Download Pintu App

Bitcoin and Altcoins at Critical Crossroads, Will the Crypto Market Recover?

Jakarta, Pintu News – The crypto market has recently experienced a sharp correction, sparking big questions about its future. Bitcoin (BTC) and altcoins are now at a crucial point that could determine their next direction. With various on-chain metrics providing important insights, investors and analysts are looking for signs of recovery or a possible further decline.

On-Chain Indicator Shows Negative Trend

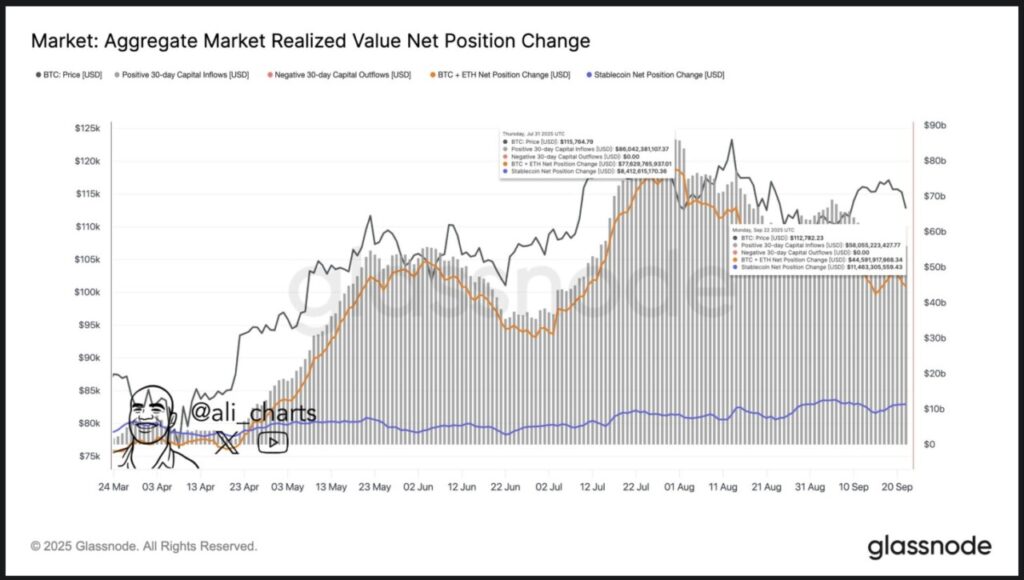

According to crypto analyst Ali Martinez, there has been a drastic decrease in capital flows into the crypto market. This signals that investors are starting to lose faith in the potential for a short-term recovery.

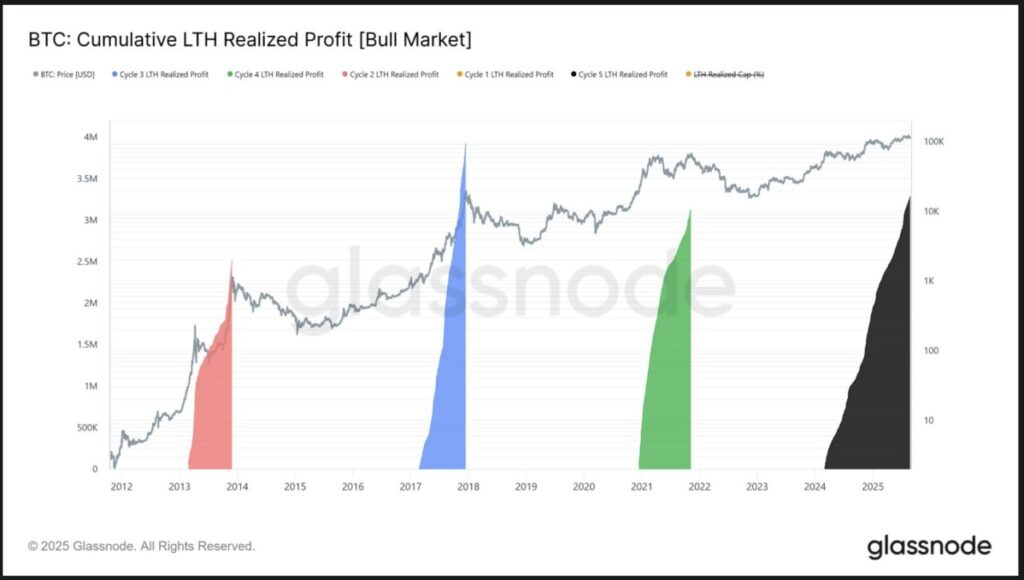

Glassnode, an analytics platform, reported that long-term Bitcoin (BTC) holders have realized cumulative gains of 3.4 million BTC since the beginning of the current cycle. This shows that even long-term investors are starting to secure their profits.

In addition, fund flows to Bitcoin ETFs have turned negative, indicating a selling sentiment in the market. CryptoQuant, which tracks crypto exchange activity, noted massive whale activity on Binance this week. This could be an indicator of further selling pressure.

Also read: Tom Lee’s Prediction: Ethereum (ETH) Could Reach $12,000 by the End of the Year!

Bitcoin and Altcoins on the Threshold

Bitcoin (BTC) price is currently hovering around $112,500, after experiencing strong selling pressure earlier in the week. Popular crypto analyst CryptoBullet points out that Bitcoin (BTC) is currently trading in a critical support zone between $109,500 and $111,500. If this zone does not hold, there could be a significant further price drop.

On the other hand, Rekt Capital analysts reported that the market capitalization of altcoins, except for the top ten, is experiencing a test of volatility on key trend lines. This suggests that not only Bitcoin (BTC), but also altcoins are facing uncertain times and could affect the overall market sentiment.

Read also: Bhutan Government Transfers $47 Million Worth of Bitcoin Back, What’s the Impact?

Market Projections and Expectations

Although the current conditions seem bleak, some analysts are still optimistic about the future of Bitcoin (BTC). They predict that Bitcoin (BTC) could rally to $150,000 by the fourth quarter of 2024. However, this projection is highly dependent on various external factors such as government regulation, institutional adoption, and broader global economic dynamics.

The altcoin market, although currently experiencing uncertainty, also has the potential to recover if macroeconomic conditions are favorable and innovations in blockchain technology continue to develop. Investors and market watchers should stay alert to these developments to make informed investment decisions.

Conclusion

With all the challenges and uncertainties, the crypto market is currently at a critical juncture. Investors and analysts should pay close attention to key indicators and follow market developments to anticipate possible scenarios. Patience and caution are key in dealing with the current crypto market volatility.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Will Crypto Market Recover as Bitcoin and Altcoins Test Crucial Support. Accessed on September 25, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.