Download Pintu App

4 Surprising Secrets of “Binance Dollar” Becoming Venezuela’s Real Currency Amid 500% Inflation!

Jakarta, Pintu News – The prolonged economic crisis and extreme hyperinflation have prompted Venezuelans to seek a stable alternative store of value outside of their national currency, the bolivar. A unique phenomenon emerged when Binance USD (BUSD)-a stablecoin whose value is pegged 1:1 against the US Dollar-unofficially became the most widely used currency for daily transactions and commerce.

This move away from crumbling fiat currencies towards stable cryptocurrencies shows people’s remarkable adaptation to survival, according to a report presented by Cointelegraph. The use of the “Binance Dollar” is not just a trend, but a practical solution driven by several key factors amidst the collapse of local currency purchasing power.

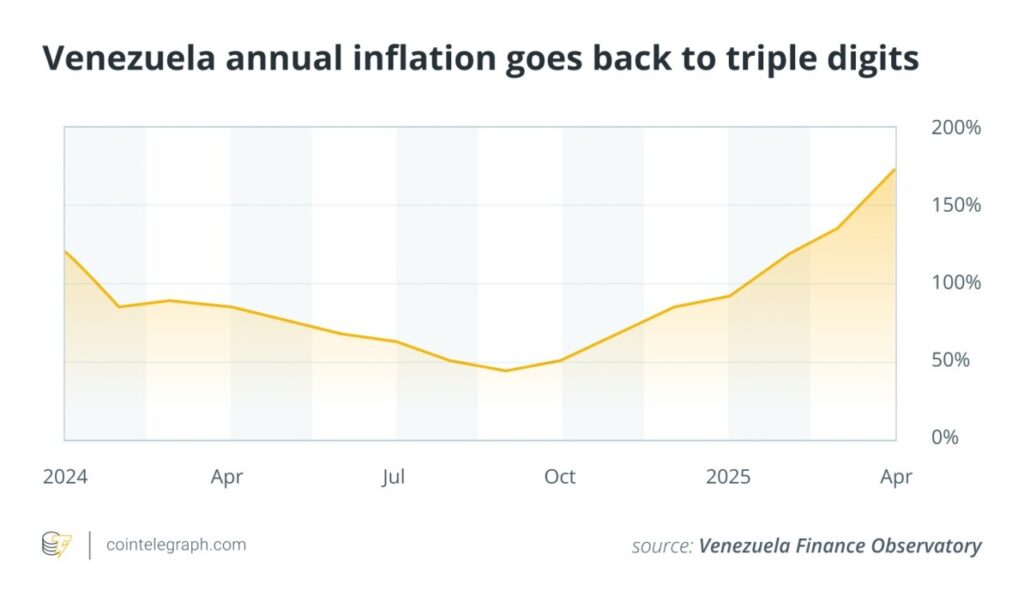

1. Hyperinflation and the Collapse of Local Currency Purchasing Power

Hyperinflation in Venezuela has reached extremely severe levels, often exceeding very high percentages, with some reports citing annual inflation exceeding 500% at its peak. This situation saw the Venezuelan bolivar currency drastically lose purchasing power in a matter of days. As a result, Venezuelans no longer have faith in the traditional financial system and are looking for solutions that offer value stability.

It is this quest for stability that is driving the adoption of US Dollar-based cryptocurrencies like BUSD. According to economic analysis, when national currencies fail to perform the basic function of money as a store of value, people will naturally turn to more reliable assets, and in the Venezuelan context, these digital assets offer ease of access. The stability of BUSD’s value-equivalent to IDR16,609 per unit (referring to the exchange rate of 1 USD = IDR16,609)-provides a certainty that the bolivar cannot offer.

