Download Pintu App

Antam Gold Price Chart Today September 30, 2025: Up or Down?

Jakarta, Pintu News – Antam’s gold price showed another increase in trading on Tuesday, September 30, 2025. Based on data from Brankas LM, today’s physical gold purchase price is at the level of IDR 2,234,000 per gram, up IDR 12,000 compared to the previous price of IDR 2,222,000 per gram.

For corporate customers through the Corporate Safe product, the gold purchase price was recorded at IDR 2,174,600 per gram, also up IDR 12,000 from IDR 2,162,600 per gram. This increase confirms the positive trend in gold prices at the end of the third quarter of 2025.

Antam Gold Price Chart for the Last 6 Months

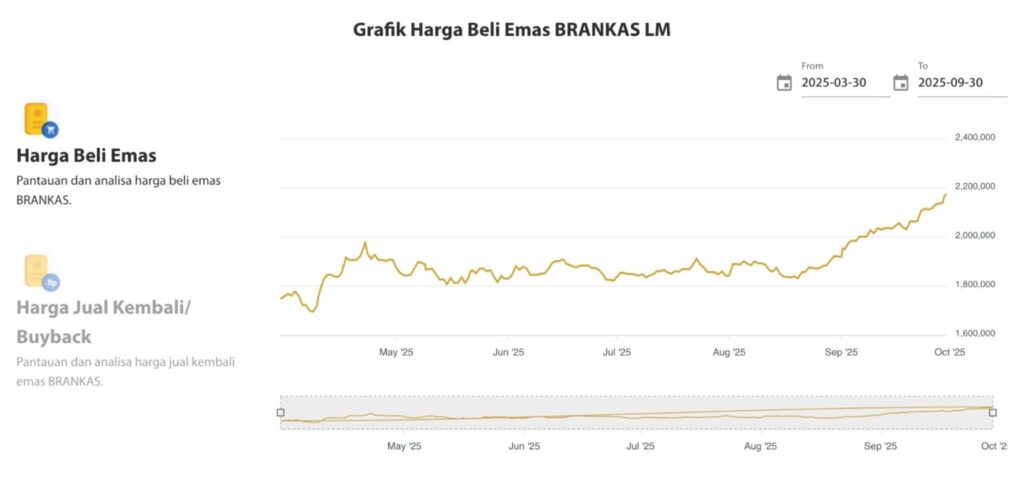

If you look at the LM Brankas gold price chart for the period March 30 – September 30, 2025, you can see a significant upward trend since early August 2025. Prices that had moved flat in May to July in the range of IDR 1,800,000 – IDR 1,950,000 per gram, now continue to climb to penetrate IDR 2,200,000 per gram at the end of September.

This increase shows that investors’ interest in gold as a safe haven asset is increasing, especially amid global uncertainty. LM vault data shows that price movements were relatively stable at the beginning of the year, but bullish momentum began to strengthen since the middle of the third quarter.

Factors Driving the Rise in Gold Prices

According to global gold analysts, world gold prices are getting a boost from speculation of a Fed rate cut as well as rising physical demand in Asia. Geopolitical factors also play an important role in making investors turn to safe assets such as gold.

For retail and corporate investors, this trend is a signal that gold is still relevant as a hedging instrument, especially with high volatility in crypto assets and stocks. LM Brankas data, which is updated daily, is one of the main references for monitoring Antam gold prices in Indonesia.

Conclusion: Gold Remains a Safe Investment Option

The increase in Antam gold prices today to the level of IDR 2.23 million per gram marks the market’s optimism towards gold as a defensive asset. With a trend that is still strengthening, gold is still worth considering for investors who want to maintain portfolio stability.

Chart monitoring from Brankas LM shows a medium-term bullish trend, so many expect gold prices to continue to strengthen until the end of the year, as global macroeconomic conditions are not yet stable.

Also Read: 5 Major Corrections Before Bitcoin Breaks the New ATH: This is Analyst’s Prediction!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Data Source:

- LM vault – Gold Price Dashboard. September 30, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.