Download Pintu App

Q4 2025 Bitcoin Price Prediction: Analysts Expect Decline, Historical Pattern Fails to Repeat?

Jakarta, Pintu News – Although investors are expecting a bullish trend in the usually strong fourth quarter, a leading crypto analyst warned that the rally supported by historical patterns may not be repeated this time.

Bitcoin (BTC) price has fallen more than 10% from its previous record high of $124,457. Various indicators and market data suggest that the difficult period may still continue. Read our full analysis and predictions for BTC price in Q4 2025!

Bitcoin (BTC) Price Prediction for ‘Uptober’

October is known as a strong month for Bitcoin (BTC) price increases, but this year may be different. On September 24, 10x Research predicted that Bitcoin (BTC) price could fall or rise by $20,000 due to “converging key technical levels.” The crypto options market is showing warning signals, with traders inclined to bet against a possible rise.

Meanwhile, some on-chain indicators are showing stress points that have historically marked major trend changes. Macroeconomic factors affecting the crypto market also add to the indications that a major surprise is possible in the fourth quarter. Although 10x Research has accurately predicted fourth-quarter bullish rallies for the past three years, the current situation seems more uncertain.

Read also: Bhutan Government Transfers $47 Million Worth of Bitcoin Back, What’s the Impact?

BTC Options Data Shows Bearish Trend

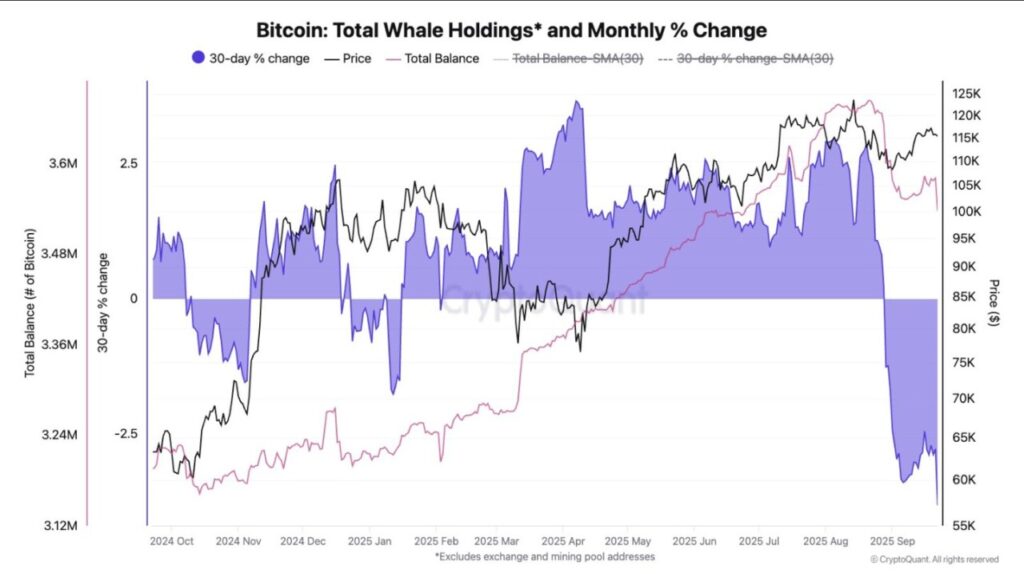

Julio Moreno, head of research at CryptoQuant, revealed that the net short position maintained by the whales is the main reason why Bitcoin (BTC) price has been on the decline. In one month, the whales have sold 147,000 BTC and the total balance is declining at the fastest monthly rate in this cycle.

This suggests that major investors may be losing confidence in Bitcoin’s (BTC) short-term prospects. The negative sentiment amplified by seasonal weakness and historical peak patterns has triggered massive selling in the crypto market.

This is evident from the outflows from spot Bitcoin (BTC) ETFs and the exit of key entities, including the Satoshi-era Bitcoin (BTC) OG. Today, Matrixport predicts $109,899 as the critical level to watch, with the bull market remaining intact as long as Bitcoin (BTC) holds above it.

Also read: Tom Lee’s Prediction: Ethereum (ETH) Could Reach $12,000 by the End of the Year!

Bitcoin (BTC) Price and Trading Volume Analysis

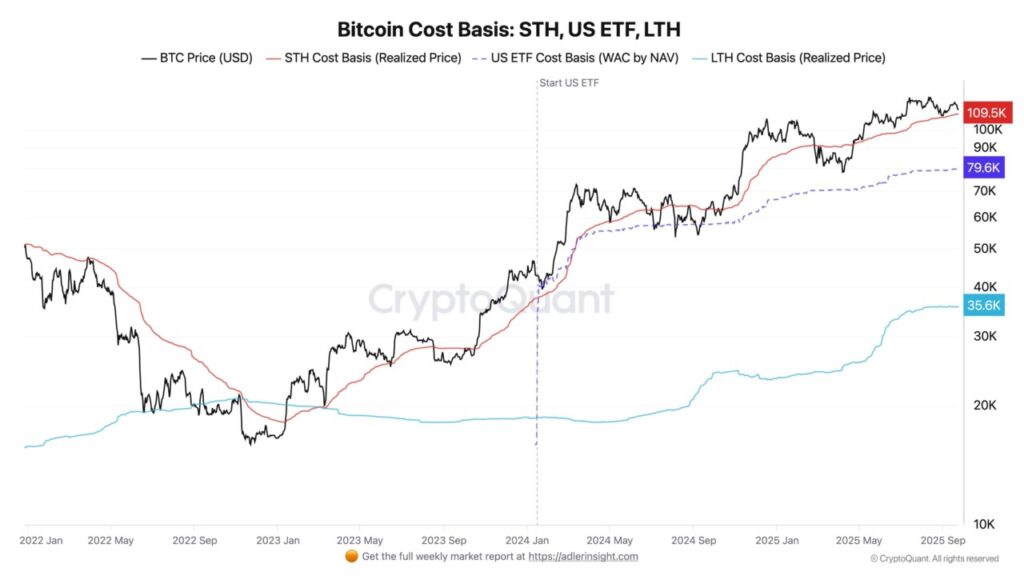

Currently, Bitcoin (BTC) is trading at $112,550, down 5% on the week. The lowest and highest prices in 24 hours were $111,229 and $113,351, respectively. Trading volume has dropped further by 13% in the past 24 hours, indicating a decline in interest among traders. If Bitcoin (BTC) price falls below $109,580, the STH Bitcoin (BTC) Base Cost (Realized Price) indicator suggests that the price will turn bearish.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Bitcoin Price Could Fall or Rise by $20k in Q4: 10x Research Reports. Accessed on September 27, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.