Also Read: 5 Reasons Eric Trump’s IDR16 Billion Bitcoin Prediction Could Be Real

2. Ease of Access through Peer-to-Peer (P2P) Platforms

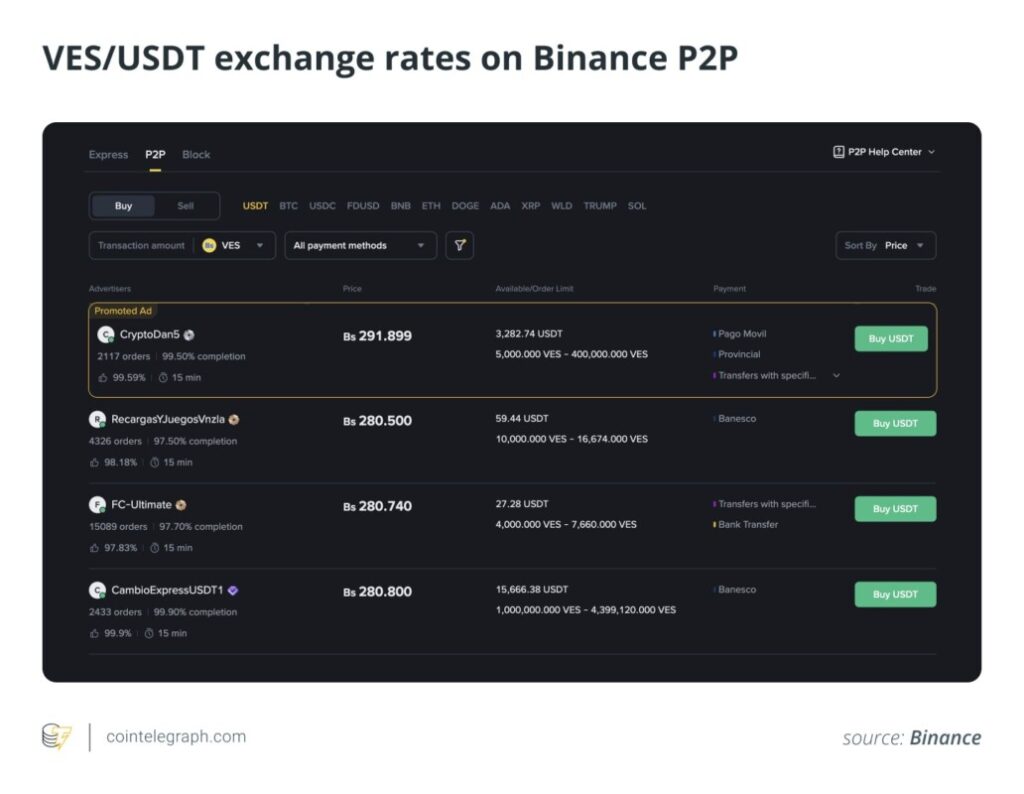

One of the biggest reasons behind the mass adoption of BUSD is the ease of access and liquidity provided through the Peer-to-Peer (P2P) platform on the Binance exchange. The P2P platform allows users to buy or sell BUSD directly from and to other users using bolivars or local bank transfers. This process circumvents the traditional Venezuelan banking system which is often complicated and full of restrictions.

According to a report from Cointelegraph, the P2P function on Binance acts as a safe and efficient bridge for Venezuelans to convert their devalued local currency into stable assets. This feature is crucial as it allows citizens, ranging from freelancers to traders, to receive and hold value in a form that cannot be influenced by government monetary decisions. Thanks to this platform, they can effectively “polarize” their savings and transactions.

3. Avoiding Capital Controls and Government Restrictions

The use of stablecoins like BUSD allows Venezuelans to effectively circumvent various capital controls and restrictions imposed by the government. The Venezuelan government has frequently implemented policies that limit the amount of foreign currency that citizens can access or transfer, further complicating international trade and money transfers from abroad. Binance USD provides a borderless and decentralized solution.

The decentralized nature of cryptocurrencies makes these assets difficult for governments to confiscate or unilaterally regulate, a fact much appreciated by residents who have experienced asset confiscation and bail-ins. Users can store value in their digital wallets and access it at any time without the need to go through a heavily monitored bank, as described in various reviews of the currency black market in Venezuela. This gives Venezuelans a much greater degree of financial autonomy.

4. Trust in Stablecoins Compared to Hard Currency (Cash Dollars)

While US Dollar (USD) cash is also widely used in Venezuela, BUSD is often considered a more practical and efficient tool for storing and moving value. Holding physical US Dollars poses security risks, such as theft, and practicality issues, especially when conducting digital or remote transactions. Additionally, obtaining large quantities of physical US Dollars can be difficult and expensive.

The BUSDstablecoin, as part of the crypto ecosystem, offers cryptographic security and ease of digital transfer that is vastly superior to physical cash. According to local merchants interviewed, BUSD transfers can be made in seconds and are free from physical risk. Therefore, for Venezuelans who frequently transact digitally or receive remittances from abroad, BUSD has become the preferred “Digital Dollar”, serving as a superior means of exchange and store of value in the face of crisis.

Also Read: 5 Reasons XRP Could Hit IDR66,000 by the End of 2025: ETFs, Fed, & Crypto Market Momentum

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. How ‘Binance Dollars’ Became Venezuela’s Real Currency. Accessed October 2, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.