Download Pintu App

Gold Price Chart Today September 25, 2025: Up or Down?

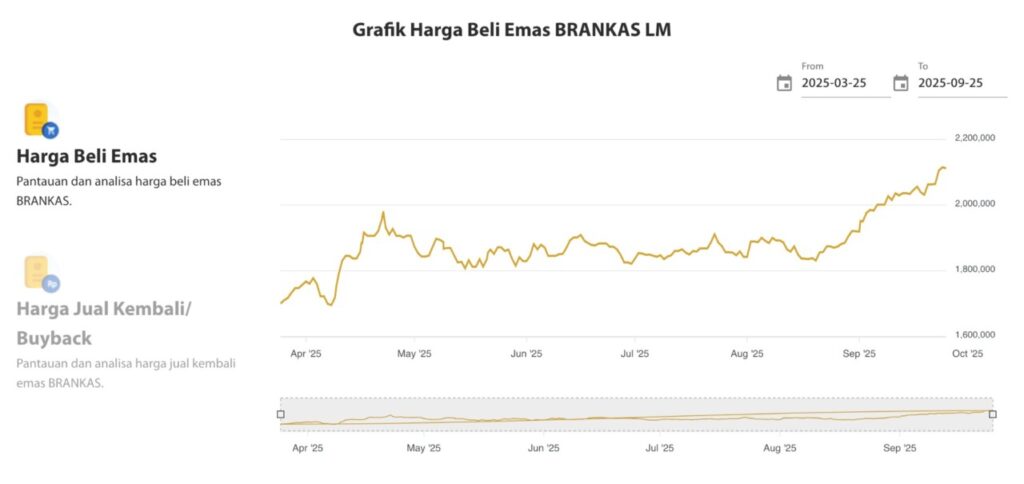

Jakarta, Pintu News – Gold prices are again the main concern of investors today. The latest data from the BRANKAS LM platform shows a significant price movement in recent months.

On Thursday, September 25, 2025 at 08:32 a.m., the Corporate BRANKAS gold buying price stood at IDR 2,111,600/gram, while the physical gold buying price stood at IDR 2,171,000/gram, each down by IDR 3,000 from the previous day. Based on the gold price chart for the last 6 months (March-September 2025), here are three important trends that gold investors need to pay attention to.

1. Consistent Gold Price Increase Since the Beginning of August 2025

Based on the BRANKAS LM gold purchase price chart, the upward trend in prices began to stabilize since the beginning of August 2025. After fluctuating during the May to July period, prices began to rise consistently from a level of around IDR 1,950,000 to close to IDR 2,200,000/gram at the end of September.

This consistency indicates positive market sentiment towards gold as a hedge asset. According to BRANKAS data, this price strengthening is also in line with increasing demand from both the corporate and retail sectors ahead of the year-end quarter.

Also Read: 5 Key Points of Arthur Hayes’ Analysis: Bitcoin (BTC) Could Reach Rp56 Billion by 2028?

2. Volatile Prices in the Second Quarter of 2025

If you look at the period from April to July 2025, gold prices experienced quite sharp volatility. After scoring a sharp increase in mid-April, the price dropped again and fluctuated throughout May to July, with a price range between Rp1,850,000 to Rp1,980,000 per gram.

These ups and downs are largely influenced by external factors, including fluctuations in the rupiah exchange rate and global economic uncertainty. Based on BRANKAS’ historical data, this period is a consolidation point before prices rebound in August.

3. Today’s price fell slightly, but still on a positive trend

Despite today’s recorded decline in gold prices by IDR3,000 per gram for both Corporate BRANKAS and physical gold, current prices are still on track for a medium-term upward trend. The purchase price of Corporate BRANKAS gold today is IDR 2,111,600/gram, down from IDR 2,114,600/gram previously. Meanwhile, physical gold is priced at IDR 2,171,000/gram, down from IDR 2,174,000/gram.

This slight decline can be attributed to a natural correction after the price increase in recent days. However, if you look at the chart of the past 6 months, the current price remains at its highest level since March 2025, indicating that the long-term sentiment towards gold is still strong.

Conclusion: Is Now the Right Time to Invest in Gold?

Looking at the chart and price trends as of September 25, 2025, gold remains a stable and promising investment instrument, especially in the face of global economic uncertainty. Despite today’s small decline, the medium-term trend remains positive, and prices are expected to continue to strengthen towards the end of the year.

Investors are advised to continue monitoring daily prices through official platforms such as BRANKAS LM in order to make decisions based on accurate and up-to-date data.

Also Read: Deutsche Bank Predictions About Bitcoin (BTC) Becoming Central Bank Reserves in 2030!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BRANKAS LM. Gold Price Dashboard. Accessed September 25, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.