639,835 BTC, which was acquired for a total value of $47.33 billion at an average price of $73,971 per Bitcoin.

Read also: Bitcoin Sinks to $112,000 Today as $1.70 Billion Liquidation Wave Hits Markets

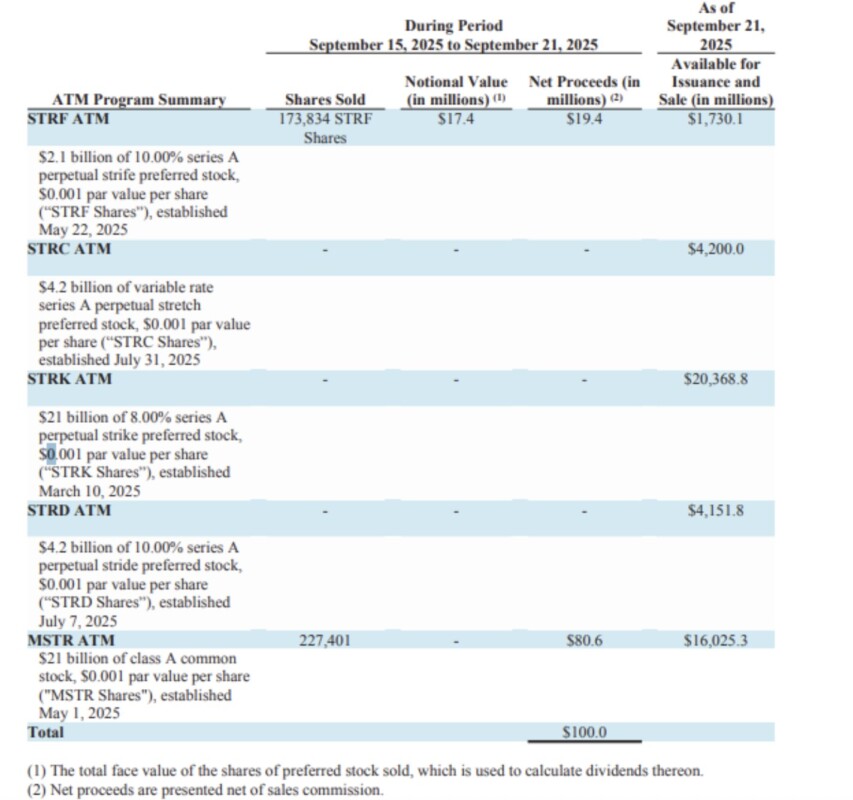

Based on filings with the SEC, it is known that Strategy sold MSTR and STRF shares to fund this purchase. From the sale of MSTR shares, the company earned $80.6 million, while $19.4 million was collected from STRF.

Strategy co-founder Michael Saylor hinted at the purchase in a post on X yesterday, writing that “The Orange Dots go up and to the right.”

The statement reiterated that Saylor and his company intend to continue adding to their BTC holdings and have no plans to sell.

Notably, this is the eighth consecutive weekly Bitcoin purchase since late July. In the previous week, the company added 525 BTC worth $60 million, which was one of the smallest weekly purchases so far this year.

MSTR and Bitcoin Shares Decline

Strategy’s latest BTC purchase comes amid a decline in MSTR’s stock price and Bitcoin.

Read also: Vitalik Buterin’s Grand Illusion: Why Ethereum Isn’t Destined to Be the Next Google

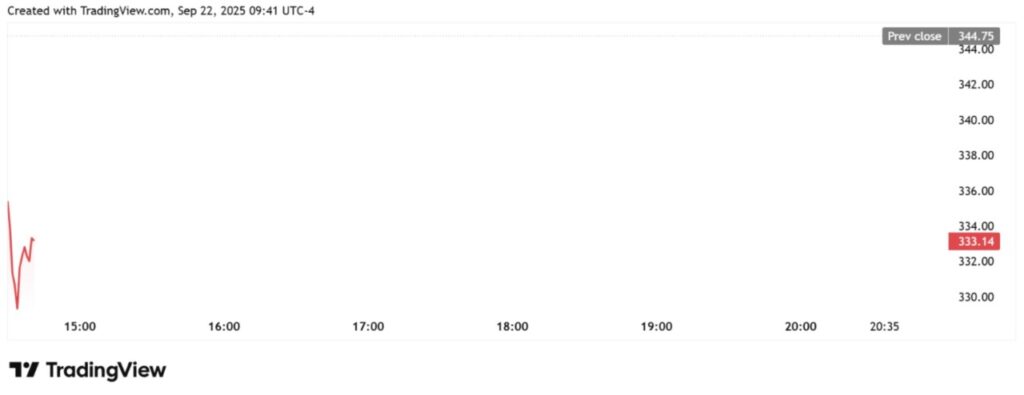

Data from TradingView shows that MSTR shares as of September 22 were trading at around $336, down more than 2% compared to last week’s closing price of $344.

Over the past month, MSTR shares have been flat with a gain of less than 2%. Meanwhile, Strategy shares also hit a five-month low of $323 per share last week. On the plus side, the stock is still up 14% since the start of the year.

Bitcoin price is also on the decline. TradingView data notes the major crypto is trading slightly below the psychological level of $113,000, down more than 2% as of September 22, 2025.

This comes amid broader crypto market turmoil, which is believed to be influenced by various macroeconomic factors, including rising US government bond yields. Peter Schiff, a critic of Bitcoin and Strategy, predicts BTC could still fall below $100,000 as gold prices rally towards $4,000.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Michael Saylor’s Strategy Adds More BTC as Bitcoin and MSTR Fall. Accessed on September 23, 2025

- Cointelegraph. Strategy Buys $99.7 Million Worth of Bitcoin Fed Rate Cut. Accessed on September 23, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.