Download Pintu App

These 3 Crypto Coins are Trending in Indonesia, Why?

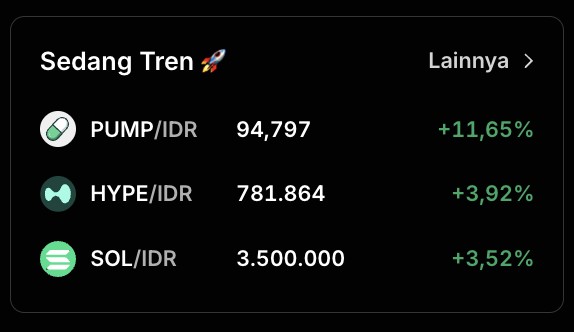

Jakarta, Pintu News – Three crypto coins are currently the talk of the town among Indonesian traders. Based on Pintu Pro Market data, the three digital assets occupy the top spot in the list of trending coins thanks to a significant spike in trading volume and price movement. This phenomenon not only attracts the attention of retail investors, but also serves as an indicator of market sentiment towards crypto assets in Indonesia.

Which cryptos are there? Read the full analysis in this article!

1. Pump.fun (PUMP)

The chart above shows the price movement of PUMP/IDR in the daily timeframe (1D) on the Pintu Pro market. It can be seen that the price experienced a very strong bullish trend from mid-August to mid-September, characterized by a series of long green candlesticks that pushed the price from the Rp40-50 range to a peak above Rp140. The increase was also accompanied by a significant spike in trading volume, signaling a large influx of buying.

However, after reaching the highest level, the price began to correct sharply. This correction can be seen from the formation of consecutive red candlesticks that brought the price back down to the Rp90s range. The high selling pressure made the moving average indicator (MA 7) fall through MA 25, confirming a short-term trend reversal in a bearish direction.

Interestingly, the end of September saw a rebound attempt. The green candlestick appeared after the price had touched the support level of around IDR94,000, while the current price closed at around IDR95,873 despite still falling -4.04% in the last session. The price position moving between MA 7 (IDR92,302) and MA 25 (IDR101,899) indicates a consolidation phase, where the market is looking for a new direction whether to continue the recovery or to be depressed again.

Overall, this chart shows that PUMP/IDR is in a transitional phase after the big rally in early September. If the price is able to stay above the strong support of IDR90K and break back through the resistance at MA 25, the bullish trend is likely to continue. Conversely, if selling pressure increases, prices are at risk of continuing to weaken towards the IDR85k area.

Read also: Price of 1 Pi Network (PI) in Indonesia Today (29/9/25)

Hyperliquid (HYPE)

The chart above shows the price movement of HYPE/IDR in the daily timeframe (1D) on Market Pintu Pro. In the last session, HYPE closed at Rp781,864, down slightly by -0.49% from the opening price of Rp787,000. During the day, the price moved in the range of IDR774,210 – IDR797,172, indicating moderate volatility in the market.

If you look at the trend of the last few weeks, HYPE had recorded a sharp increase to near the level of Rp900 thousand, before finally correcting quite deeply. This sharp decline can be seen from a series of red candlesticks that pushed prices to the Rp720 thousand area, but after that there were signs of a rebound. Currently, prices are starting to move up again with the support of green candlesticks, although they are still held below strong resistance in the range of Rp840 thousand (MA 25).

Technical indicators also show a consolidation phase. The 7-day MA is at Rp752,919, while the 25-day MA is still higher at Rp838,850, indicating that the short-term trend is trying to recover, but has yet to confirm a full trend reversal. Trading volume (SMA 9) is at around 28K, relatively lower than the previous spike period, signaling that buying momentum is still limited.

Overall, HYPE/IDR shows recovery potential after a sharp correction, but investors need to pay attention to the resistance area at IDR840K as a key level. If successfully broken, the opportunity to continue the bullish trend will be more open. Conversely, if selling pressure increases again, the price is at risk of retesting support in the range of IDR720 thousand.

Read also: 4 Altcoins Worth Watching Before October 2025, Cheaper than Coffee Price?

Solana (SOL)

The chart above displays the price movement of Solana (SOL/IDR) in the daily timeframe (1D) on Market Pintu Pro. In the last session, SOL closed at the level of IDR3,500,000, a slight decline of -0.91% after moving in the range of IDR3,496,000 – IDR3,537,000.

If you look at the trend from mid-July to early September, SOL experienced a strong bullish phase with a gradual increase that pushed prices from the range of IDR2.8 million to a peak above IDR4.2 million. However, after touching the highest level, the price began to correct quite sharply. This correction can be seen from the long red candlestick formation that pushed the price back to the IDR3.3 million area, and there was even a spike in extreme volatility with a long wick that touched the IDR1.8 million range before quickly recovering.

Technical indicators show that SOL is currently in a consolidation phase. The 7-day MA is at IDR3,465,142, while the 25 MA is at IDR3,690,160, with the price moving between the two lines. Meanwhile, the 99 MA at Rp3,082,848 illustrates that the long-term trend is still relatively maintained despite the correction. Trading volume (SMA 9) was recorded at 129,516, quite high compared to the previous quiet period, signaling increased market activity.

Overall, SOL/IDR is trying to bounce back after a sharp decline, with the nearest resistance around IDR3.7 million. If it is able to break through this level, the opportunity to continue the bullish trend is open again. Conversely, if it fails to stay above IDR3.3 million, selling pressure could potentially bring the price to lower support around IDR3 million.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Market Door Pro

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.